-

Men listed as the primary borrower on a mortgage on average get approved for larger-balance loans than women, Ellie Mae finds in its latest Millennial Tracker survey.

December 6 -

The vast majority of consumers with a home equity line of credit said they are considering using it to pay for planned home renovations this winter.

December 6 -

Mortgage application volume decreased 3.1% from one week earlier as the start of the holiday shopping season likely slowed activity, according to the Mortgage Bankers Association.

November 29 -

Mortgage applications rose slightly this week, increasing 0.1% from a week earlier, according to the Mortgage Bankers Association.

November 22 -

The private equity firm obtained a $540 million loan on the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes, which are situated on 500 acres at the headwaters of the Everglades, from Barclays and Wells Fargo.

November 15 -

Many have speculated that low refinance rates have been preventing homeowners from selling, but this factor is less consequential than expected, according to ValueInsured.

November 15 -

The 60-day-plus mortgage borrower delinquency rate dropped to the lowest point since the recession suggesting that there is still room to broaden credit.

November 15 -

Mortgage application activity rose 3.1% from one week earlier as refinance demand increased, according to the Mortgage Bankers Association.

November 15 -

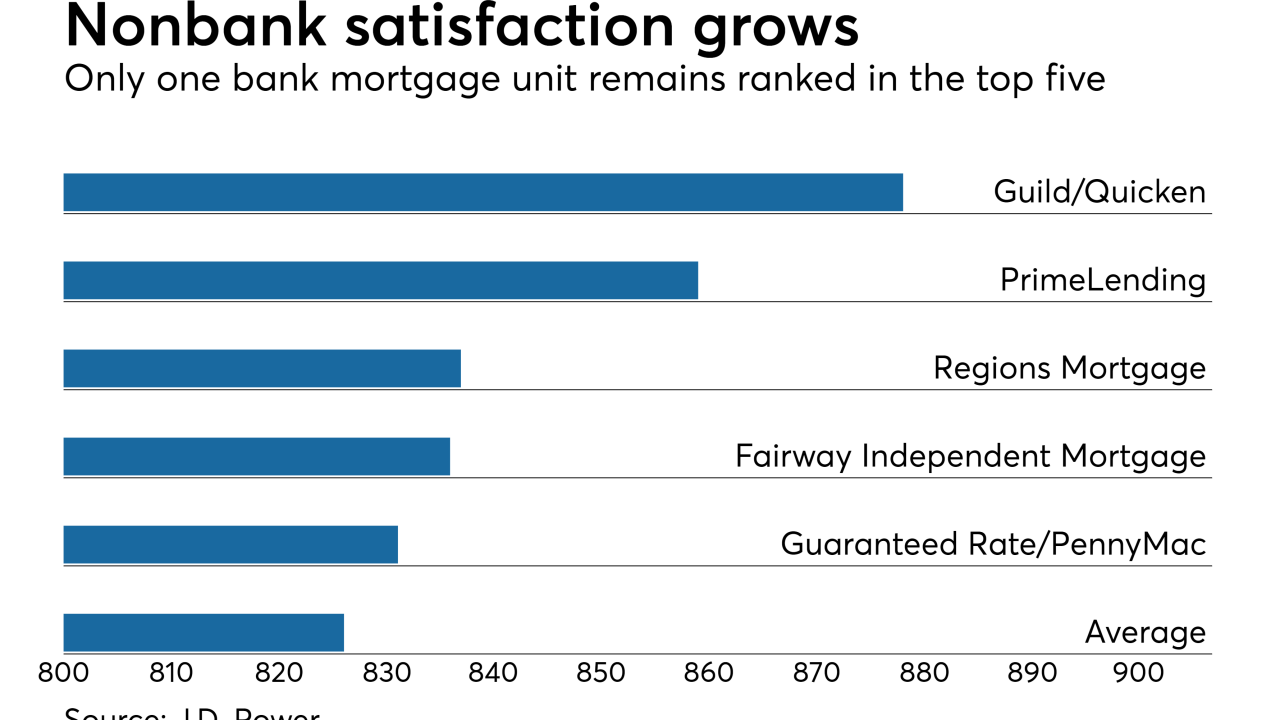

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

