-

Castle & Cooke Mortgage launched a consumer-direct unit that is focused on capturing repeat business from its existing servicing customers.

April 5 -

Mortgage applications decreased 1.6% from one week earlier as refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 5 -

Late payments on securitized commercial mortgages rose again in March, led by industrial and retail property loans.

April 4 -

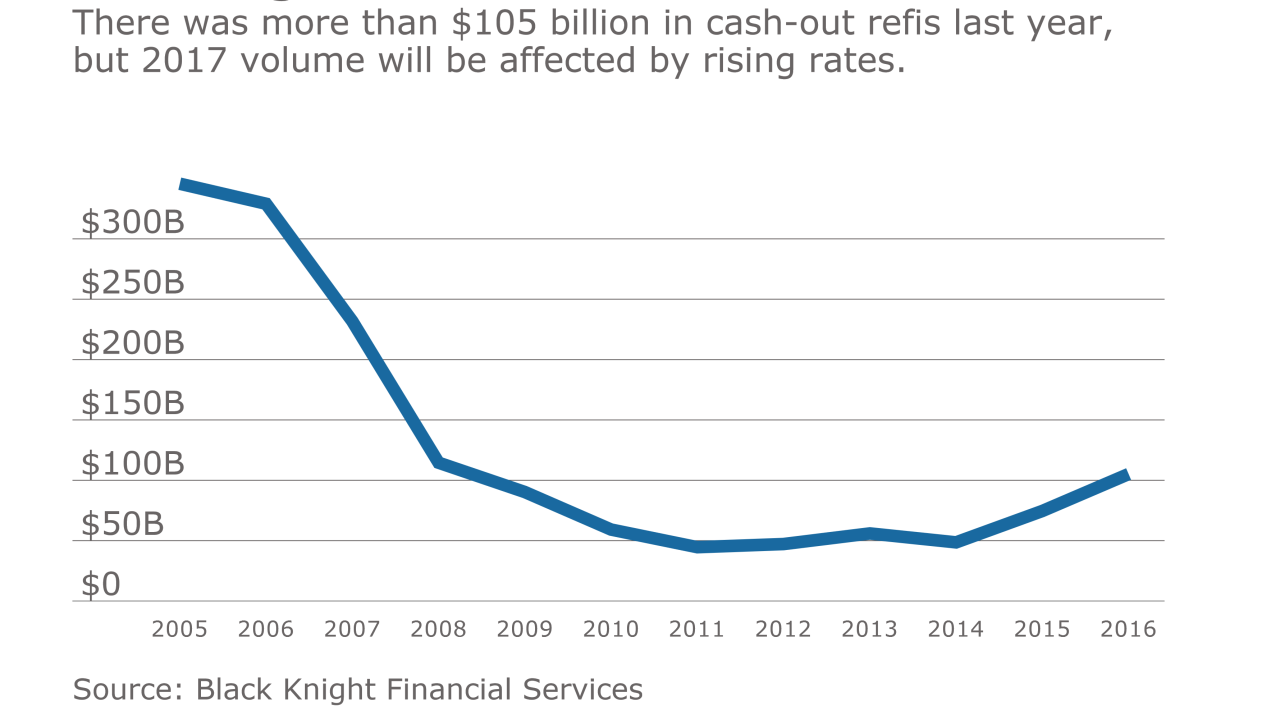

Rising rates will dampen what had been a growing cash-out refinance market even as equity available to homeowners continues to increase.

April 3 -

Loan defects are inching upward in a market where higher rates could lead to more fraud risk.

March 31 -

Despite the additional risks, originating mortgages for landlords of single-family rentals could help lenders fill the gap of waning refinance volume.

March 24 -

Mortgage lenders have already begun to feel the burn of higher interest rates.

March 21 -

Reflecting the post-election interest rate rise, closed purchase loans were 57% of February's total volume, according to Ellie Mae's Origination Insight report.

March 15 -

Goldman Sachs is selling $1.02 billion of bonds refinancing the Blackstone Group's acquisition of the Willis Tower, formerly known as the Sears Tower.

March 14 -

Dramatic shifts in borrower expectations and a growing purchase market have elevated consumer-direct mortgages from a refi-driven channel to an alternative for staff-heavy lending to homebuyers.

March 14