-

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, has requested no funding from the Federal Reserve in the second quarter and instead will use reserves to fund the agency.

January 18 -

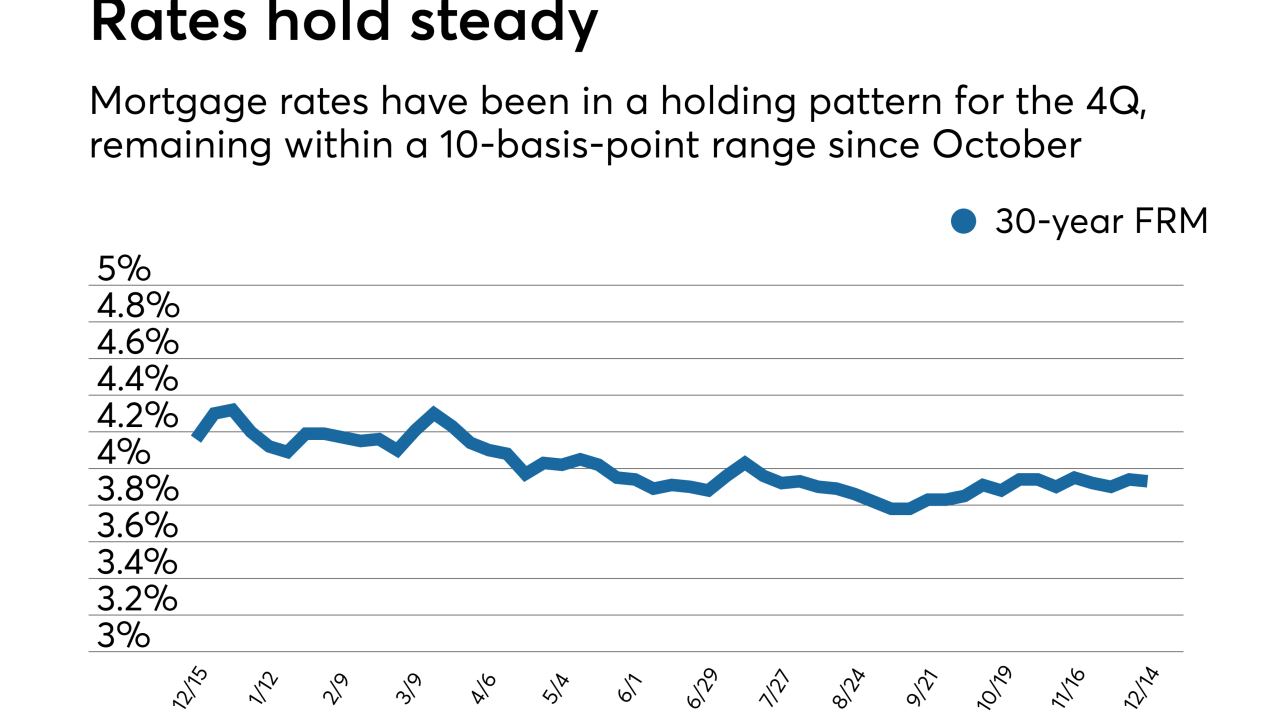

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Federal Reserve officials meeting earlier this month saw an interest-rate increase in the near term even as divisions persisted over the policy path forward amid tepid inflation.

November 22 -

Federal Reserve Chair Janet Yellen announced Monday that she intends to step down from the Board of Governors after her successor is sworn in when her term expires early next year, ending any speculation that she may stay on.

November 20 -

Many industry observers believe Federal Reserve Board Janet Yellen will retire from the central bank once her term as chair expires in February. But there are reasons she might stay.

November 3 -

Fed Gov. Jerome Powell, who was first nominated to the central bank by former President Obama, is widely seen as a continuity choice.

November 2 -

If President Trump picks Federal Reserve Board Gov. Jerome Powell as its next chair, it may represent the best of all worlds for bankers — a policymaker who will continue the central bank's monetary policy but be open to regulatory changes.

October 30 -

Federal Reserve Chair Janet Yellen said Wells Fargo’s treatment of customers was “egregious and unacceptable," hinting that more regulatory action was likely.

September 20 -

Federal Reserve Chair Janet Yellen defended post-crisis reforms but allowed that further adjustments may be necessary to reduce adverse effects on small businesses and subprime borrowers.

August 25 -

For all the talk that Janet Yellen’s plan to shrink the Federal Reserve’s balance sheet will hurt Treasuries, U.S. mortgage bonds face a bigger test.

August 11 -

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

A regulatory plan to create new restrictions on banks’ executive compensation practices appears dead — but changes since the financial crisis may have made the proposal largely obsolete anyway.

July 21 -

The industry and GOP lawmakers face short time frames and other challenges in trying to repeal the Consumer Financial Protection Bureau's arbitration rule.

July 13 -

Mortgage rates rose across the board for the second consecutive week, with the 30-year fixed-rate loan moving over 4%, according to Freddie Mac.

July 13 -

A divided Federal Reserve policy committee couldn’t reach agreement in June on the timing of when to begin shrinking its massive balance sheet, according to minutes of the meeting.

July 5 -

Federal Reserve officials have mapped out plans to reduce their $4.5 trillion balance sheet, but they’ve left out one key detail: the starting point.

July 5 -

Fed Chair Janet Yellen called the Treasury's report a "complicated document" that shared many of the central bank's objectives, including reducing regulatory burden without sacrificing safety and soundness.

June 14 -

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

June 14 -

U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers.

March 20