-

The MBA also said it has been lobbying for a measure that would enable cash-out refinances in forbearance to be sold to the GSEs.

May 20 -

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

The Mortgage Bankers Association's forecast anticipates tremendous coronavirus stimulus-related debt coming on to the market.

May 19 -

Other safety measures taken to protect settlement agents and consumers include drive-up closings and overnight mail.

May 19 -

The Federal Housing Finance Agency clarified that borrowers with Fannie Mae- or Freddie Mac-backed mortgages who have entered into forbearance plans can be eligible for a refi or new purchase once they are considered “current” on their mortgage.

May 19 -

The economic contraction will keep mortgage rates low for the foreseeable future.

May 14 -

The commercial mortgage broker's move is part of its formation of a dedicated multifamily group.

May 14 -

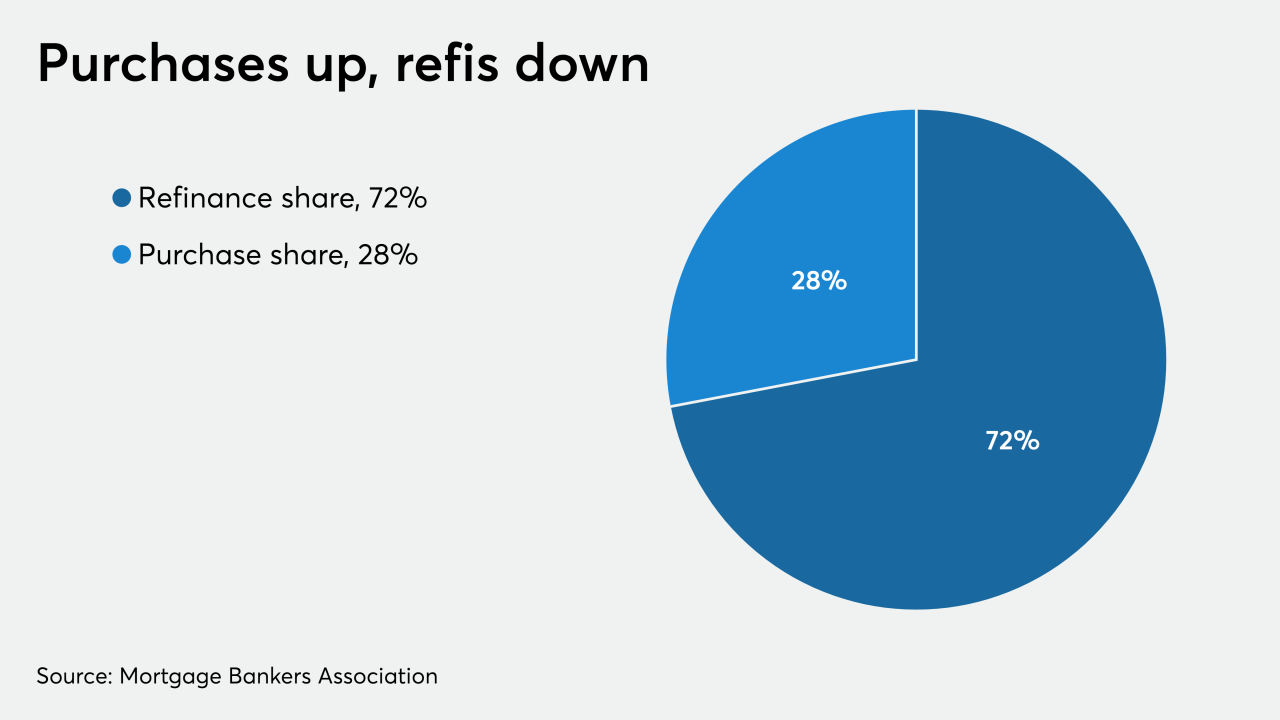

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

The title insurer did not disclose the number of layoffs.

May 11 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

Mortgage rates are at record lows, but borrowers hoping to take advantage are running into the toughest loan-approval standards in years.

May 8 -

Mortgage rates ticked up slightly this week, but whether consumers are able to take advantage of them for purchases and refinancings depends on who looks at the data.

May 7 -

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

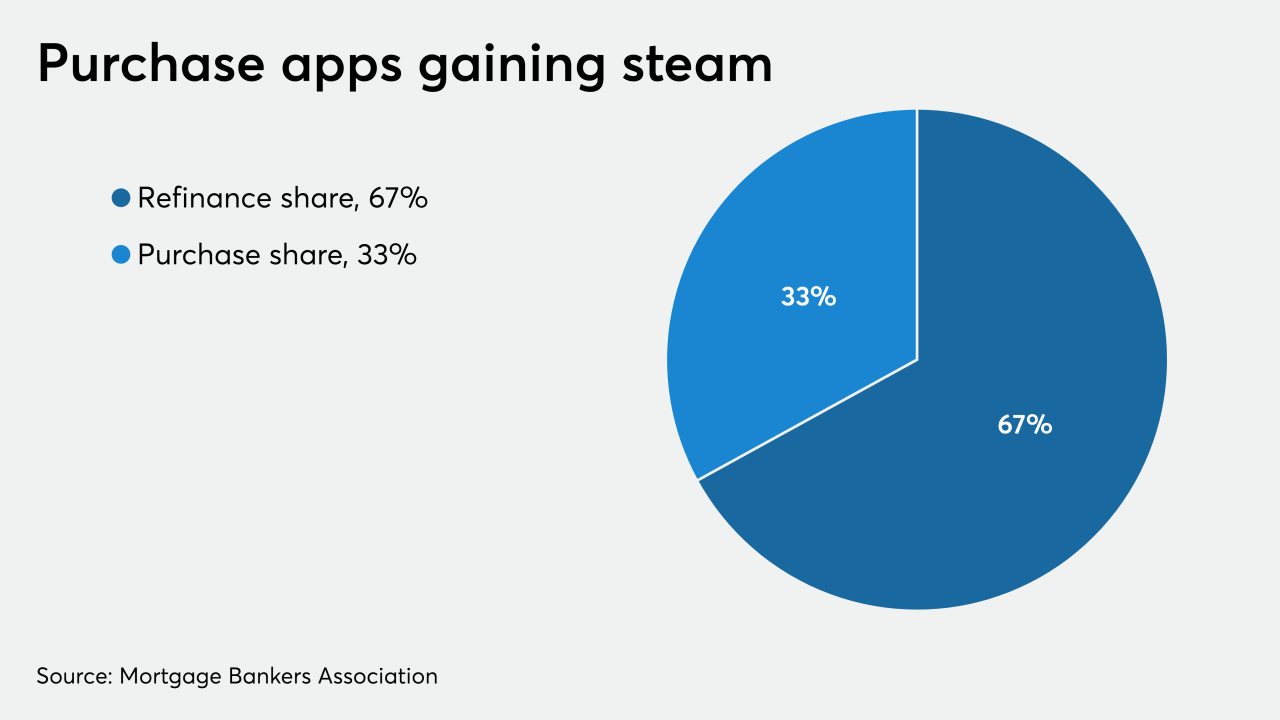

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28