-

While the housing market will suffer from the COVID-19 crisis, it's stronger than it was in during its last crash in 2008, according to First American Financial.

March 31 -

It's been slim pickings inside the Cape Cod housing market for quite a while, the past year at least.

February 14 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

A city agency that in recent years lost its luster as a place where low-income New Orleanians could go for low-interest mortgages is set to re-emerge as a key player in plans to develop more affordable housing in the city.

February 10 -

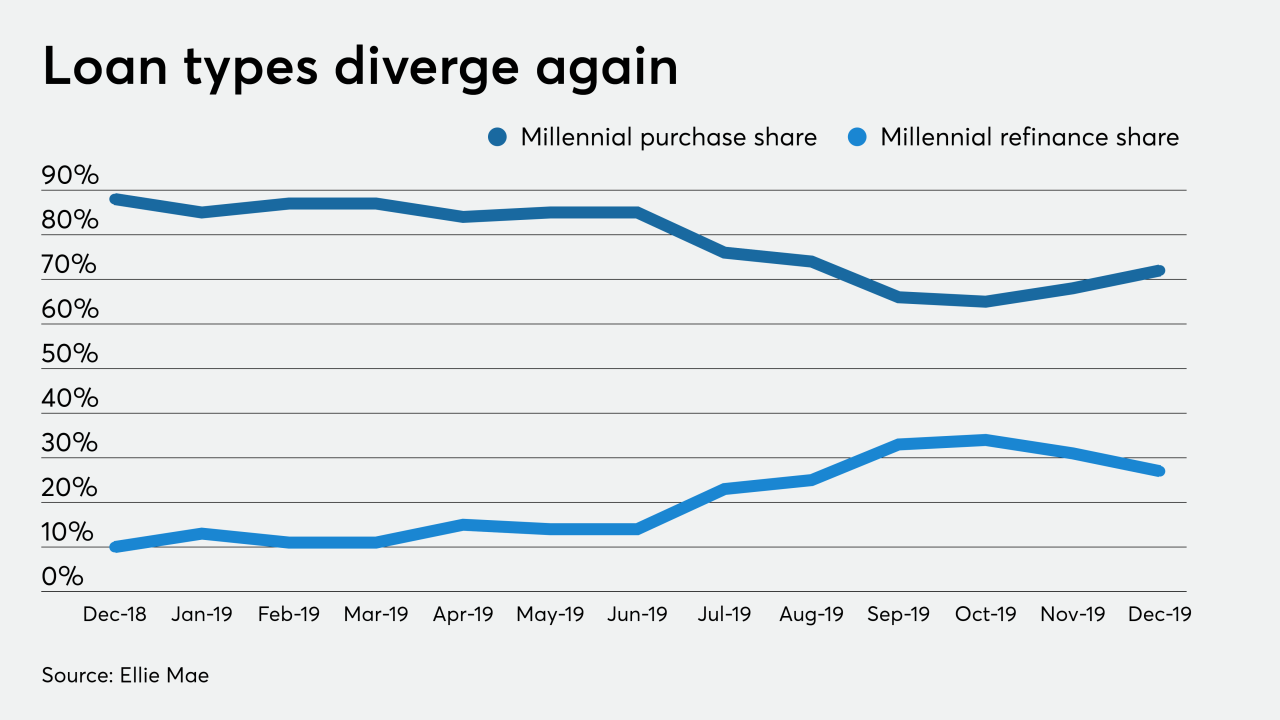

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

With steady home price appreciation and falling interest rates, by some measures the shares of distressed mortgages existing in the market shrunk to record lows, according to Black Knight.

February 3 -

For people in their 20s and 30s, New Hampshire's home prices are rising as fast as their concerns over affording a place to live.

February 3 -

Loan application defect risk fell in December after stabilizing the prior month, but it's not dropping as it quickly as it once was, according to First American Financial.

January 30 -

Home sellers in the suburbs north of New York City discounted their way to a strong fourth quarter, whittling pricing to levels that even luxury buyers found appealing

January 9 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

December home sales in the Houston area jumped 14% from the year before, capping a dramatic turnaround over the course of 2019.

