-

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

February 26 -

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

February 25 -

A rally in Treasuries that's driven 10-year yields toward record lows could have more room to run, a Goldman Sachs report said.

February 24 -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

For the first time in 15 years, fewer than 2 million mortgaged properties lie in default or foreclosure status as of the end of January, according to Black Knight.

February 20 -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

As the hunt for yield intensifies, investors including Pacific Investment Management Co. see an attractive opportunity in mortgage bonds.

February 14 -

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Mortgage rates ticked up slightly, marking the first increase in four weeks, but they remain at levels which encourage borrowers to refinance, according to Freddie Mac.

February 13 -

While boosting origination volume for lenders and providing financial benefits for borrowers, the refinance boom could have adverse effects down the road, according to TransUnion.

February 12 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12 -

Forget about Edina, Arden Hills and other coveted communities. A flight to affordability is upending the housing market in the Twin Cities.

February 12 -

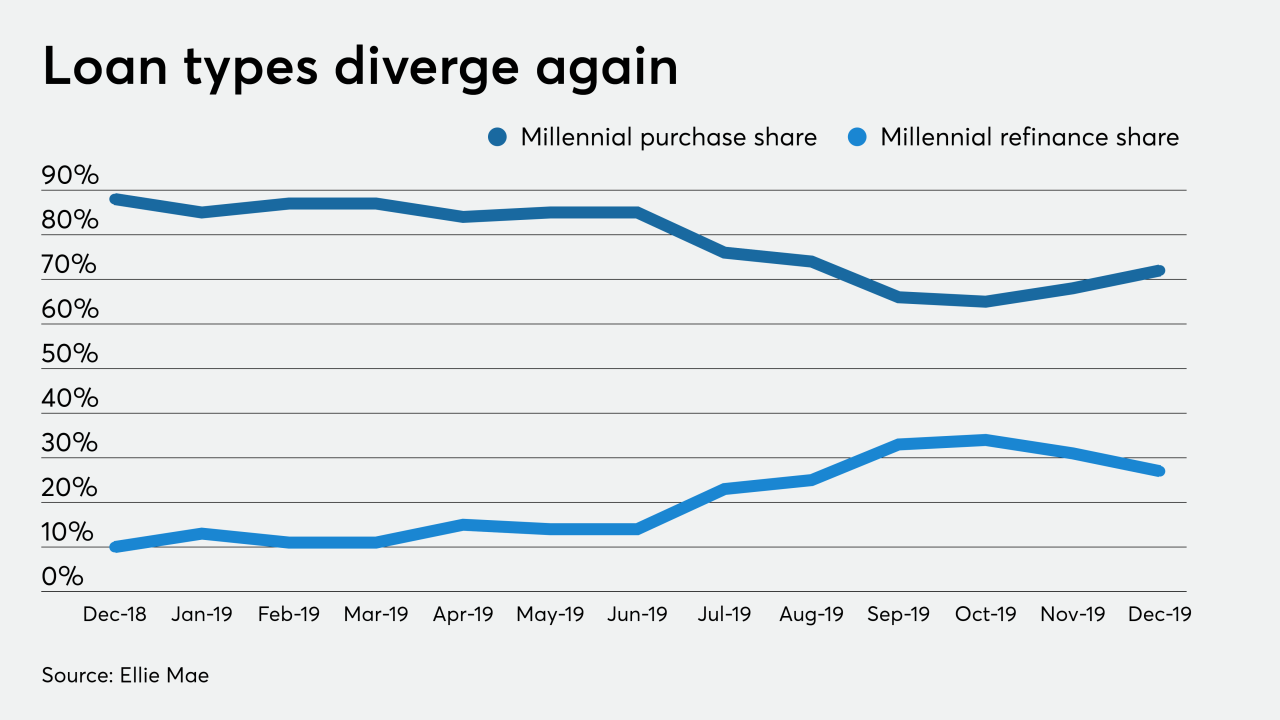

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

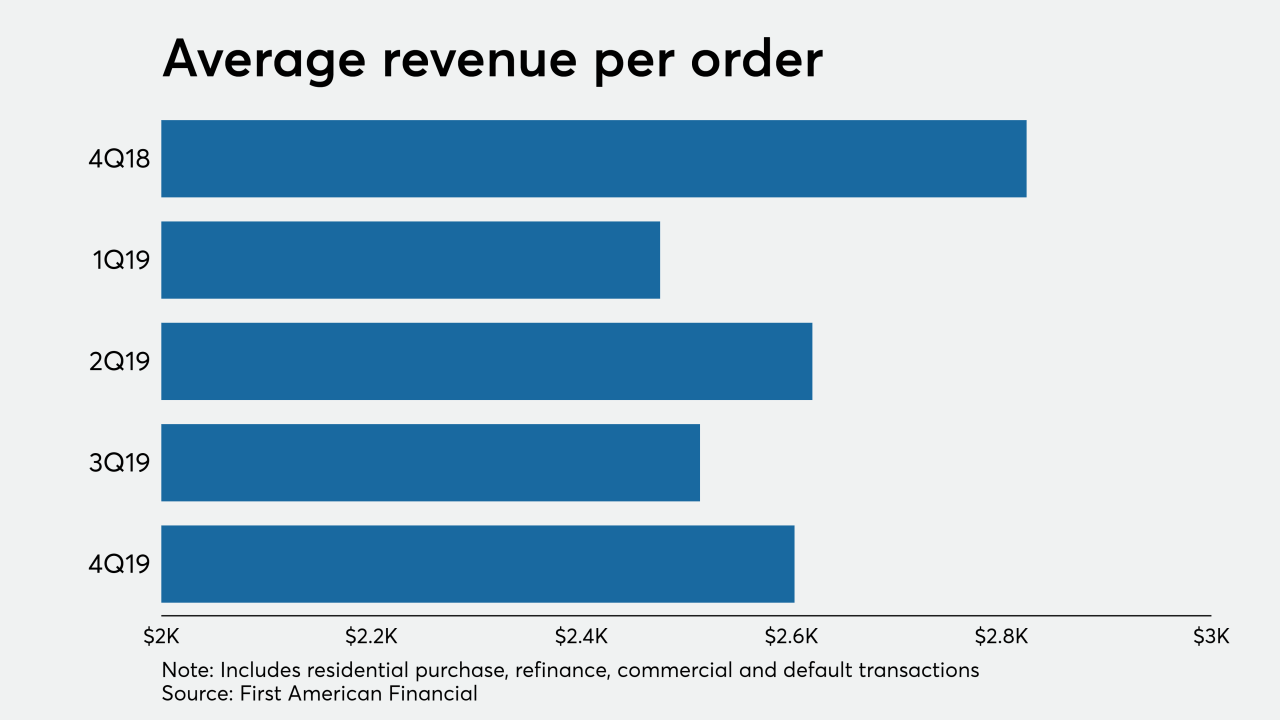

The strong refinance market in the fourth quarter propelled earnings at three different mortgage-related business that also were dealing with merger and acquisition activity during and after the period.

February 6 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5