Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Wells Fargo Home Lending is tapping eOriginal to launch an electronic note program, marking a step forward for the mortgage industry's push toward a more digital process.

October 15 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

Wells Fargo’s first private-label mortgage securitization since the financial crisis doesn’t break any new ground — and that’s probably the point.

October 10 -

Wells Fargo is planning its first post-crisis offering of bonds tied to U.S. home loans without government backing, according to people familiar with the matter.

October 5 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

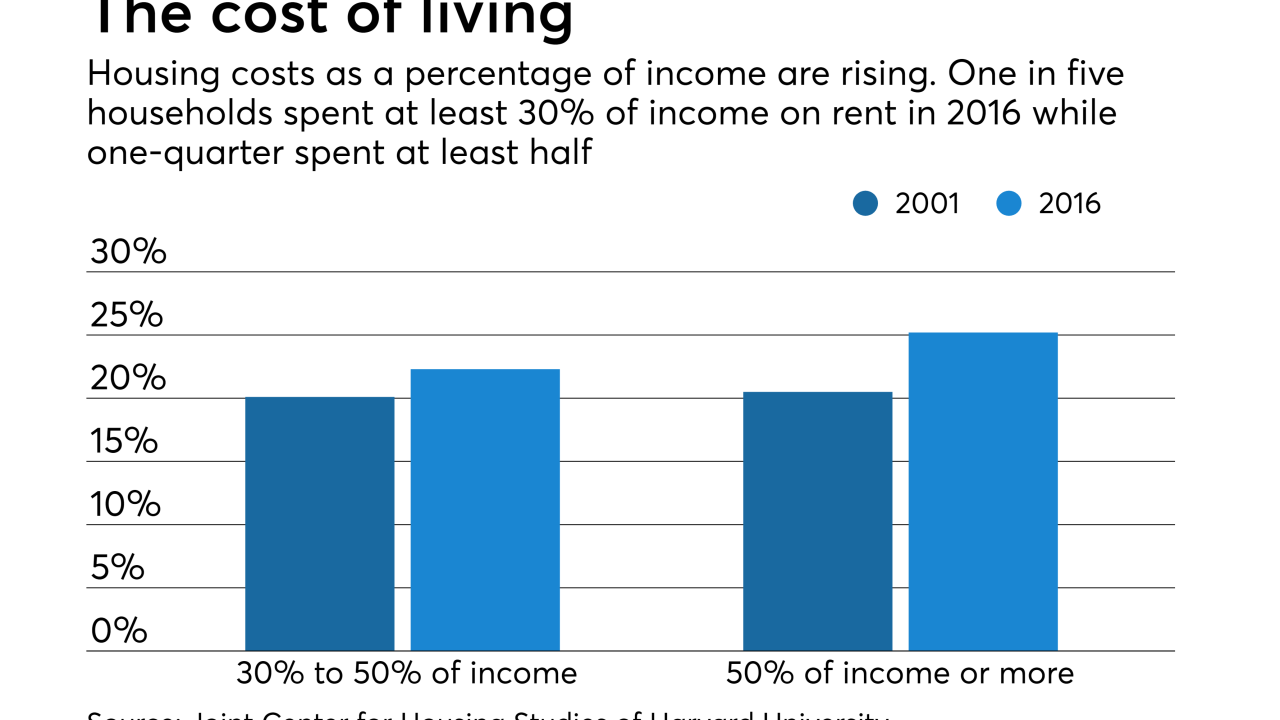

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 19 -

Wells Fargo & Co. is cutting 638 mortgage employees as the nation’s largest home lender contends with a slowdown in the business.