January 9 -

The Las Vegas housing market continues to ride a wave of stability as the median price for an existing single-family home in Southern Nevada last month was just under $313,000.

January 8 -

Consumer perception of the housing market ticked up slightly in December, as potential buyers remain bullish about making a home purchase in 2020, a Fannie Mae report said.

January 7 -

Home sales dropped in Toronto in December, but prices continued to rise as demand outstripped a dwindling supply of units available for purchase.

January 7 -

Metro Denver home prices, after years of effervescent gains, are going as flat as that unfinished bottle of champagne.

January 2 -

The drop in home buying power heightened the risk of misrepresentations on purchase mortgage loan applications during November, as consumers are more willing to fudge information in an uncertain market, First American Financial said.

December 30 -

Homebuyer purchase power took another big jump in October as wages grew and mortgage rates stayed low despite continuously tight housing inventory, according to First American Financial.

December 23 -

With more consumers believing it’s a great time to buy a home, the Home Purchase Sentiment Index had its best November since the index's release in 2011, according to Fannie Mae.

December 9 -

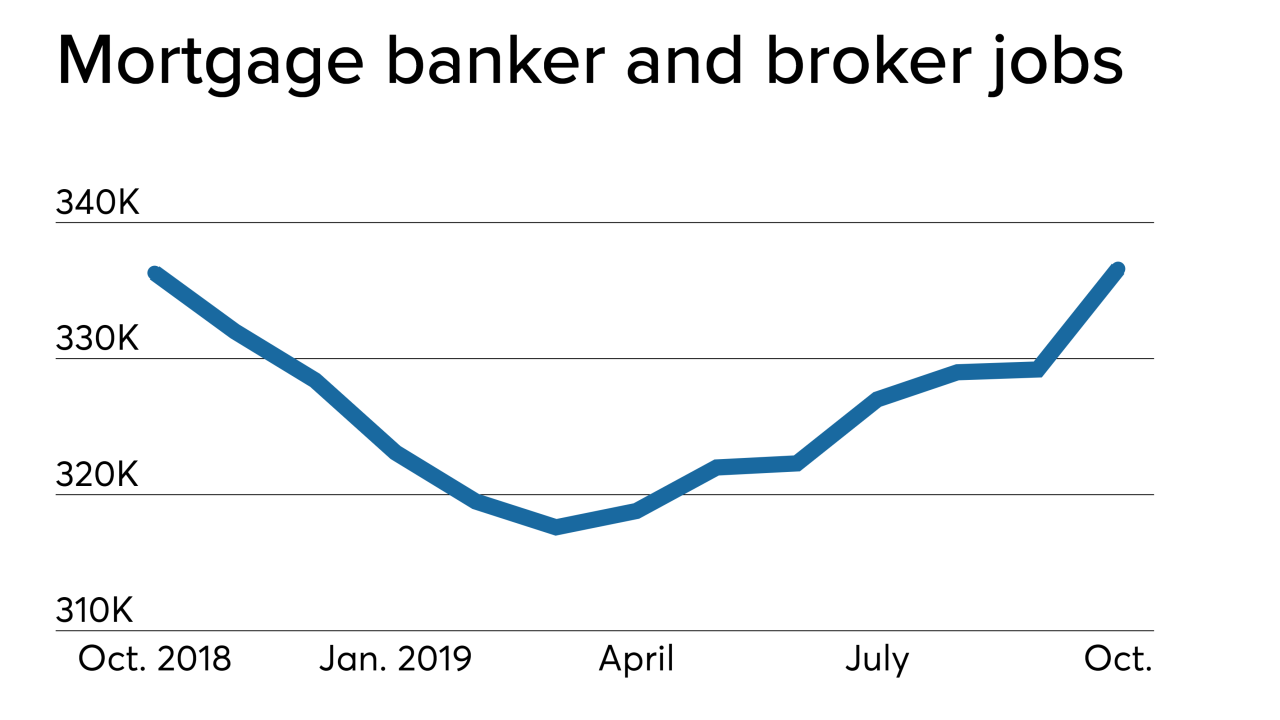

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

The Federal Housing Administration's loan limits will generally increase 5% next year, but changes in the composition of statistical areas will lead to decreases in 11 counties.

December 4