-

The Fed’s decision to lower rates amid a pandemic proved serendipitous for home lenders who benefited from a refinance boom last year, but they may need to make adjustments in the coming months.

January 5 -

Mortgage applications increased 0.8% from one week earlier, an indicator of the housing market’s strength as this year comes to an end, according to the Mortgage Bankers Association.

December 23 -

Demand for home purchases and car loans would need to increase substantially to make up for what's expected to be a sharp drop in refinancing revenue.

December 22 -

The boom continues, with refinances making up a 61% share of all mortgage loans issued that month, according to Ellie Mae.

December 17 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

Mortgage applications increased 1.1% from one week earlier as a decline in rates to yet another low point brought consumers into the market, according to the Mortgage Bankers Association.

December 16 -

The $425 million loan securitization is among two single-asset, commercial-mortgage deals launching this week. Brookfield Asset Management's global real estate arm is also tapping investors to finance an $825 million loan backed by a downtown Manhattan office building.

December 15 -

The industry is now likely to top 2019's nearly $16 billion in premiums written.

December 14 -

Borrowers who exit CARES Act-related forbearance in the spring and have stacks of other bills to attend to may be in search of liquidity via such products, the company predicts.

December 10 -

The likelihood of a purchase-focused market in 2021 means it’s time to make time to improve operations, LodeStar Software Solutions CEO Jim Paolino says.

December 9 LodeStar Software Solutions

LodeStar Software Solutions -

Mortgage application activity decreased 1.2% on a seasonally adjusted basis last week, but refinance volume picked up as interest rates reached a new survey low, according to the Mortgage Bankers Association.

December 9 -

Recent Black Knight numbers put the average retention rate at a record low for the post-crisis period that followed the Great Recession.

December 7 -

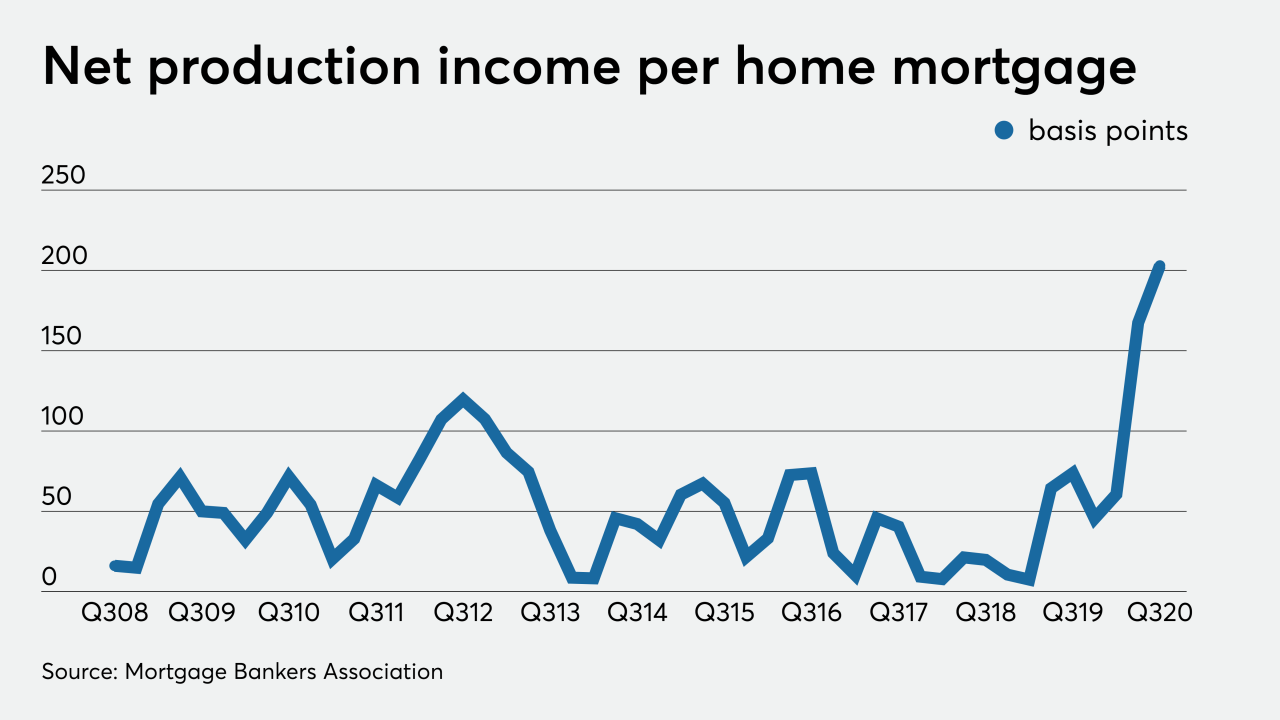

Set alight by the Fed’s low interest rates and bond purchases, the mortgage industry is on fire.

December 4 -

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

Mortgage applications decreased 0.6% on a seasonally adjusted basis from one week earlier as the period was truncated by the Thanksgiving holiday, according to the Mortgage Bankers Association.

December 2 -

Tough competition for home listings makes consumers more likely to misrepresent themselves on loan applications.

December 1 -

Mortgage applications increased 3.9% from one week earlier as another week of record low rates drew more borrowers into the market, according to the Mortgage Bankers Association.

November 25 -

As mortgage rates stayed below 3% in the third quarter, originations spiked to the highest quarterly total since 2007 and highest dollar volume since 2005, according to Attom Data Solutions.

November 20 -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18