-

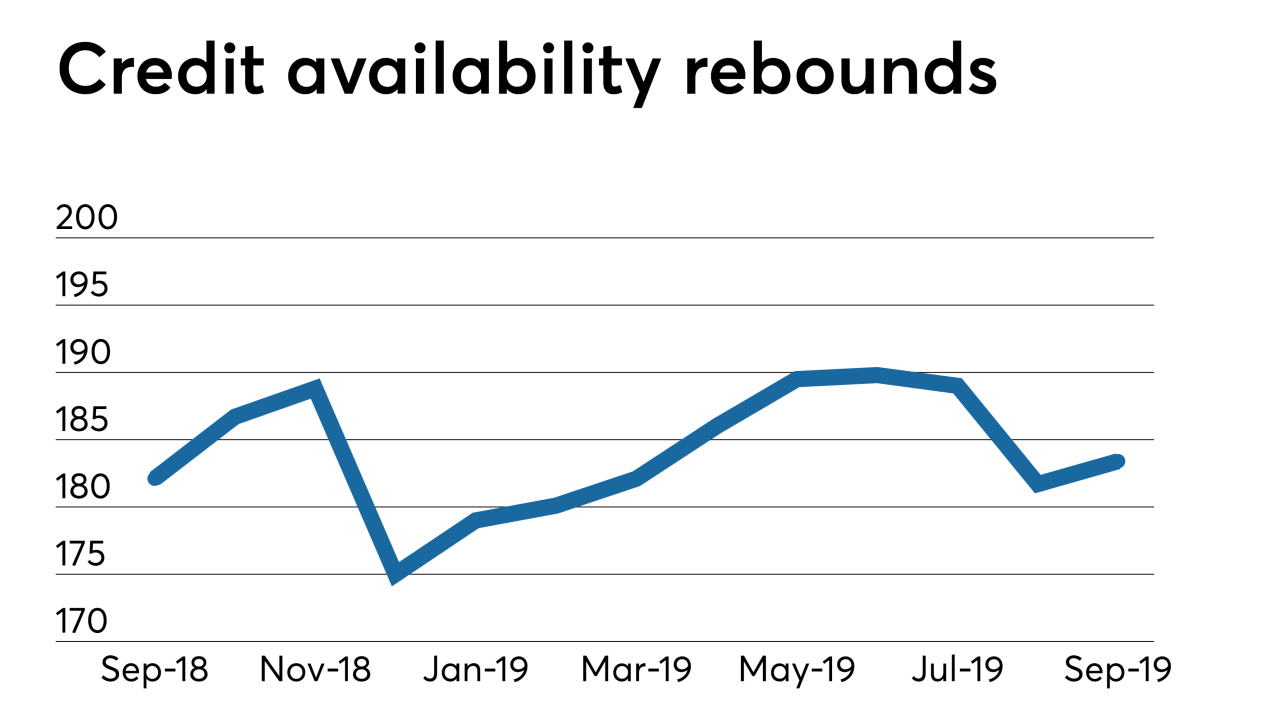

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

Mortgage applications increased 8.1% from one week earlier as conventional mortgage rates fell under 4% again, according to the Mortgage Bankers Association.

October 2 -

As the affordable housing crisis comes to a head, the Mortgage Bankers Association put up opposition to the "not in my backyard" mindset by getting behind the Yes, In My Backyard bill introduced in the House of Representatives.

September 30 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

The recent spike in mortgage interest rates reduced home purchase application activity last week, contributing to a 10.1% decline in total activity, according to the Mortgage Bankers Association.

September 25 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

Mortgage applications decreased 0.1% from one week earlier as conforming and jumbo interest rates climbed back above 4%, which slowed refinance activity, according to the Mortgage Bankers Association.

September 18 -

The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

September 17 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

Mortgage applications increased 2% on an adjusted basis from one week earlier driven by gains in the purchase market while refinance activity was flat, according to the Mortgage Bankers Association.

September 11 -

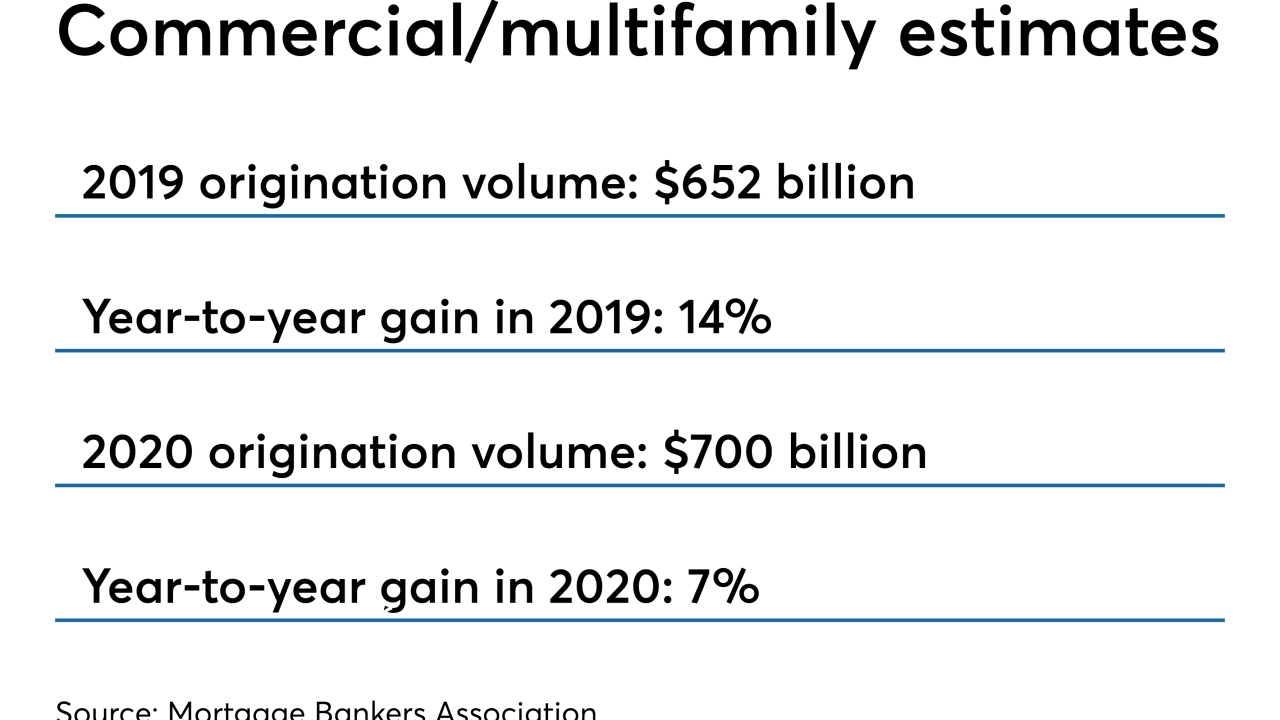

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

The Mortgage Industry Standards Maintenance Organization has released a dataset designed to prepare lenders for a new mortgage application and automated underwriting system upgrades at Fannie Mae and Freddie Mac.

September 5 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Mortgage application volume fell last week as the small drop in interest rates slowed refinancing activity, while economic worries likely kept purchasers out of the market, according to the Mortgage Bankers Association.

August 21