-

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

Mortgage credit availability declined in May as lenders reduced the number of government-guaranteed products they market by nearly 2%.

June 9 -

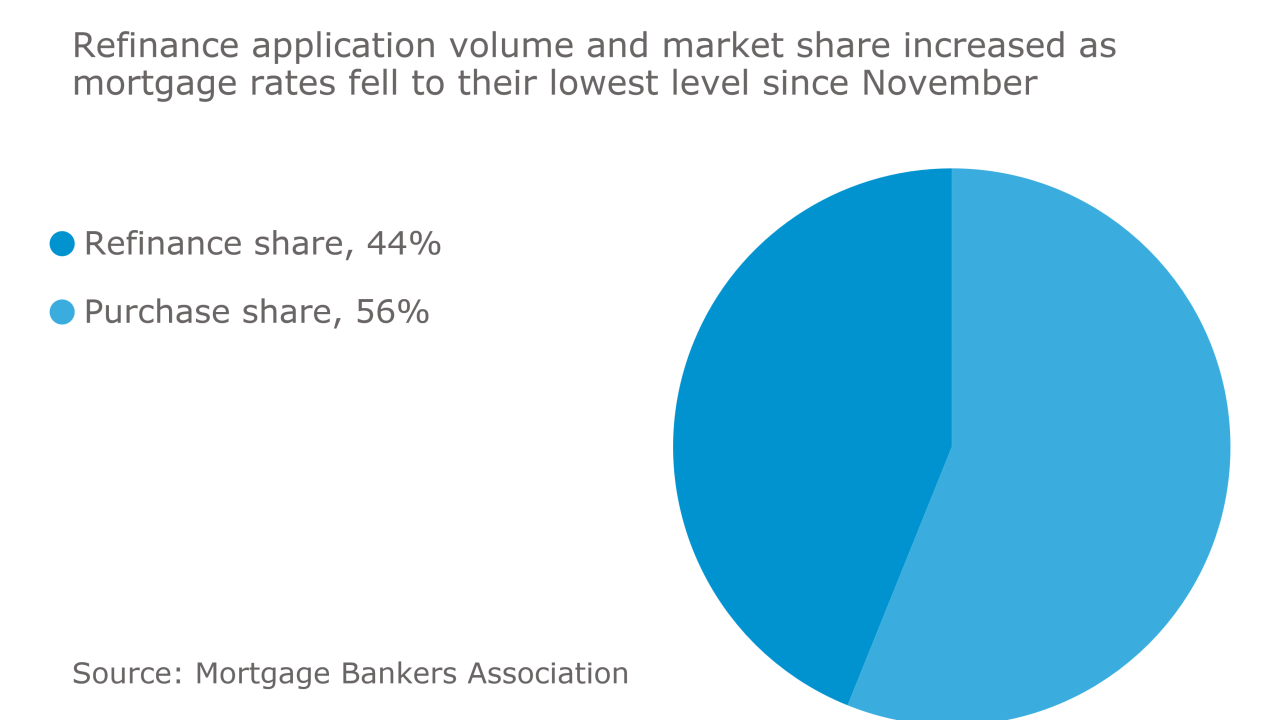

Lower rates led to an increase in both purchase and refinance applications compared with the previous week. according to the Mortgage Bankers Association.

June 7 -

Production expenses averaged $8,887 per loan for independent mortgage bankers in the first quarter as there were fewer originations to absorb the costs.

June 6 -

From pockets of growth in a shrinking refi market to the possibility of REITs buying agency risk-sharing securities, here's a look at recent market shifts that major industry players are focused on right now.

