Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The city of Philadelphia and Wells Fargo have agreed to resolve a 2017 lawsuit in which the city accused the bank of violating the Fair Housing Act by steering minority borrowers into risky, high-cost loans.

December 16 -

Without admitting wrongdoing, the bank has agreed to contribute $10 million to city programs promoting homeownership for low- and moderate-income residents.

December 16 -

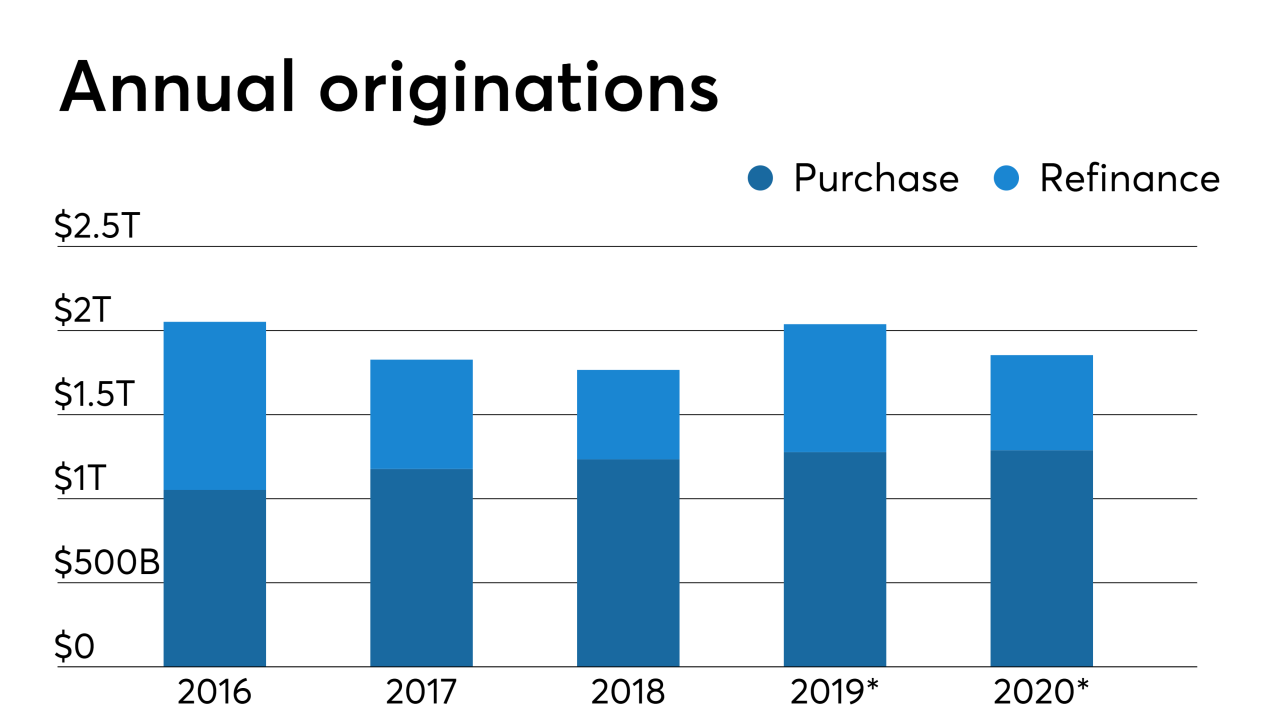

Mortgage-bond investors will need to absorb about 26% more agency MBS supply in 2020 as both home sales and prices continue to climb, according to the average estimate of six of Wall Street's biggest dealers.

December 5 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

The latest deal, WFCM 2019-C54, involves 44 loans secured by 88 properties, with a heavy exposure to office (32%), multifamily (21.1%) and retail (17.9%) properties.

December 3 -

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Homebuilder sentiment climbed to the highest level since February of last year as cheaper borrowing costs and a still-sturdy job market lifted measures of prospective buyer traffic, sales and the demand outlook.

