-

The coalition, led by New York’s Letitia James and Minnesota’s Keith Ellison, argues that PHH Mortgage’s payment processing fees violate some state laws.

February 1 -

The regulator's demands for ending the action were excessive, Ocwen claimed.

January 6 -

Under the agreement, Oaktree could purchase up to a 4.9% stake in Ocwen when the deal closes, and warrants to purchase an additional 3%.

December 23 -

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20 -

The agreement with Florida ends the saga that began in April 2017, when several states sued the company. However, the CFPB's case filed at the same time remains active.

October 15 -

The annual survey and ranking of mortgage servicers found that while trust is increasing, borrowers were frustrated with some digital interactions and long wait times with call centers.

July 30 -

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

July 17 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

A federal judge granted in part and denied in part Ocwen Financial's motion to dismiss Florida regulators' case against the company, the last remaining of 30 state lawsuits filed in 2017.

October 2 -

A federal judge in Florida dismissed the Consumer Financial Protection Bureau's lawsuit against Ocwen Financial Services, stating the agency improperly asserted an excessive number of claims without specifying the particular count to which they applied.

September 6 -

Black Knight's second-quarter earnings dropped 20% from the previous year as it took a hit from its indirect investment in Dun & Bradstreet, offsetting a 7% increase in revenue.

August 7 -

A Florida-based loan servicing company has agreed to pay $84,000 to cover attorneys fees, penalties and costs associated with improper foreclosures it initiated in Maine, the state said.

August 7 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

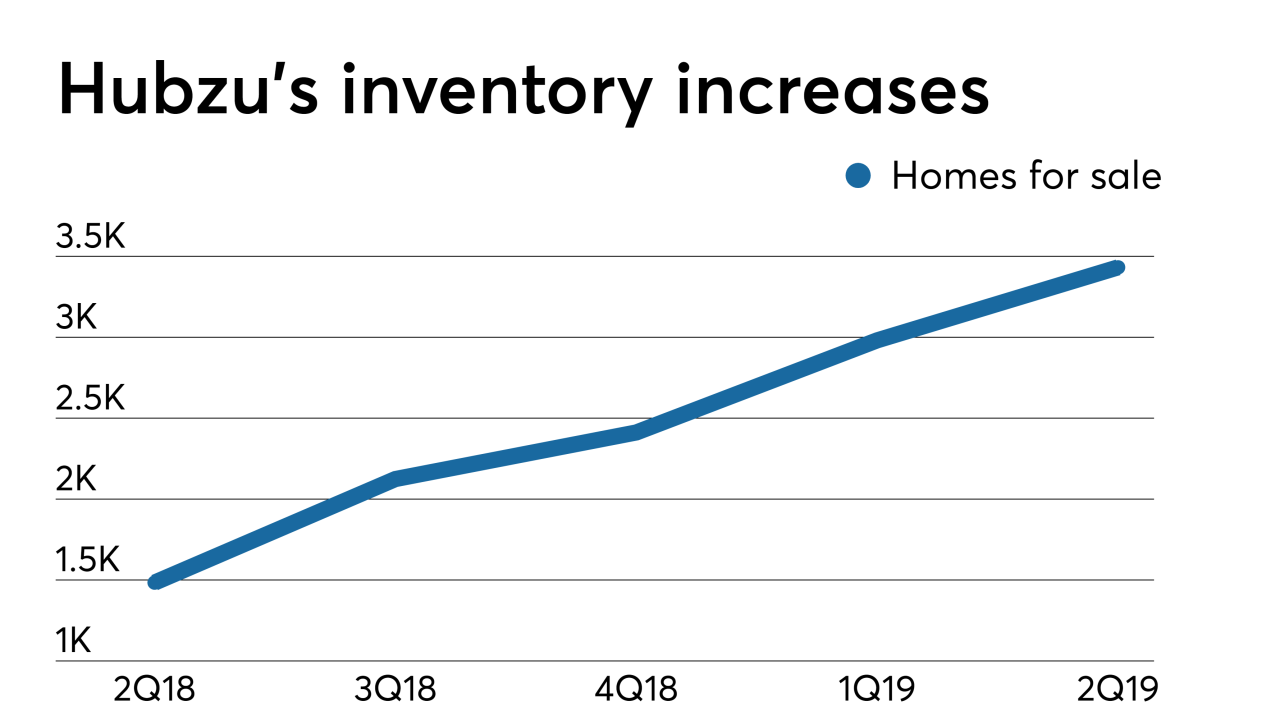

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25