June 5 -

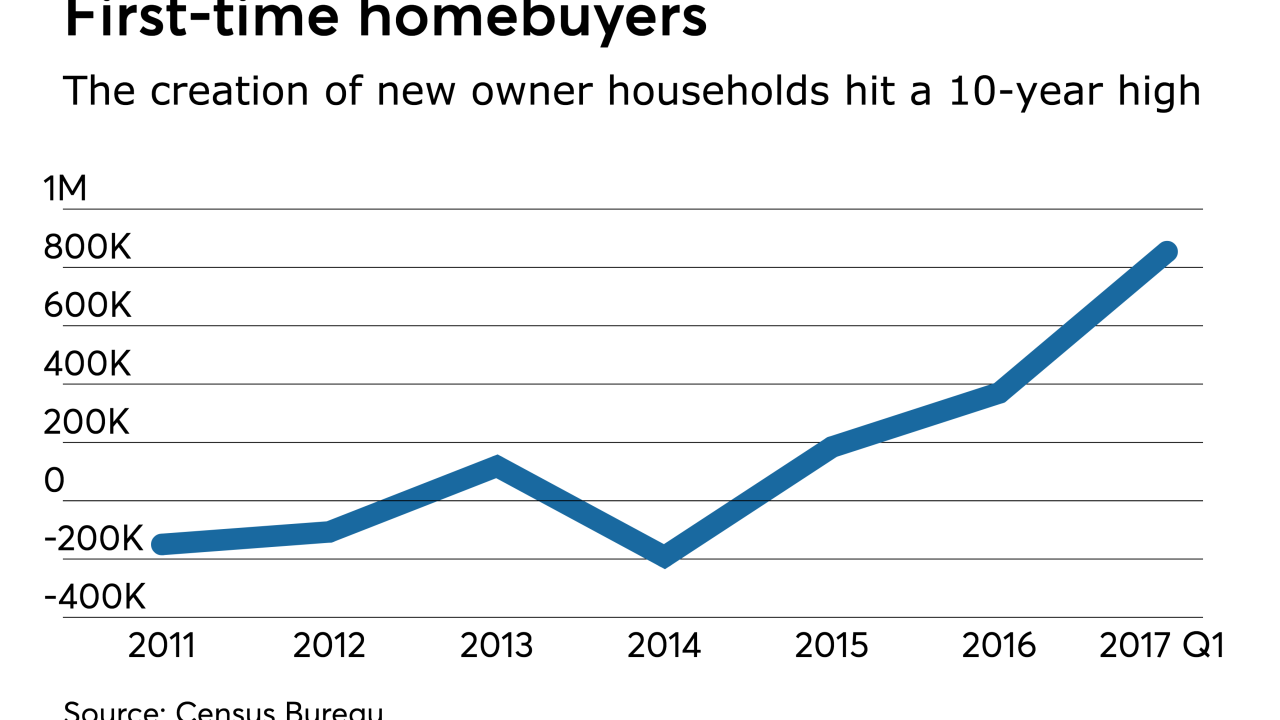

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

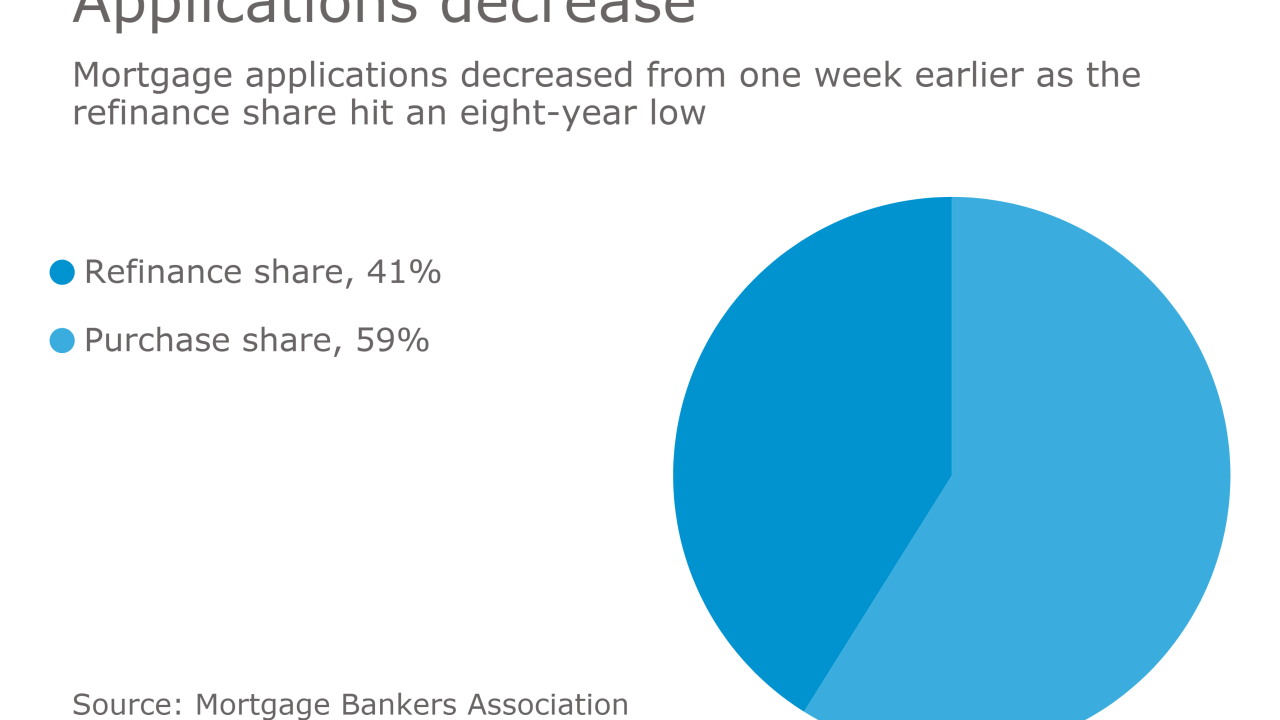

Application volume decreased 3.4% from one week earlier, according to the Mortgage Bankers Association.

May 31 -

Application volume increased 4.4% from one week earlier as rates hit their lowest level in seven months, according to the Mortgage Bankers Association.

May 24 -

Mortgage applications decreased 4.1% from one week earlier as the refinance share hit an eight-plus-year low, according to the Mortgage Bankers Association.