October 16 -

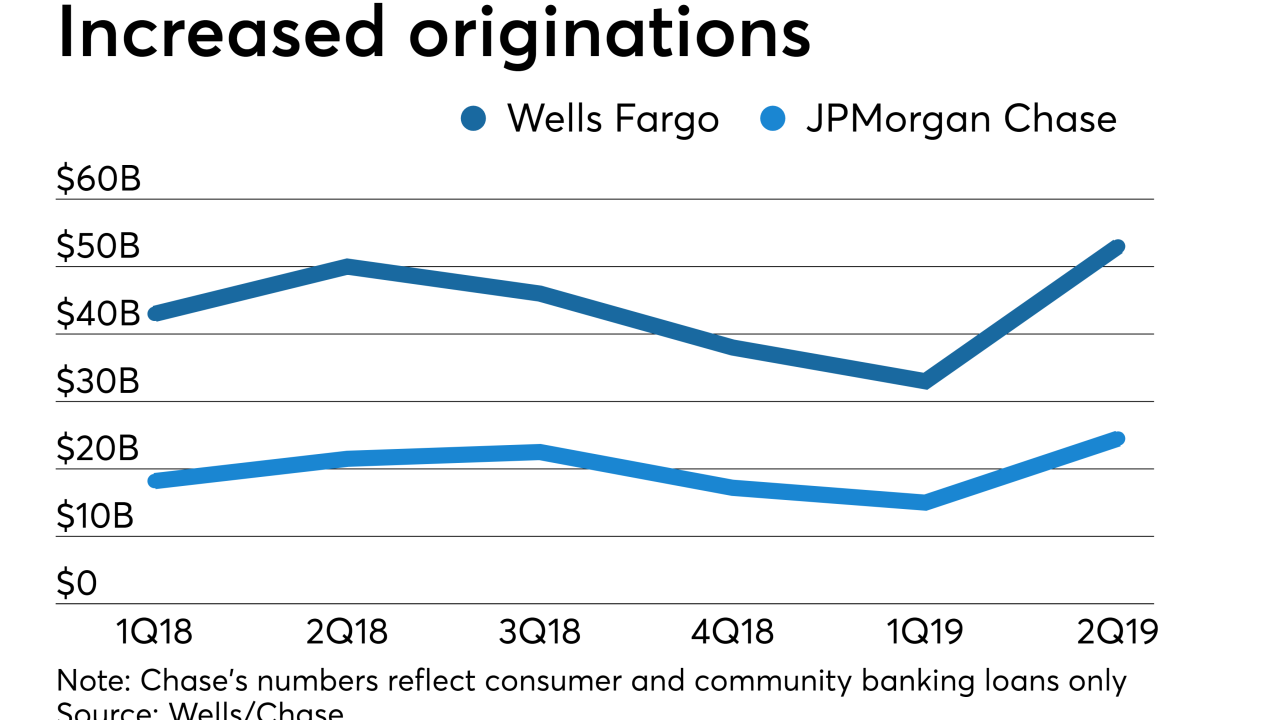

Origination volumes continued to drift upward at JPMorgan Chase and Wells Fargo in the third quarter as mortgage servicing rights values fell more sharply than some analysts expected.

October 15 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27 -

Scharf next month will become the fourth leader at Wells Fargo in three years. Meanwhile, Bank of New York Mellon has named Thomas P. "Todd" Gibbons as acting chief executive.

September 27 -

Sentiment among homebuilders climbed to the highest in almost a year on stronger current sales momentum, adding to signs that lower mortgage rates are giving the industry a boost.

September 17 -

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13 -

For the third time in five months, the San Francisco bank made a downward revision Monday to its guidance on net interest income. An executive cited the impact of lower interest rates.

September 9 -

Sentiment among homebuilders rose in August to match its 2019 high as mortgage rates tumbled, though a weaker outlook signaled concern that any gains will be temporary as investors fret about an economic downturn.

August 15 -

Two key economic forces are responsible for driving single-family housing forward, but their potential is limited, according to the National Association of Home Builders.

July 22 -

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Homebuilders' optimism increased as low mortgage rates fueled demand. However, affordability constraints and the continuing scarcity of construction workers and land parcels remain concerns.

July 16 -

Almost two-thirds of consumers think they must be debt-free to get home financing when in fact they can have debt-to-income levels as high as 43% or greater, according to Wells Fargo.

July 10 -

The bank has hired Brandee McHale away from Citigroup to head its charitable foundation and implement a new strategy that will place a greater emphasis on rental housing and combating homelessness.

June 5 -

Wells Fargo hired two seasoned veterans for their mortgage technology and data security expertise amid a digital era for financial industries.

May 29