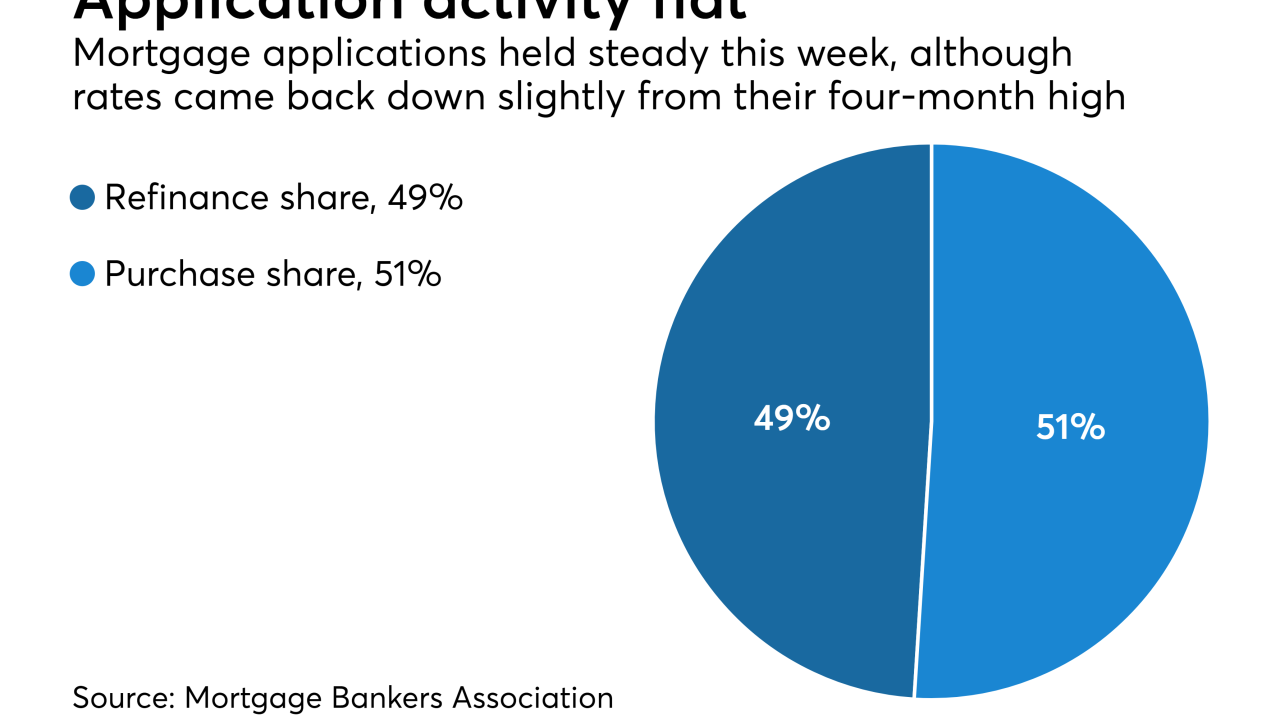

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 8 -

More FHA homeowners than expected are refinancing out of the program and into conventional mortgages, despite an increase in mortgage rates over the past year.

November 7 -

Ocwen Financial Corp. lost $6.1 million in the third quarter, as pretax losses from its origination business outweighed any profits generated from the servicing side.

November 2 -

Millennials took advantage of lower interest rates in September to refinance their mortgages, according to Ellie Mae.

November 1 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

A large portion of the collateral for both IH 2014-SFR2 and IH 2014-SFR3 is being rolled into a new securitization, IH 2017-SFR2.

November 1 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Continued economic growth, a strong jobs market and higher wages will lead to a 7.3% increase in purchase origination volume next year, according to the Mortgage Bankers Association.

October 24 -

Mortgage lenders are urging the thousands of displaced homeowners to reach out to them in the aftermath of the devastating wildfires so fire victims can begin the process of either rebuilding or moving on, leaving behind the home they once had.

October 23 -

To protect veterans from predatory lending practices, Ginnie Mae and the Department of Veterans Affairs should remove lenders' financial incentive for originating Interest Rate Reduction Refinance Loans.

October 20 Chrysalis Holdings

Chrysalis Holdings