-

The Mortgage Bankers Association is calling for Ginnie Mae, states, the Internal Revenue Service and other government agencies to overcome remaining digital mortgage challenges.

April 16 -

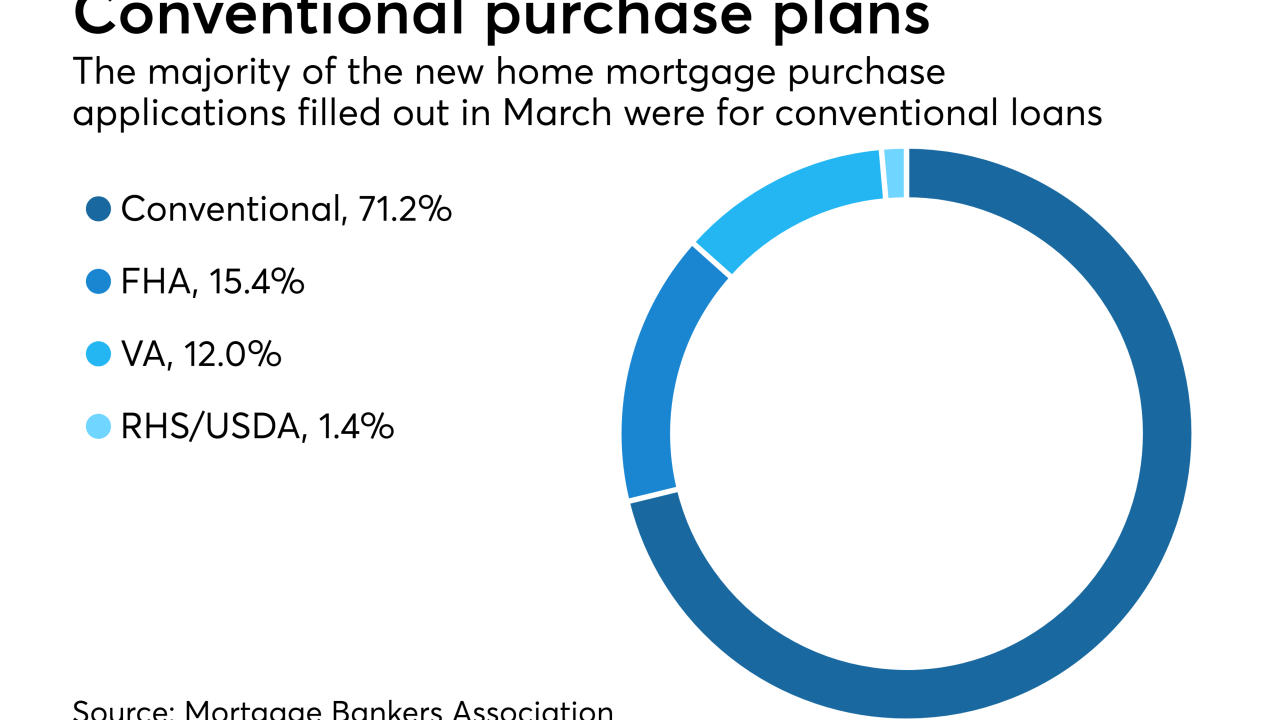

March mortgage applications for new home purchases were stronger than in February but lenders didn't produce as many of them as they did a year ago.

April 13 -

While the mortgage industry heads in a digital direction, homebuyers are still expecting a more electronic experience during the mortgage process, which would also stand to benefit lenders.

April 11 -

Mortgage applications decreased 1.9% from one week earlier as purchase activity was down again, according to the Mortgage Bankers Association.

April 11 -

Mortgage rates dropped as the stock market downturn at the start of the week drove yields on the 10-year Treasury lower.

April 5 -

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

Mortgage application activity decreased 3.3% from one week earlier as purchase and refinance volume fell prior to the start of the home buying season, according to the Mortgage Bankers Association.

April 4 -

Lenders should not get so desperate chasing volume by originating lower credit non-qualified mortgage products that they are inviting the next regulatory crackdown, said David Stevens, the Mortgage Bankers Association's CEO.

March 28 -

Mortgage applications increased 4.8% from one week earlier and rose for the fourth time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

March 28 -

Independent mortgage banks and mortgage subsidiaries of chartered banks saw production profits tank in the fourth quarter of 2017, according to the Mortgage Bankers Association.

March 23 -

The share of mortgage refinance applications dropped to its lowest level in nearly 10 years as interest rates continued to climb.

March 21 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

February's volume of mortgage loan applications for newly constructed homes rose both year-over-year and month-to-month, continuing the momentum from a surprisingly strong showing in January.

March 13 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

Loan program revisions made by one large conventional mortgage investor led to a decrease in total residential home finance credit availability in February.

March 8 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

Mortgage application activity increased slightly from one week earlier even as the rate for the 30-year conforming loan rose to its highest level in four years.

March 7 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

Higher levels of purchase activity even with rising interest rates drove the increase in mortgage applications compared with one week earlier.

February 28