-

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

Remodeling activity stepped up in recent years as homeowners stayed put for nearly twice as long as before the housing bubble burst, but several forecasts point to a potential slowdown on the horizon, which is a welcome sign for the mortgage business.

April 30 -

Purchase mortgage applications, which until now were unaffected by the recent rise in interest rates, fell by 4% on a seasonally adjusted basis from last week, according to the Mortgage Bankers Association.

April 24 -

After a strong February, existing-home sales took a U-turn in March. While buyer conditions heat up and mortgage rates remained low, consumers took a patient approach — especially in the expensive West Coast markets.

April 22 -

Surging loan production expenses and low revenue killed profits in 2018 for loans originated by independent mortgage bankers and subsidiaries of chartered banks, according to the Mortgage Bankers Association.

April 17 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

Loan applications for newly constructed properties accelerated going into this year's peak home buying season, contrasting with the weakness seen in the market a year ago, according to the Mortgage Bankers Association.

April 9 -

Nondepositories in the mortgage business cut 2,900 more jobs in February, bringing industry employment to its lowest point in nearly three years.

April 5 -

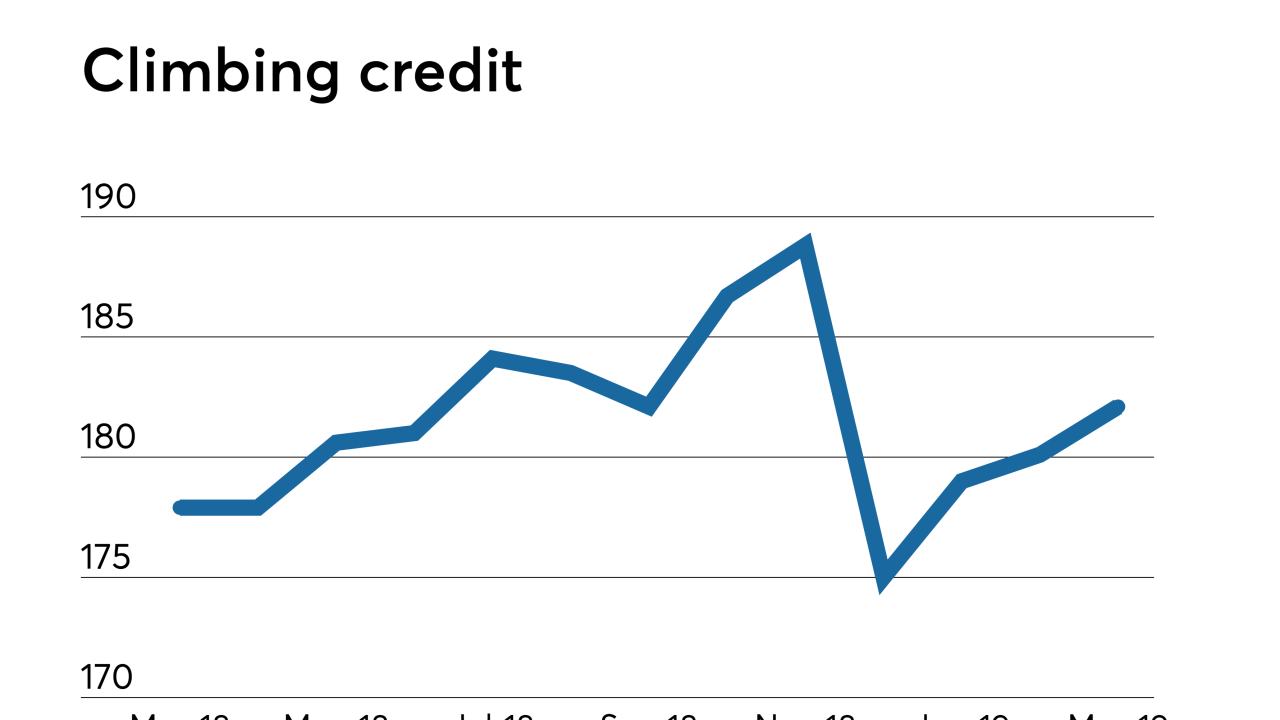

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Mortgage refinance applications reached their highest level in three years as interest rates plunged last week in the aftermath of the Federal Open Market Committee's March meeting.

April 3 -

Costs, process, privacy: Here's a look at some key digital mortgage drivers and obstacles identified by experts at this year's MBA Technology Solutions Conference.

March 27 -

There was a huge rise in mortgage refinance application activity due to the large drop in interest rates following last week's Federal Open Market Committee meeting.

March 27 -

The mortgage industry is eager to adopt digital strategies like artificial intelligence to streamline processes, but they are finding it difficult to extend through the full lifecycle of the loan.

March 26 -

Independent mortgage bankers lost the largest amount for originating a loan in the fourth quarter since this data has been tracked, as costs rose and volume dropped, according to the Mortgage Bankers Association.

March 26 -

Mortgage costs to close surged in the last decade because of technological investments as borrowers clamored for speed and digitalization. Industry experts believe those costs will decrease in the near future once acclimation sets in.

March 26 -

The Mortgage Bankers Association is investing $2 million to support the creation of online notary standards and several other initiatives.

March 25 -

Mortgage lenders are being forced to evaluate expenses carefully when deciding whether buying or building technology is the right move.

March 25 -

If mortgage rates fall below 4%, it could more than double the dollar volume of agency mortgages exposed to refinancing incentive, analysts at Keefe, Bruyette & Woods found.

March 25