May 17 -

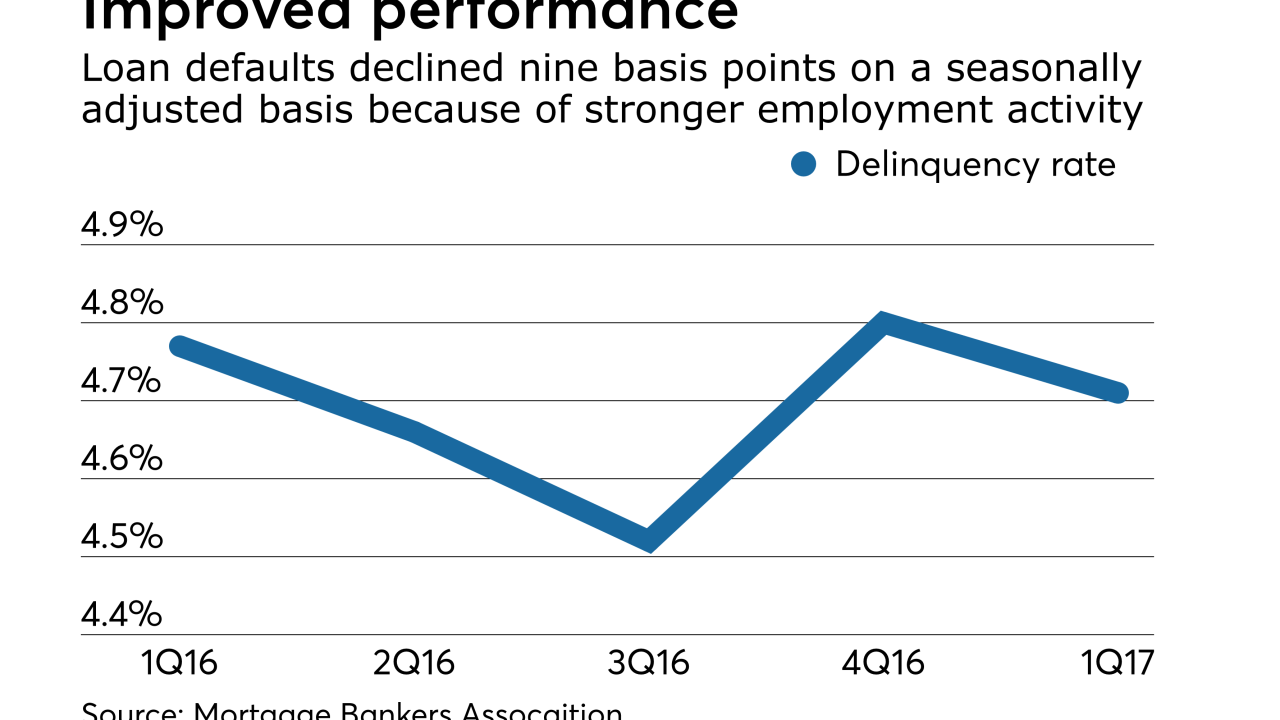

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

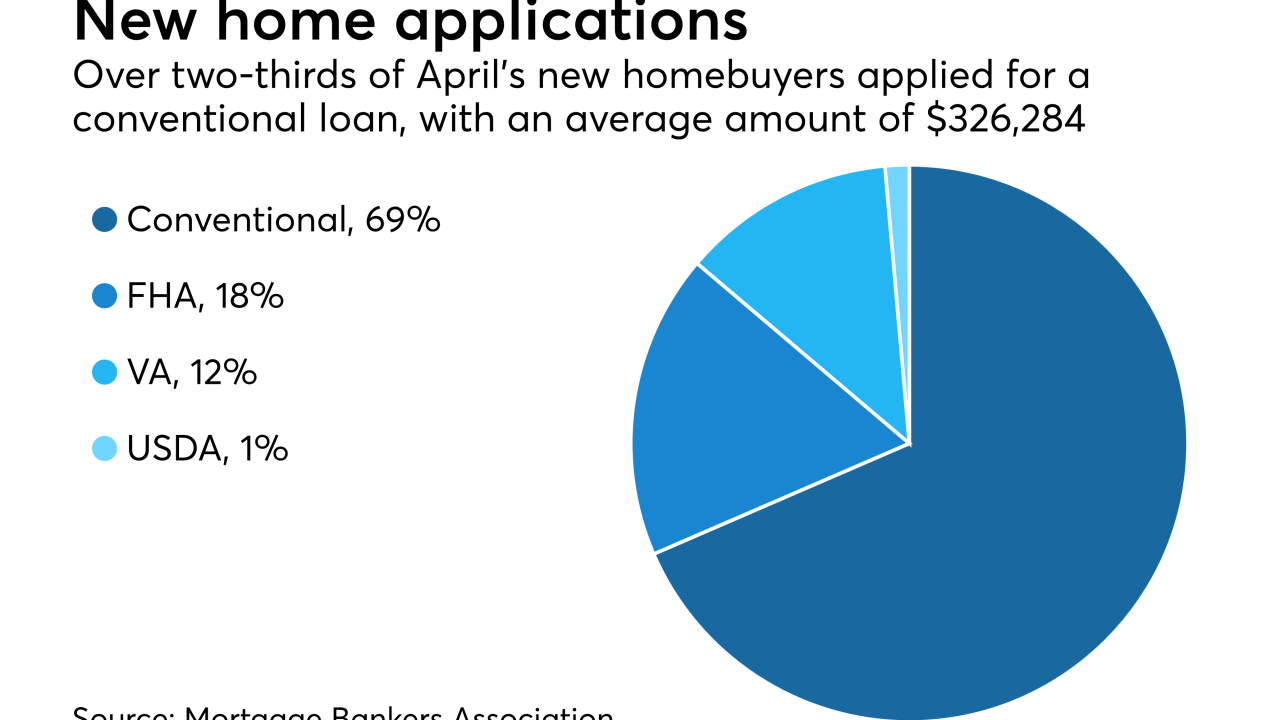

There were fewer new home purchase loan applications in April, as year-over-year activity declined for the first time in 2017.

May 15 -

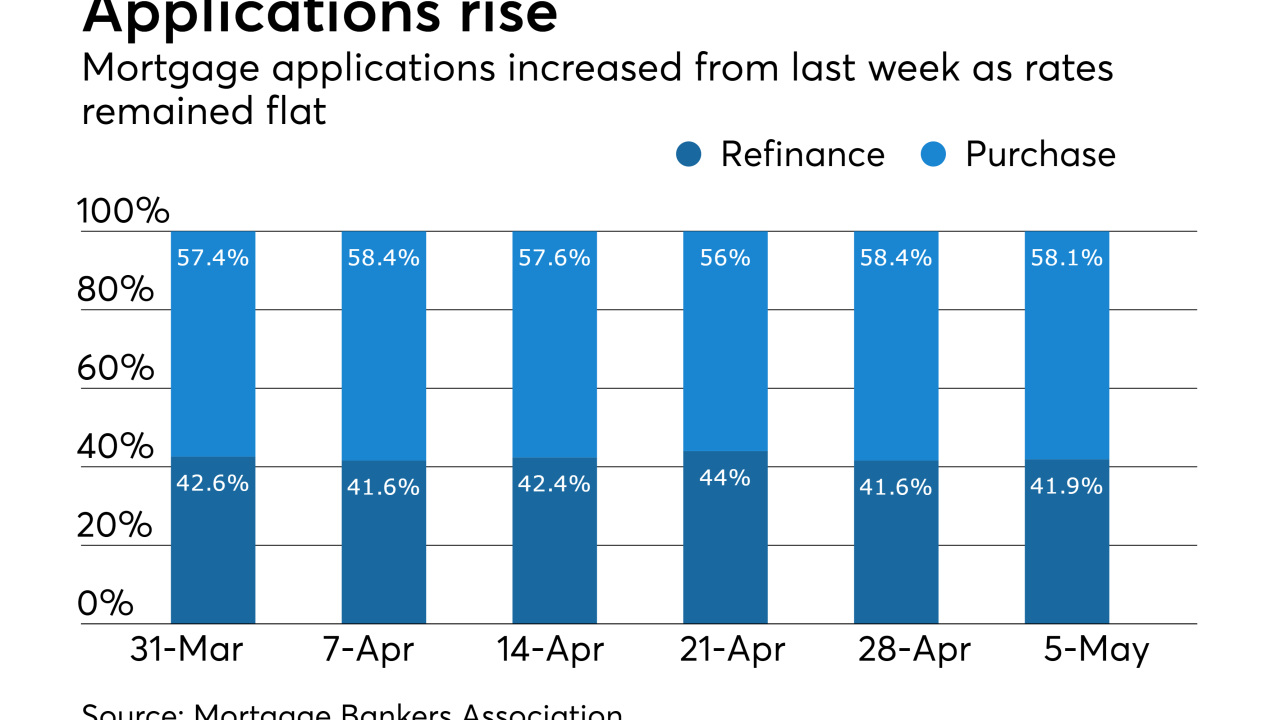

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

Mortgage credit availability declined in April as lenders cut back on the number of conforming products they offered.

May 4 -

Mortgage rates held steady in anticipation of the Federal Open Market Committee not increasing short-term rates at its meeting Wednesday, according to Freddie Mac.

