-

Hopes that tax reform might soften a weakening of the mortgage interest deduction were quickly dashed as the GOP plan landed a double punch on the incentive cherished by the mortgage and housing industries.

November 2 -

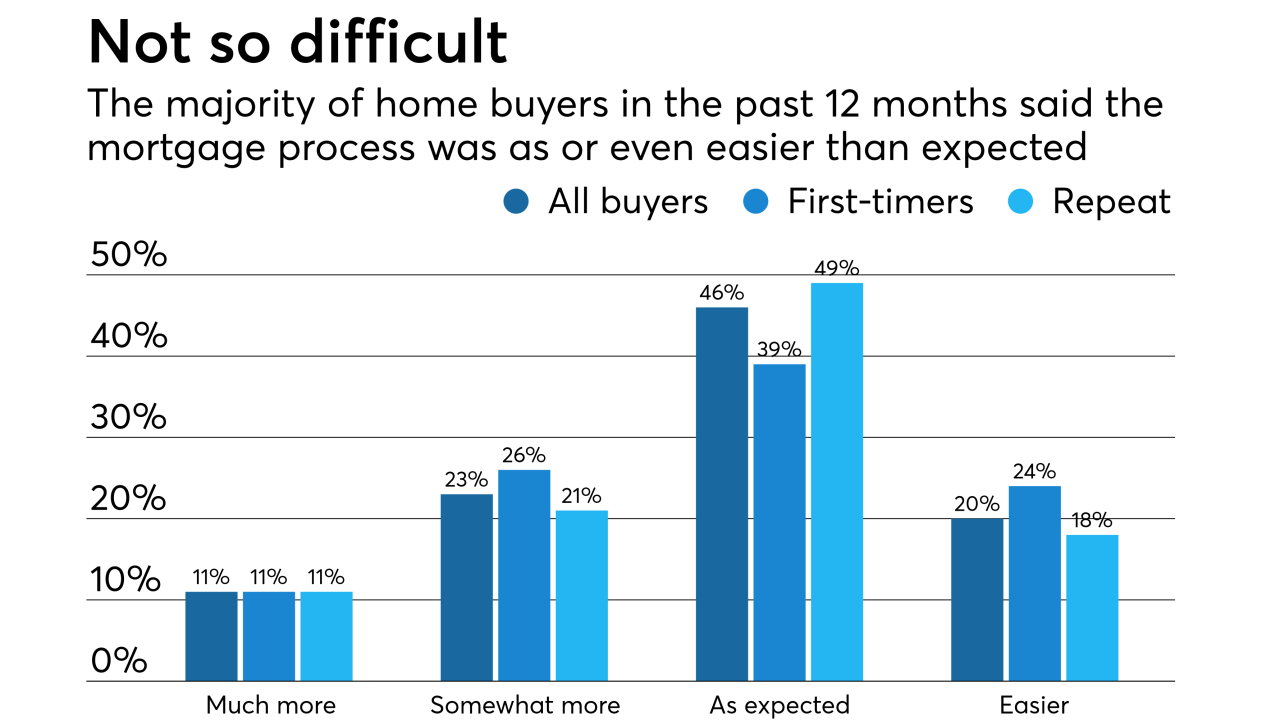

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

Lennar Corp.'s record takeover of CalAtlantic Group Inc. is a bullish sign for homebuilding in the U.S. Trade groups, meanwhile, worry that lawmakers are about to kneecap the industry.

October 30 -

A gauge of contract signings to purchase previously owned homes was unchanged in September at the lowest level since the start of 2016 as Hurricane Irma depressed sales in the Southeast and a limited number of listings restrained activity elsewhere.

October 26 -

Strong growth in the sale of existing homes in Lake County in September was almost enough to pull the seven counties that make up the Greater Northwest Indiana Association of Realtors into positive territory for the month.

October 23 -

Some housing groups are warming to an idea that they say could help more Americans benefit from housing-related subsidies than the mortgage interest deduction.

October 20 -

A group backed by billionaire industrialists Charles and David Koch unveiled a television and digital campaign that argues "corporate welfare" threatens Republican efforts to dramatically alter the U.S. tax code.

October 11 -

Nondepository mortgage bankers and brokers increased their headcounts in August, but hurricane recovery efforts and other macro factors may stymie additional growth.

October 6 -

Consumer views on the economy and finances are not to blame for the retreat in existing-home sales in four of the past five months, according to the National Association of Realtors.

