-

More than 70% of women mortgage professionals have experienced sexual harassment in the workplace, but these incidents go drastically underreported, according to a recent Mortgage Bankers Association survey.

January 29 -

With compensation accounting for 80% of the cost to originate a mortgage, lenders are developing new strategies to attract and retain top talent, while keeping wage expenses in check.

January 29 -

Supporters of an unreleased bill to revamp the housing finance system say the plan strikes a middle ground that can gain support from both sides of the aisle.

January 24 -

Purchase loan applications were at their highest level in nearly eight years because of rising interest rates, according to the Mortgage Bankers Association.

January 24 -

Even as mortgage rates rose to their highest level since March, application activity increased from one week earlier, according to the Mortgage Bankers Association.

January 17 -

Loan applications for newly constructed homes slowed on a month-to-month basis in December as the storm-driven spike in volume ended.

January 11 -

Mortgage application volume started the year on the upswing because of higher refinance activity, even with a slight increase in rates.

January 10 -

There were fewer mortgage programs available to borrowers at the lower end of the credit spectrum in December, resulting in an overall decrease in credit availability.

January 9 -

Refinance volume fueled recent market gains by nonbank mortgage originators. But lower volume amid the shift to purchase lending has nonbanks trimming headcounts and may position banks to recapture market share.

January 5 -

Mortgage application volume decreased 2.8% during the last two weeks of 2017, according to the Mortgage Bankers Association.

January 3 -

With recommended reads from Chase Mortgage's Mike Weinbach, New American Funding's Patty Arvielo and more, check out these 13 books every mortgage pro should have on their winter reading list.

December 29 -

The share of new refinance mortgage applications reached its highest point since December 2016, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 20 -

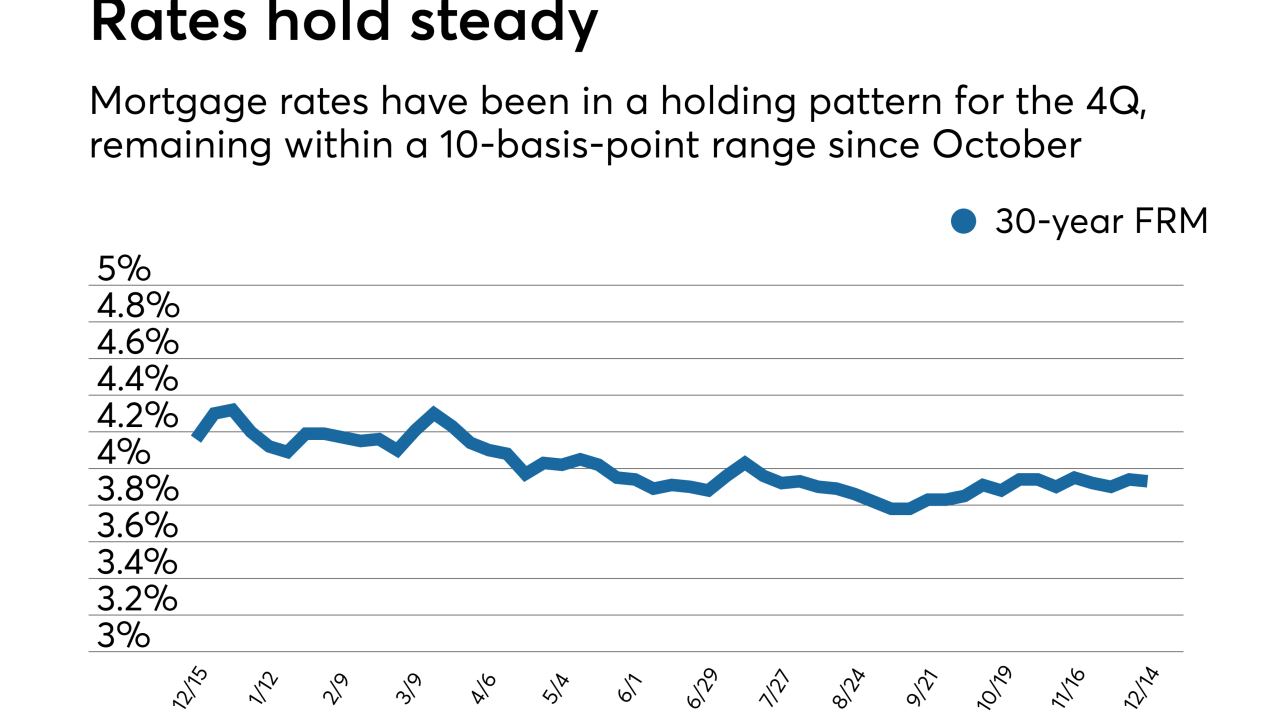

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

The share of new refinance mortgage applications reached its highest point since January, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 13 -

Mortgage applications for new home purchases increased by 12.2% in November from the same period a year ago, according to the Mortgage Bankers Association.

December 12 -

Nonbank mortgage employment fell for the second consecutive month, according to the Bureau of Labor Statistics.

December 8 -

Mortgage application volume increased from one week earlier, driven by a boost in refinance activity, according to the Mortgage Bankers Association.

December 6 -

Colonial Savings founder James S. DuBose died after a yearlong battle with cancer. He was 93.

December 4 -

Higher costs dampened mortgage lenders' profitability, outweighing near-term gains in origination volume and per-loan revenue during the third quarter, according to the Mortgage Bankers Association's quarterly.

December 1 -

Mortgage application volume decreased 3.1% from one week earlier as the start of the holiday shopping season likely slowed activity, according to the Mortgage Bankers Association.

November 29