May 4 -

From housing finance reform to the latest economic projections, here's a look at the biggest stories and best insights from this week's Mortgage Bankers Association National Secondary Market Conference in New York.

May 3 -

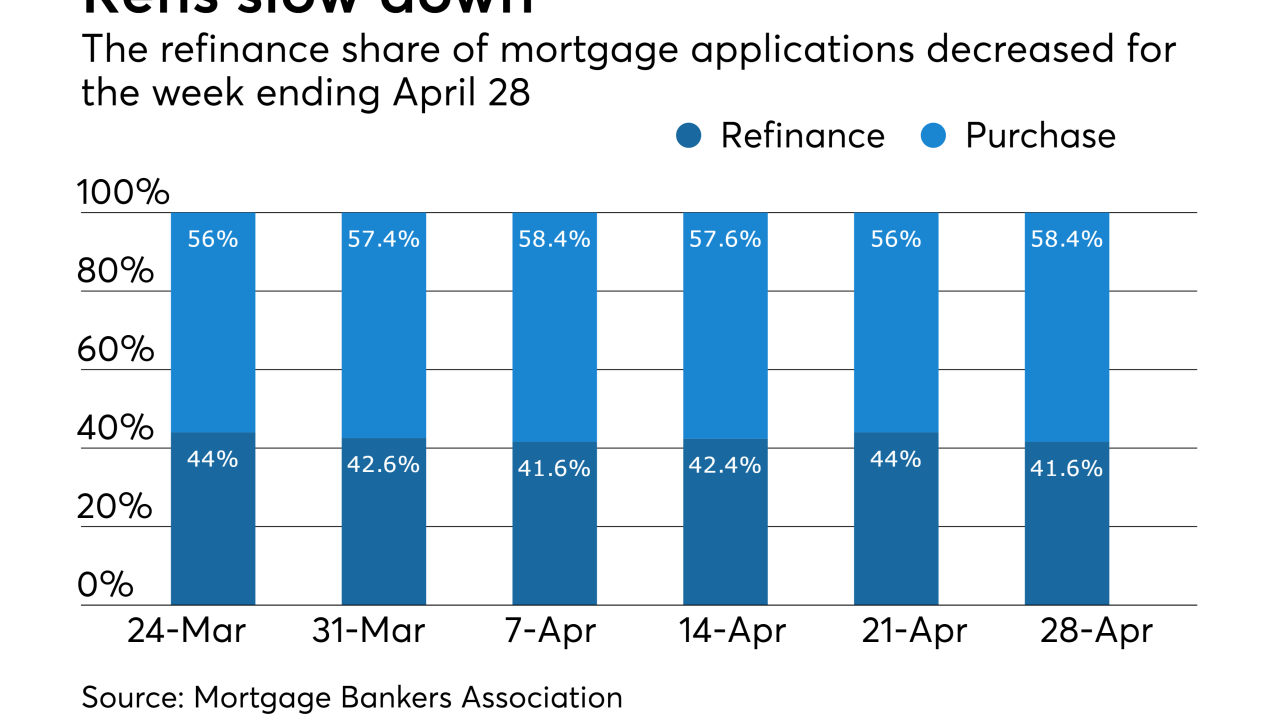

Mortgage application volume decreased 0.1% from one week earlier as refinance activity resumed its decline, according to the Mortgage Bankers Association.

May 3 -

Fannie Mae and Freddie Mac will continue to pursue opportunities for the government-sponsored enterprises to provide liquidity to the single-family rental market, despite opposition from mortgage and real estate industry groups.

May 2 -

Mortgage Bankers Association President David Stevens is confident that housing finance reform will move forward under the Trump administration, but criticized calls to simply let the government-sponsored enterprises recapitalize and be returned to shareholders without additional reforms.

May 1 -

The Trump administration's initial tax plan may be short on details, but a bipartisan bill offers some very specific relief for the commercial real estate industry.

April 27