-

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

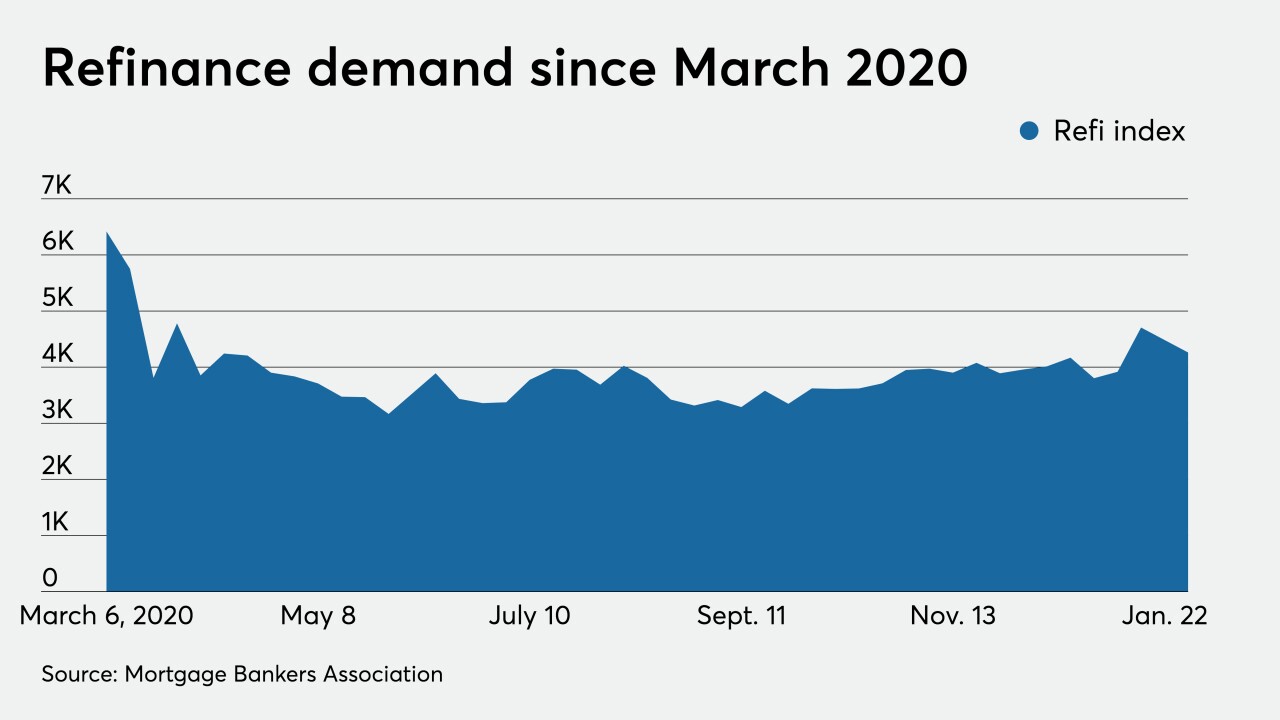

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

With refinance volumes predicted to fall — but currently continuing apace — lenders explain how they’re readying themselves for eventual contraction and its implications for their expenditures.

January 19 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

The survey period runs through Feb. 19, so don't dally!

January 8 -

Mortgage applications decreased 4.2% over the final two weeks of 2020, but the strong demand for home buying throughout most of the year should continue, according to the Mortgage Bankers Association.

January 6 -

The Fed’s decision to lower rates amid a pandemic proved serendipitous for home lenders who benefited from a refinance boom last year, but they may need to make adjustments in the coming months.

January 5 -

Mortgage applications increased 0.8% from one week earlier, an indicator of the housing market’s strength as this year comes to an end, according to the Mortgage Bankers Association.

December 23 -

Demand for home purchases and car loans would need to increase substantially to make up for what's expected to be a sharp drop in refinancing revenue.

December 22 -

The boom continues, with refinances making up a 61% share of all mortgage loans issued that month, according to Ellie Mae.

December 17 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

Mortgage applications increased 1.1% from one week earlier as a decline in rates to yet another low point brought consumers into the market, according to the Mortgage Bankers Association.

December 16 -

The $425 million loan securitization is among two single-asset, commercial-mortgage deals launching this week. Brookfield Asset Management's global real estate arm is also tapping investors to finance an $825 million loan backed by a downtown Manhattan office building.

December 15 -

The industry is now likely to top 2019's nearly $16 billion in premiums written.

December 14 -

Borrowers who exit CARES Act-related forbearance in the spring and have stacks of other bills to attend to may be in search of liquidity via such products, the company predicts.

December 10 -

The likelihood of a purchase-focused market in 2021 means it’s time to make time to improve operations, LodeStar Software Solutions CEO Jim Paolino says.

December 9 LodeStar Software Solutions

LodeStar Software Solutions