-

-

But purchase activity reflected “resilient” consumer demand during the month, and first-time homebuyer loans gained market share, according to Black Knight.

May 9 -

Less than 5% of U.S. homeowners can save money by refinancing their housing loans, the smallest proportion in the history of the mortgage bond market, as borrowing rates surge to their highest level in three years.

March 25 -

Purchase lending grew despite headwinds in mortgage rates and rising home values.

March 14 -

While it was the largest quarter-to-quarter drop in three years, the percentage changes in dollar volume were more moderate, according to Attom Data Solutions.

March 3 -

But rising rates and tightening affordability are slowing appreciation rates, Black Knight found in its latest Mortgage Monitor report.

December 6 -

As interest rates fluctuated and purchase volumes increased in the second quarter, mortgage loans were more prone to defaults, according to actuarial and consulting firm Milliman.

November 22 -

But the number of prospects remains at the high end of its pre-pandemic range.

November 2 -

Rising debt-to-income ratios were behind almost a third of refinance rejections among those 65 and older, according to an analysis from the Urban Institute.

October 27 -

August’s increase in that loan type drove refinancings to take up a slim majority share of origination volume for the first time since February, according to Black Knight.

September 13 -

From 2016 to 2019, the Long Island man stole from Home Point Financial, LoanDepot and United Wholesale Mortgage, and faces 30 years in prison.

September 2 -

Purchase activity dominated the period and experienced the most growth while refinances cooled off and home equity lines of credit made a comeback, according to Attom Data Solutions.

August 19 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

Borrowers reacted positively to the increased interaction and engagement resulting forbearances and payoff requests, J.D. Power found.

July 29 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

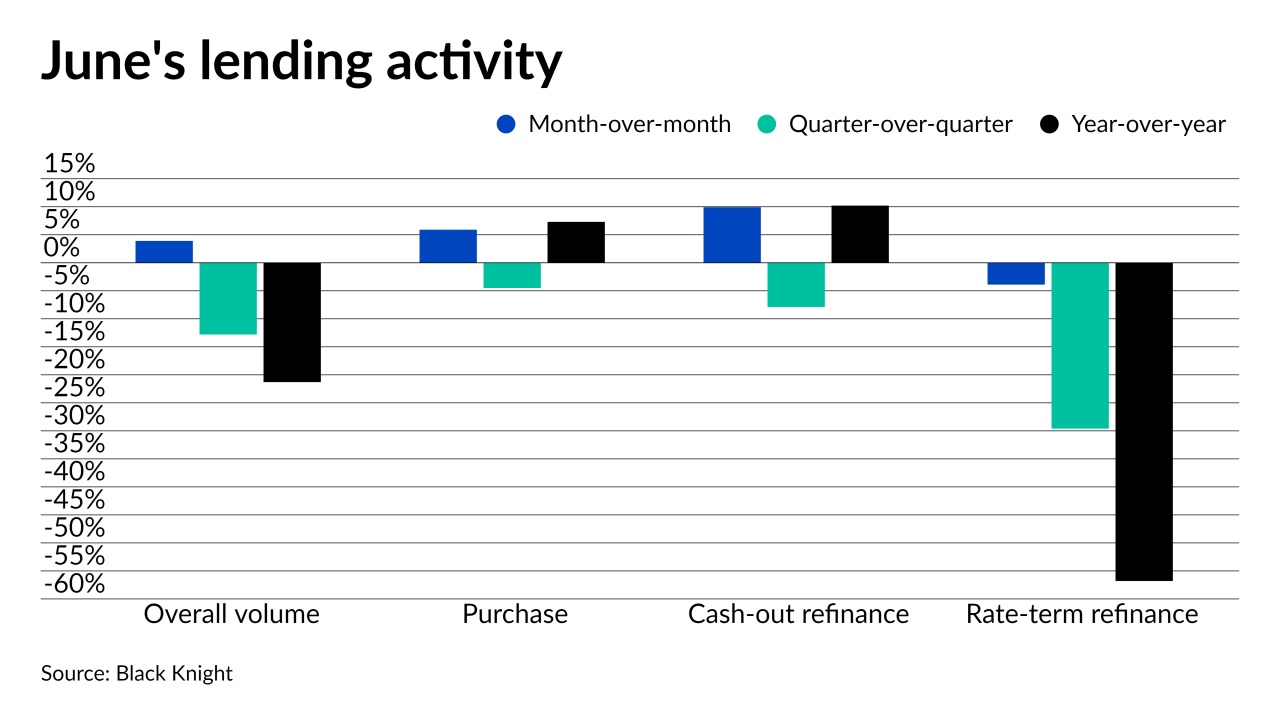

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1