August 24 -

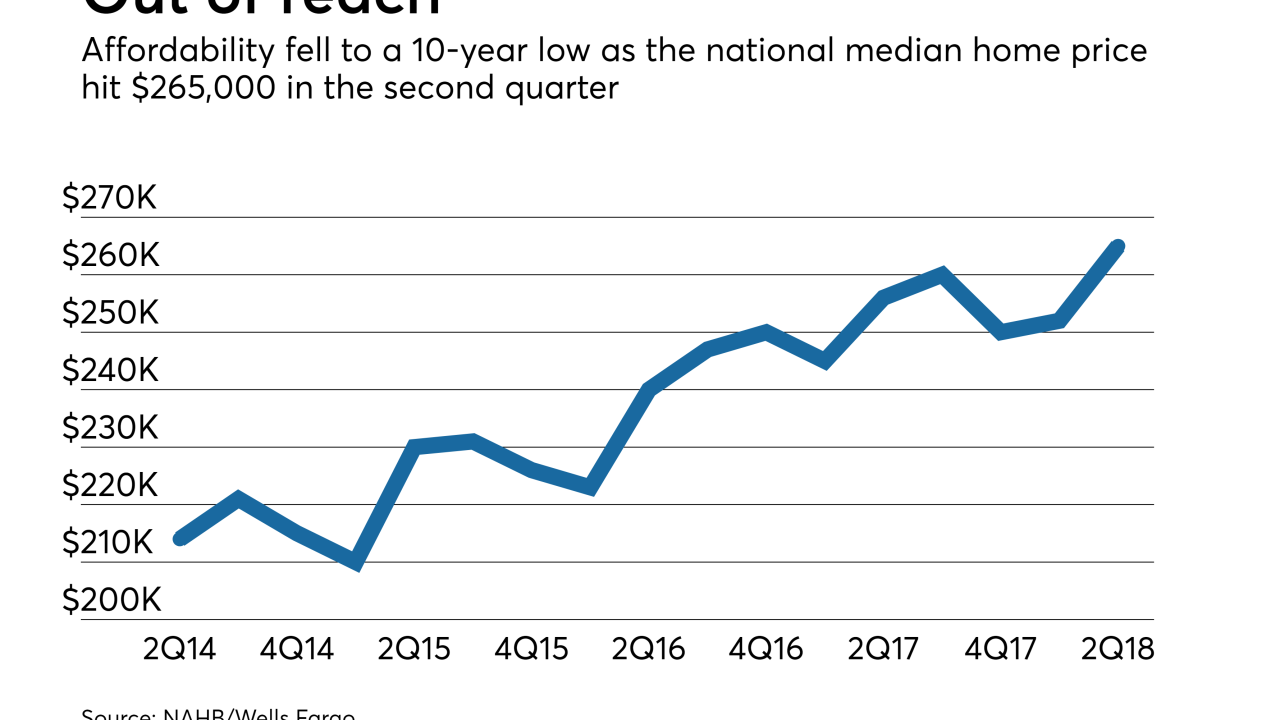

Housing market conditions pushed affordability to a 10-year low in the second quarter, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index.

August 10 -

Sen. Brian Schatz, D-Hawaii, said it is hard to imagine how Wells Fargo's $8 million remediation plan would correct a mistake that led to 400 wrongful foreclosures.

August 9 -

Wells Fargo estimates that in 400 instances, borrowers later went through foreclosure who were improperly denied or not offered a mortgage modification.

August 6 -

Multiple agencies are looking into its purchase of certain credits tied to low-income housing developments, the bank said in a securities filing Friday.

August 3 -

The agreement was likely the last of the big cases to be cleared by the Justice Department, and Wells paid less than its peers did to resolve the lingering mortgage probes stemming from the meltdown.

August 1 -

Ten years after faulty mortgages upended the global financial system, Wells Fargo agreed to pay $2.09 billion to settle a U.S. probe into its creation and sale of loans that contributed to the disaster.

August 1 -

Wells Fargo is considering a sale of commercial real estate broker Eastdil Secured, according to a person briefed on the matter.

July 26 -

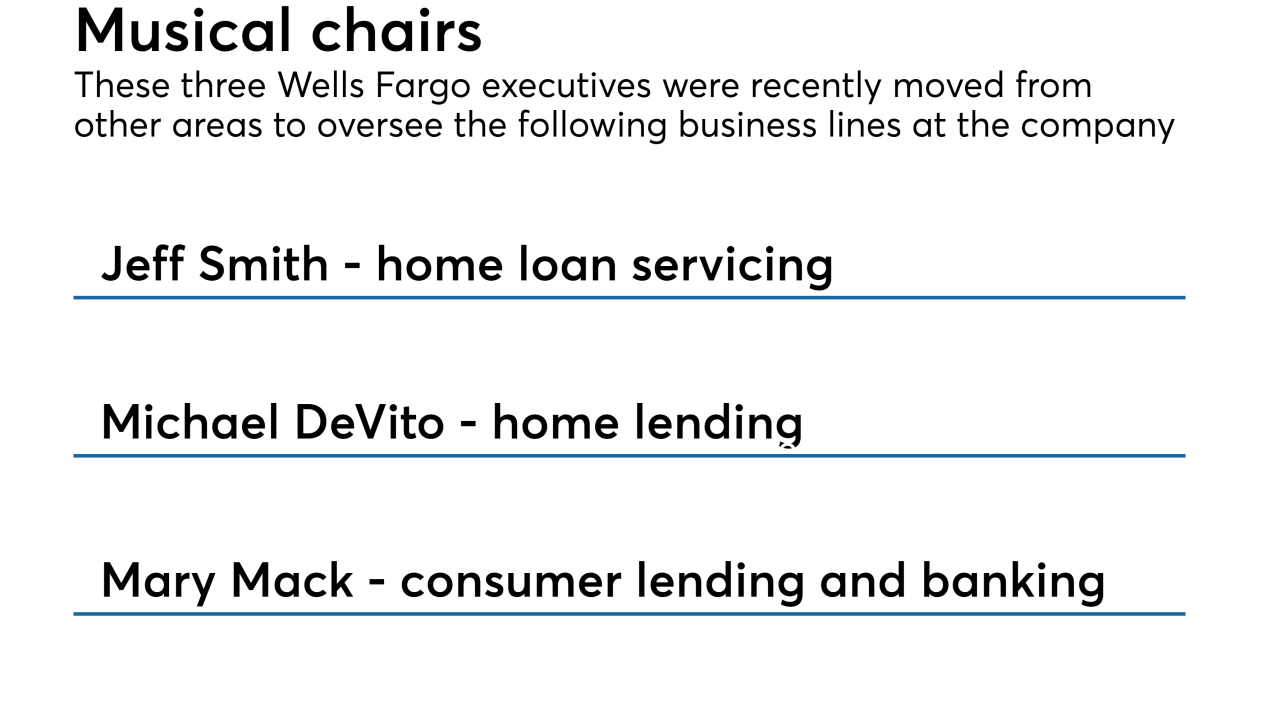

Wells Fargo has named Senior Vice President Jeff Smith to succeed Perry Hilzendeger as head of home loan servicing following Hilzendeger's earlier appointment to head of retail home lending.

July 26 -

This year's sluggish spring home buying season led to generally softer mortgage-related second quarter results at Wells Fargo, JPMorgan Chase, Citigroup and PNC Financial Services Group, but First Republic Bank bucked the trend.

July 13 -

Mortgage fees at the nation’s biggest home lender declined by a third in the three months ended June 30 to the lowest in more than five years.

July 13 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The U.S. Supreme Court agreed to decide whether thousands of borrowers can invoke a federal debt-collection law when they are facing foreclosure.

June 28 -

Overcapacity in the mortgage industry led to more competitive pricing in the first quarter, said Wells Fargo CEO Tim Sloan.

June 1