-

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

Mortgage applications increased 2% on an adjusted basis from one week earlier driven by gains in the purchase market while refinance activity was flat, according to the Mortgage Bankers Association.

September 11 -

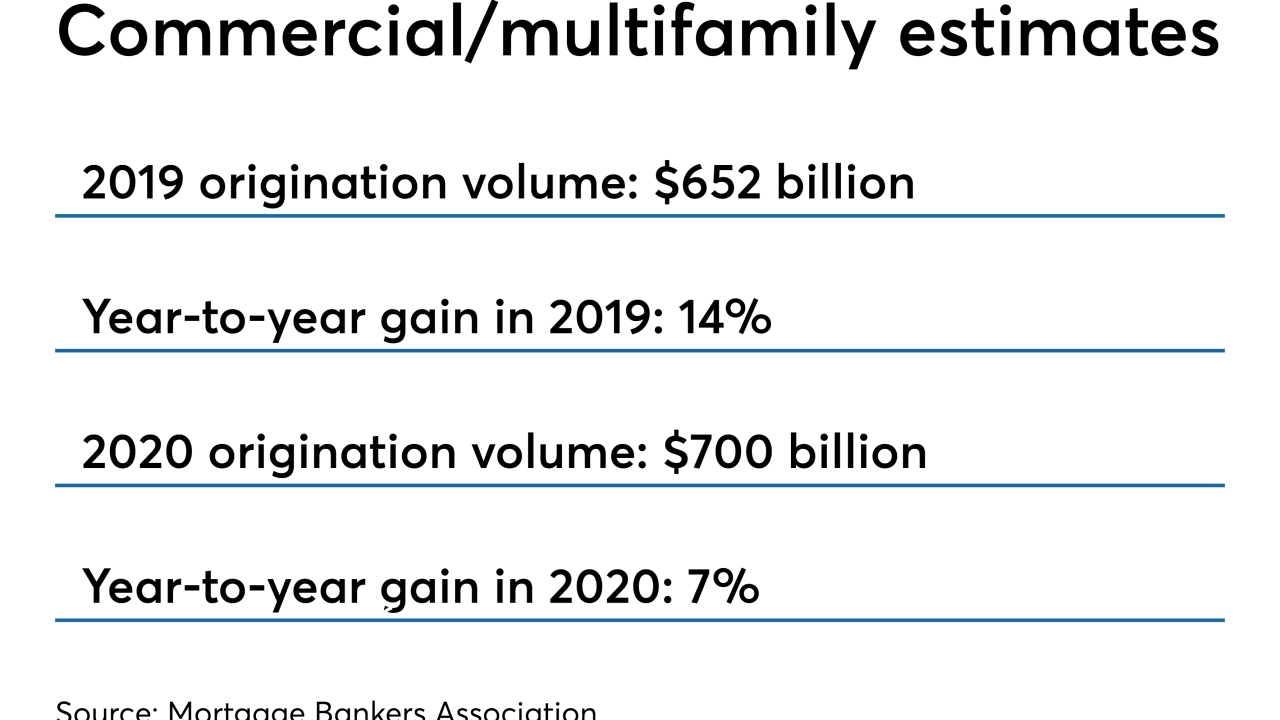

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

The Mortgage Industry Standards Maintenance Organization has released a dataset designed to prepare lenders for a new mortgage application and automated underwriting system upgrades at Fannie Mae and Freddie Mac.

September 5 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Mortgage application volume fell last week as the small drop in interest rates slowed refinancing activity, while economic worries likely kept purchasers out of the market, according to the Mortgage Bankers Association.

August 21 -

The Mortgage Industry Standards Maintenance Organization is working with stakeholders to come up with a common means of handling new tax transcript authorization requirements in the Taxpayers First Act.

August 19 -

July's low mortgage rate environment encouraged new homebuyers to overcome their fears about the direction of the economy that kept them out of the market in June, according to the Mortgage Bankers Association.

August 15 -

While last week's large drop in interest rates sparked a surge in refinance activity, purchase mortgage application volume increased for the first time in over a month, according to the Mortgage Bankers Association.

August 14 -

The mortgage delinquency rate sits at its lowest point in over 20 years after descending annually for 17 straight months through May, according to CoreLogic. But a broader look at this year's figures could signal a shift in the narrative.

August 13 -

The Federal Housing Finance Agency has repeatedly reconsidered whether to add a language question to the GSEs' loan application, but its new director's latest call may finally resolve the question.

August 9 -

Jumbo loan product availability continued climbing and reached an all-time high in July, but it wasn't enough to stop overall credit standards from tightening, according to the Mortgage Bankers Association.

August 8 -

The economic tensions between the U.S. and China drove interest rates down last week, leading to a surge in refinance applications, according to the Mortgage Bankers Association.

August 7 -

Purchase mortgage applications continue to decline, falling to their lowest level since the start of the spring, as supply constraints limit homebuyer activity, according to the Mortgage Bankers Association.

July 31 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

Fewer consumers applied for mortgages last week even as interest rates declined by 3 to 4 basis points for all product types, according to the Mortgage Bankers Association.

July 24