September 27 -

Statewide home sales rose during August, despite a nationwide pullback in purchases of previously owned properties.

September 22 -

A lackluster supply of available homes is slowing sales across South Florida — but the shortage of listings also keeps pushing prices higher as buyers have little choice but to pay more for what they want.

September 21 -

Maine's housing economy got a late-summer boost in August, with year-over-year increases in both home sales volume and median sale price.

September 21 -

Sales of previously owned homes declined to a one-year low in August as affordability continued to hamper demand and Hurricane Harvey caused a slump in Houston-area purchases.

September 20 -

An overwhelming majority of millennials with student loan debt do not currently own a home, and are blaming student debt for delaying their ability to purchase.

September 19 -

An unexpected decline in July contract signings for the purchase of previously owned homes shows the continuing impact of limited supply on the real estate market.

August 31 -

Homeowners are eager to hold onto the ultra-low mortgage interest rates they were able to get after the crash, and they are leery about taking a chance on a move.

August 28 -

An unexpected decline in sales of previously owned homes last month to the lowest level since August 2016 indicates rising prices and lean inventories are impeding faster growth in the housing market.

August 24 -

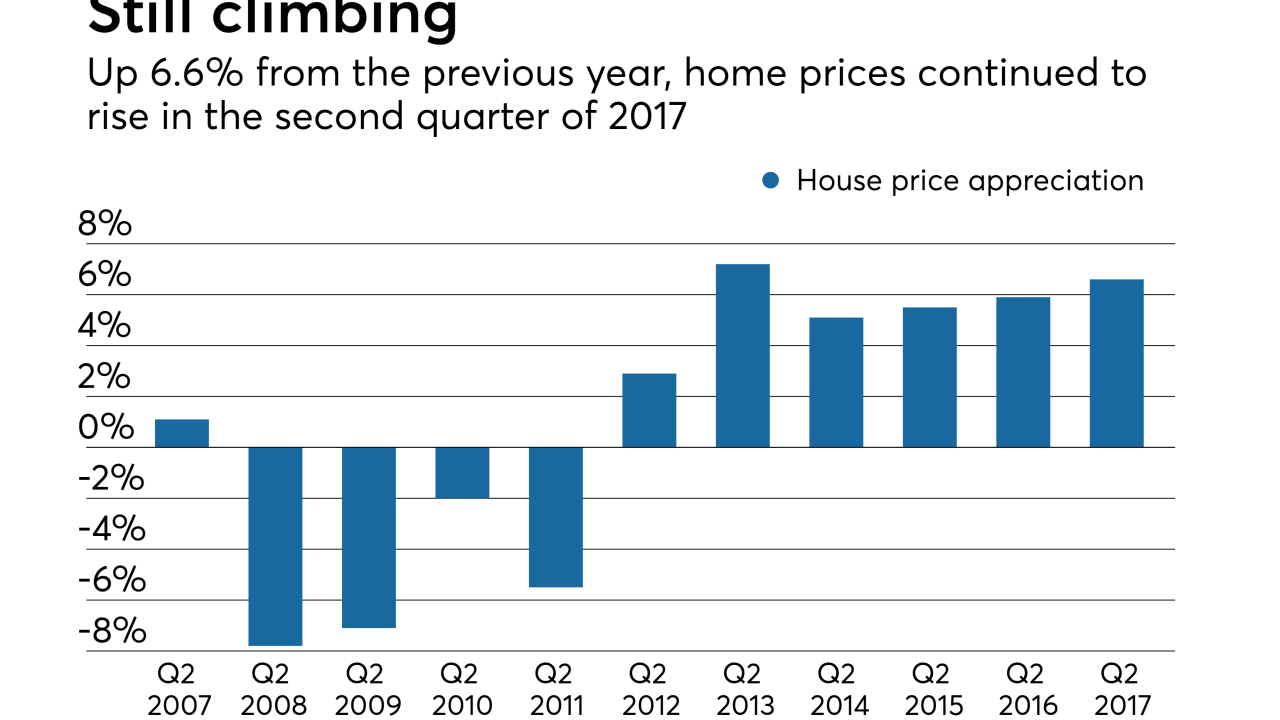

With inventory still low, home prices continued to rise in the second quarter of 2017.

August 23 -

Home prices increased 6.6% in the second quarter from a year earlier as buyers competed for a shrinking supply of listings.

August 22 -

Long the top choice for international buyers in the U.S., Florida also leads the country for foreign buyers selling off their real estate stakes.

August 2