-

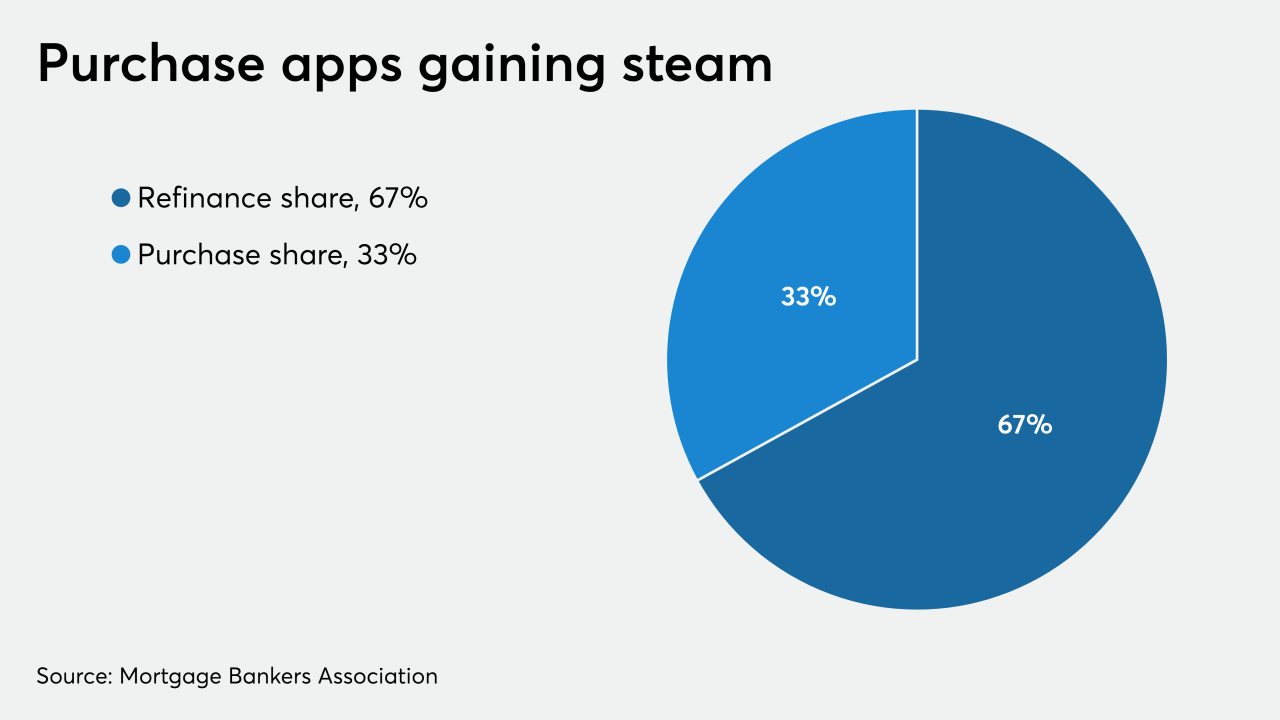

Purchase mortgage application volume continued its upswing as consumers acted on record low rates, but high unemployment and low inventory could hold home buying activity back in the future, the Mortgage Bankers Association said.

June 3 -

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

As the growth rate in forbearance requests downshifts, a vast stockpile of loans await modifications.

