-

The court struck down a 2015 update to the Telephone Consumer Protection Act, which permitted robocalls to cellphones for government-related debt collection.

July 6 -

The $38.7 billion of equity withdrawn during the period was down 8% from the fourth quarter.

July 6 -

Mortgage application volume was down for the second consecutive week, this time by 1.8%, as a new record low for rates was not enough to overcome diminished demand, according to the Mortgage Bankers Association.

July 1 -

Compared with the week prior, approximately 83,000 more loans from all investor types became forborne.

June 26 -

Even as interest rates remained at record-low levels, mortgage application activity for both purchases and refinancings declined compared to one week earlier, according to the Mortgage Bankers Association.

June 24 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

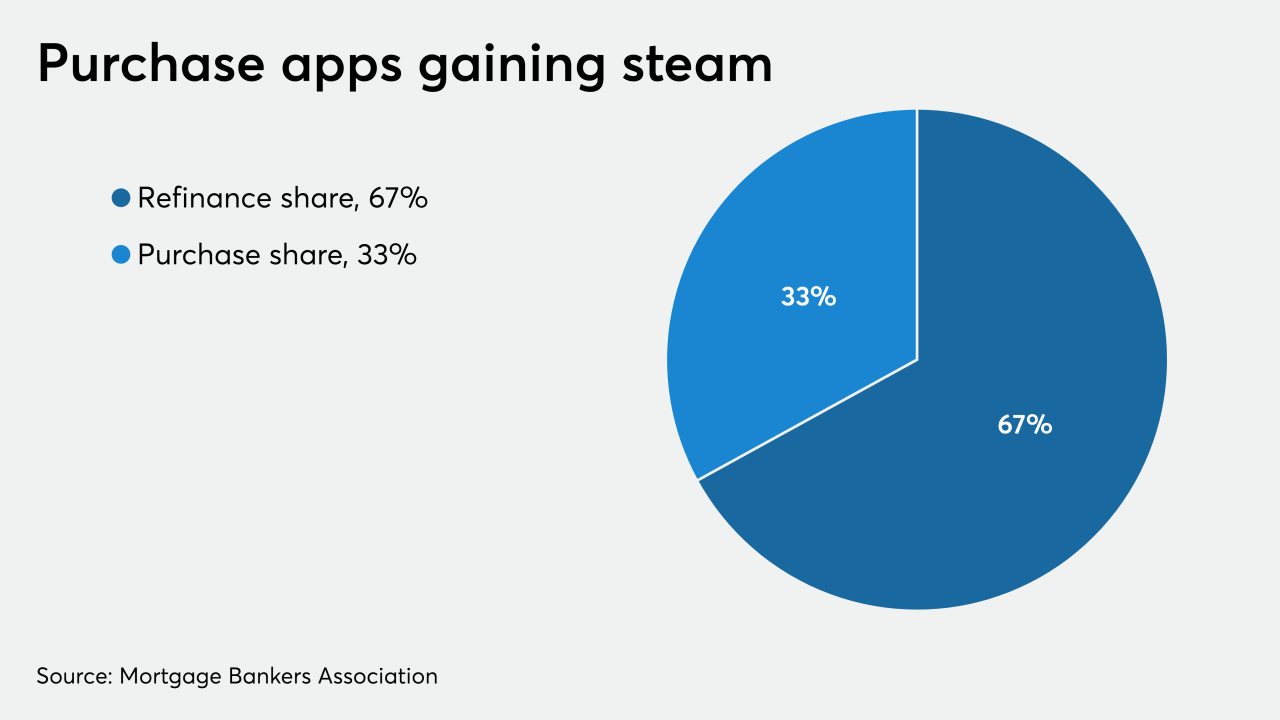

Purchase mortgage application volume was at its most in over a decade as consumer confidence continued to improve in the aftermath of the coronavirus shutdown, according to the Mortgage Bankers Association.

June 17 -

Mortgage applications increased 9.3% from one week earlier, fueled by low mortgage rates and the release of pent-up demand, according to the Mortgage Bankers Association.

June 10 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

But there was an increase in private-label mortgages in forbearance.

June 5 -

Purchase mortgage application volume continued its upswing as consumers acted on record low rates, but high unemployment and low inventory could hold home buying activity back in the future, the Mortgage Bankers Association said.

June 3 -

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

As the growth rate in forbearance requests downshifts, a vast stockpile of loans await modifications.

May 22 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

Pent-up demand is already pushing buyers to a gradual return to the market, the report asserts.

May 18 -

But in the worst-case scenario, the number of forbearances could grow by 3 percentage points through the end of June.

May 15 -

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

By the end of the first quarter, the number of borrowers 30 days late on their mortgage increased by 59 basis points.

May 12 -

Specialized Loan Servicing will pay more than $1 million to settle Consumer Financial Protection Bureau allegations that it foreclosed on protected consumers and failed to send required evaluation notices in 2014.

May 12