-

Policymakers have eased some rules and the Supreme Court recently dealt a blow to the Consumer Financial Protection Bureau. But as the landmark legislation approaches its 10th anniversary, the post-crisis regulatory regime has stayed largely intact.

July 13 -

The lending giant's filing reveals what the company's internal structure will look like going forward.

July 8 -

A Detroit-based company, which owns Rocket Mortgage and Quicken Loans, listed the size of its upcoming offering in filing as $100 million, a placeholder amount that will likely change.

July 7 -

The company could be seeking a cash infusion to handle market difficulties ahead, but representatives are keeping mum on the matter.

June 12 -

A $740 million jury verdict against Amrock was thrown out by a Texas appeals court that said tech firm HouseCanary failed to prove the big title insurer stole its trade secrets to build a competing real estate analysis tool.

June 5 -

Culture scores at the lender are equal or higher than before lockdown.

June 2 -

The Federal Reserve's emergency rescue of the U.S. mortgage market should have set off celebration among lenders trying to keep up with demand from borrowers. Instead, executives at Quicken Loans got a hefty margin call.

May 4 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

March 25 -

To address the coronavirus' impact, banks like Truist and Ally and nonbanks like Quicken Loans are assisting communities as well as making adjustments to support their workforce and customers.

March 19 -

From increased consumer engagement to new forms of payment, mortgage servicers are finding themselves faced with new trends in the market that they need to address.

February 28 -

United Wholesale Mortgage invested in regional Super Bowl advertising for the first time and local competitor Quicken Loans added to its longstanding national marketing ties to the game.

January 31 -

Dan Gilbert has been back in the office and could soon be making his first public appearance since suffering a stroke last May, Quicken Loans CEO Jay Farner said.

January 16 -

High employment, low interest rates and technology helped two Metro Detroit mortgage giants post record years in 2019.

January 8 -

Quicken Loans, which has a history of advertising its Rocket Mortgage digital application with high-profile Super Bowl promotions, is doubling down on its ties to the National Football League event.

January 7 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

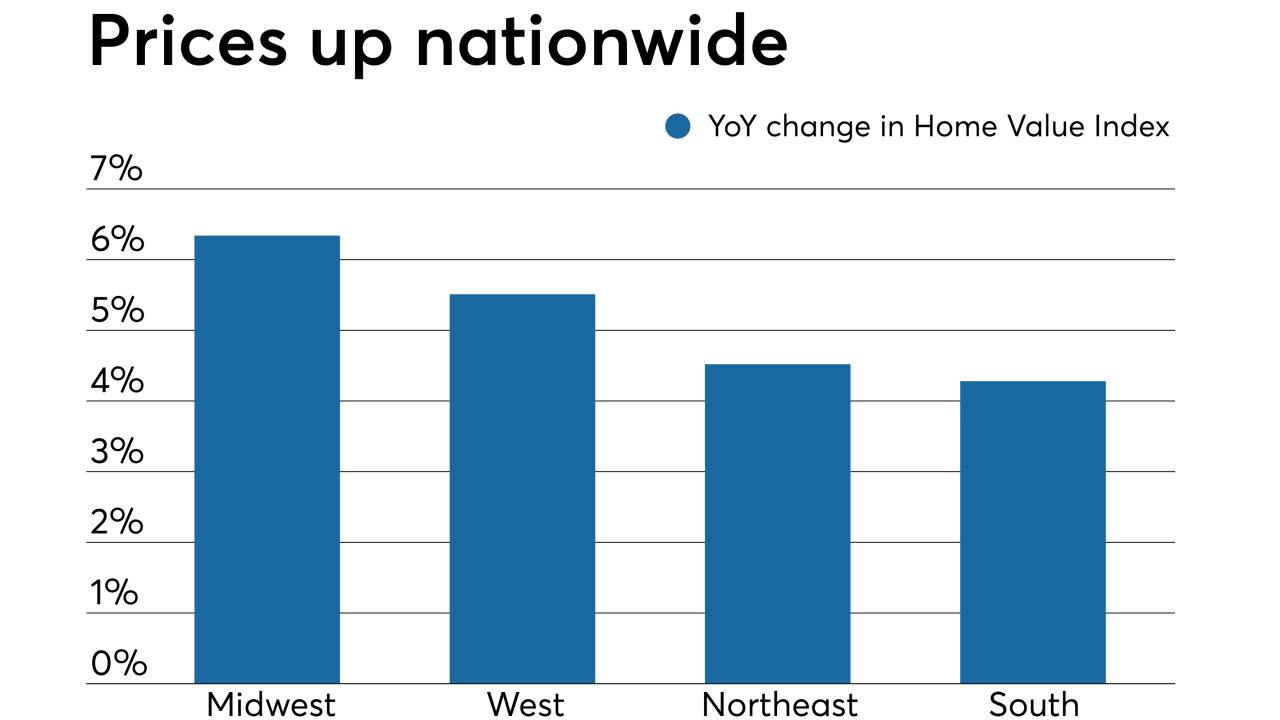

Home values posted the largest month-over-month spike in over five years due to continued buyer demand, according to Quicken Loans.

October 10 -

Quicken Loans is now able to perform an electronic mortgage closing in all 50 states, claiming to be the first lender to have this capability.

October 7 -

The race to optimize mobile capabilities for consumers is far outstripping efforts to improve the back-office experience. That imbalance carries substantial risks.

August 28 -

Digitizing the lending experience can go a long way toward boosting mortgage applications even as interest rates continue to fluctuate.

August 26 Fincity

Fincity