-

Mortgage application activity decreased 1.2% on a seasonally adjusted basis last week, but refinance volume picked up as interest rates reached a new survey low, according to the Mortgage Bankers Association.

December 9 -

Recent Black Knight numbers put the average retention rate at a record low for the post-crisis period that followed the Great Recession.

December 7 -

Set alight by the Fed’s low interest rates and bond purchases, the mortgage industry is on fire.

December 4 -

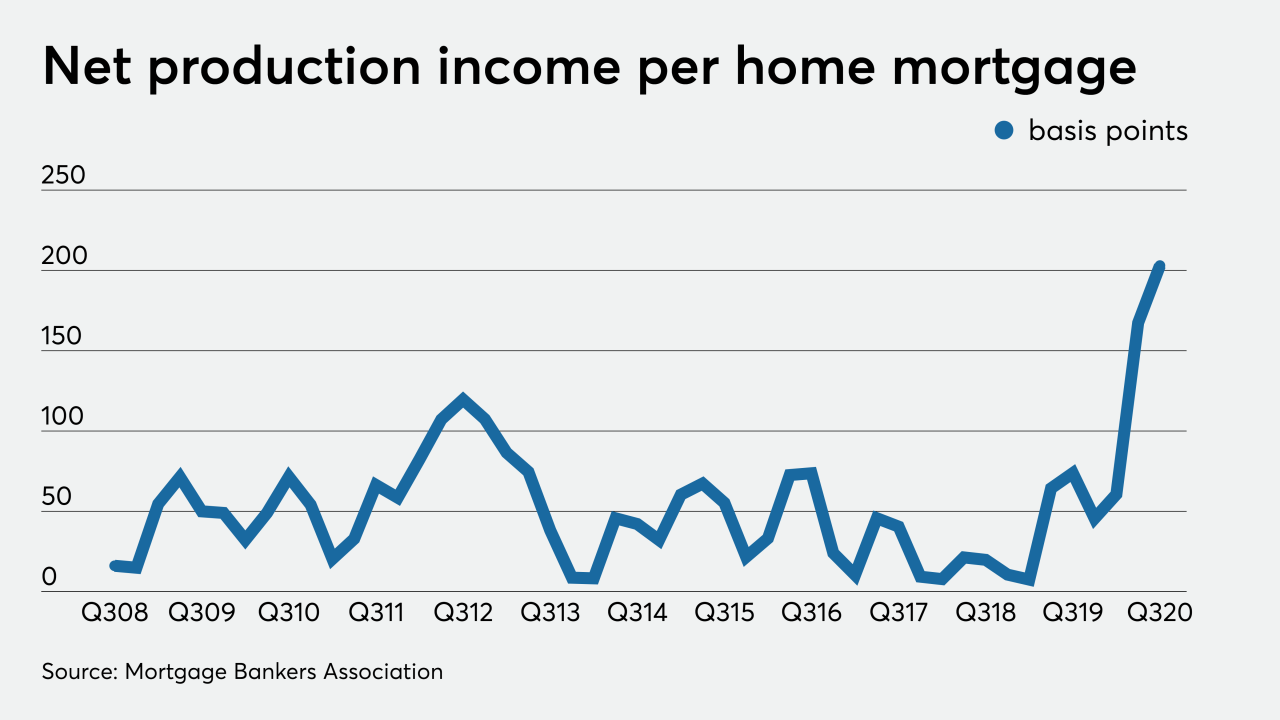

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

Mortgage applications decreased 0.6% on a seasonally adjusted basis from one week earlier as the period was truncated by the Thanksgiving holiday, according to the Mortgage Bankers Association.

December 2 -

Tough competition for home listings makes consumers more likely to misrepresent themselves on loan applications.

December 1 -

Mortgage applications increased 3.9% from one week earlier as another week of record low rates drew more borrowers into the market, according to the Mortgage Bankers Association.

November 25 -

As mortgage rates stayed below 3% in the third quarter, originations spiked to the highest quarterly total since 2007 and highest dollar volume since 2005, according to Attom Data Solutions.

November 20 -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18 -

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12 -

Rick Thornberry discusses the company's third-quarter results and the decision to drop traditional appraisals.

November 11 -

Mortgage applications decreased 0.5% from one week earlier as inadequate housing supply is putting upward pressure on home prices and affecting purchase activity, according to the Mortgage Bankers Association.

November 11 -

FHA volumes, a key contributor to Ginnie Mae issuance, could fall as long as the refinancing boom continues — unless the FHA takes a step that could reverse that trend.

November 10 -

With the 10-year Treasury yield getting a boost due to Pfizer’s COVID-19 vaccine news this week, KBW predicts insurers and title underwriters will fare best as recovery continues.

November 10 -

Problems with self-service tools and inconsistent communication have damaged consumer perception of their lender, J.D. Power said.

November 9 -

The company, which earned $535 million in net income in 3Q20, has been prioritizing purchase volume and managing costs to account for a possible decline in originations next year.

November 6 -

Compared with the second quarter, the title insurer had 154,000 more orders opened and earned $89 per residential file.

November 5 -

Brookfield and JV partner Swig Co. are refinancing debt and cashing out $200M in equity in the iconic, sloped-base midtown Manhattan office tower.

November 5 -

Mortgage applications increased 3.8% from one week earlier as a drop in most loan interest rates brought on an increase in refinance activity, according to the Mortgage Bankers Association.

November 4