May 22 -

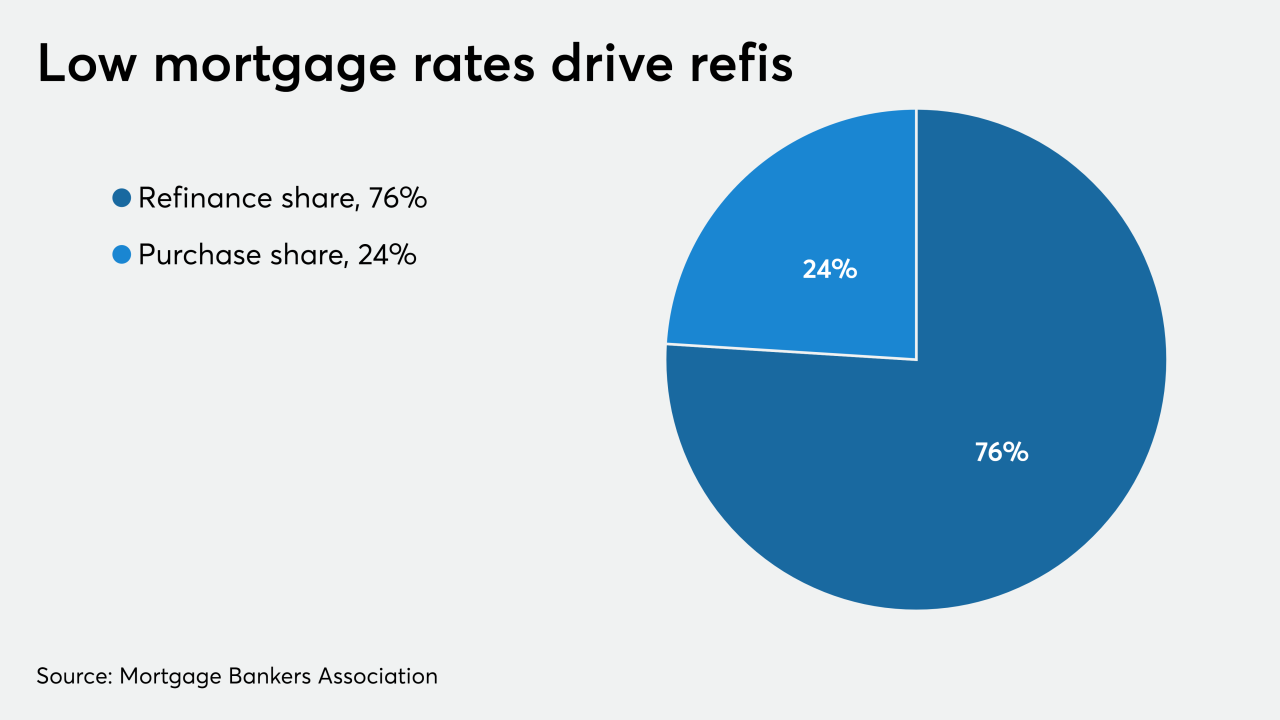

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

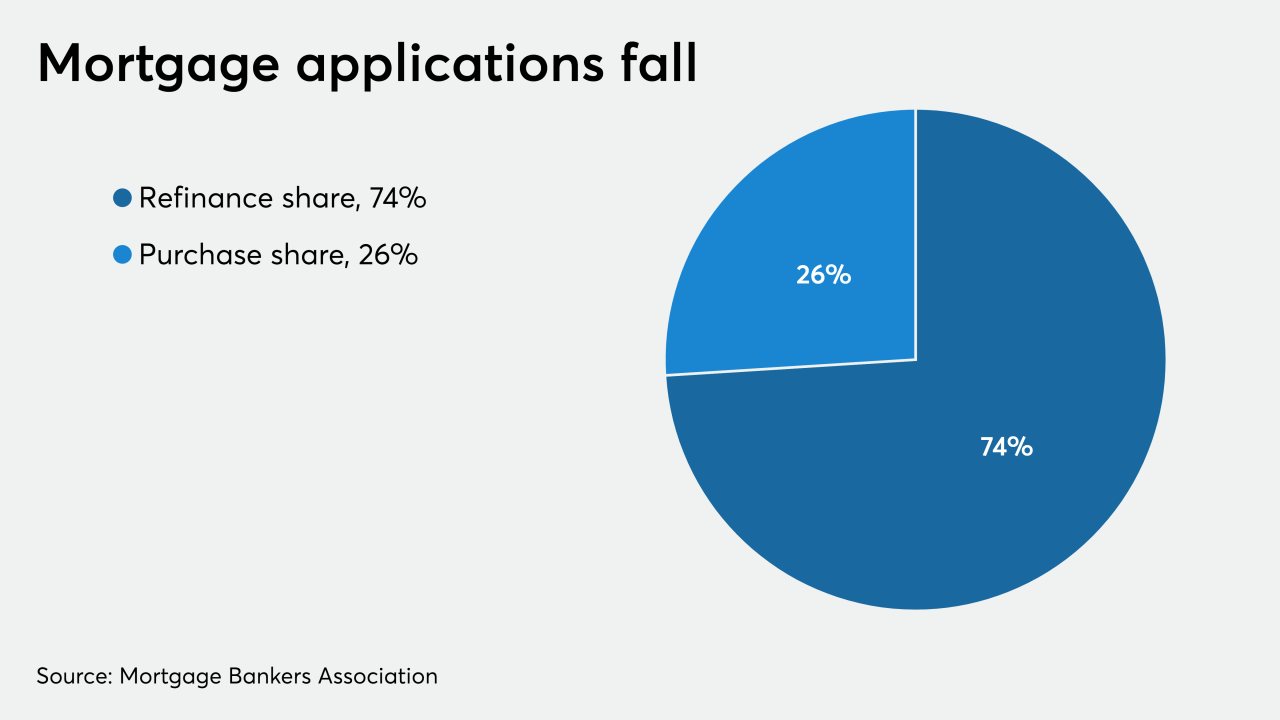

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

Pent-up demand is already pushing buyers to a gradual return to the market, the report asserts.

May 18 -

But in the worst-case scenario, the number of forbearances could grow by 3 percentage points through the end of June.

May 15 -

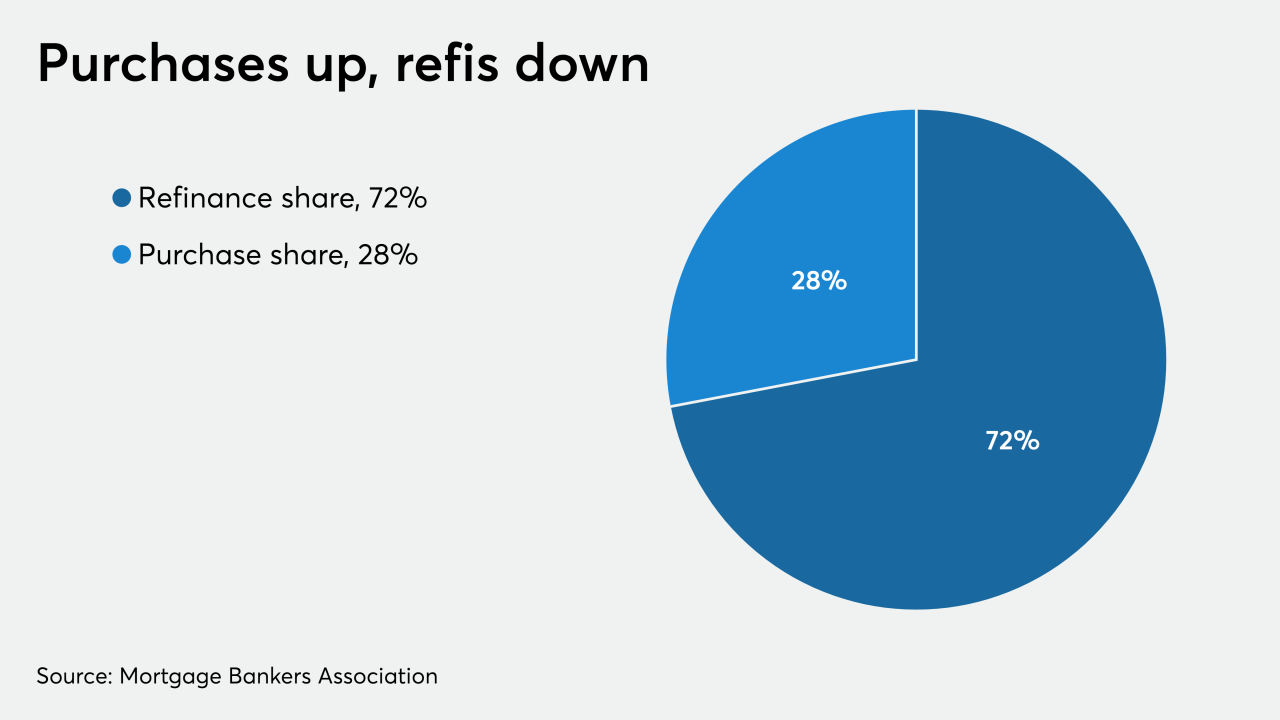

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

By the end of the first quarter, the number of borrowers 30 days late on their mortgage increased by 59 basis points.

May 12 -

Specialized Loan Servicing will pay more than $1 million to settle Consumer Financial Protection Bureau allegations that it foreclosed on protected consumers and failed to send required evaluation notices in 2014.

May 12 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1