-

While the critical defect rate for closed mortgage loans fell on a quarter-to-quarter basis, there were increases in income and packaging-related deficiencies, an Aces Risk Management study found.

September 16 -

A mere 7-basis-point increase in interest rates reduced what was a record-high number of borrowers with refinancing incentive by 2 million in a matter of days, according to Black Knight.

September 13 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

Digital mortgage strategies do more to support loan officers than some people think, according to Tom Wind, executive vice president of consumer lending at U.S. Bank.

September 12 -

A swell of refinance demand amid a low mortgage rate environment pushed lender profit margin outlooks to the highest level since the first quarter of 2015, according to Fannie Mae.

September 11 -

Mortgage application fraud risk plummeted in the second quarter as refinance loans poured into the market, according to CoreLogic.

September 11 -

Mortgage applications increased 2% on an adjusted basis from one week earlier driven by gains in the purchase market while refinance activity was flat, according to the Mortgage Bankers Association.

September 11 -

While many lenders lately managed their business expecting reduced volume, now they get to capitalize on extremely low mortgage rates. But today's benevolent conditions will not always be with the industry.

September 9 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

Expectations of lower mortgage rates are the only thing keeping up consumer confidence in the housing market, according to Fannie Mae's Home Purchase Sentiment Index.

September 9 -

With more rate-and-term refinancing in the mix, home lenders did a better job of retaining borrowers in the second quarter, but there's still room for improvement.

September 9 -

While millennials took advantage of mortgage rates falling to two-year lows, increasing their refinance share, teaching them about low down payment loan products would help grow homeownership for this group, according to Ellie Mae.

September 4 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

A growing share of refinances born by lower rates is pushing down risk levels for fraud on a mortgage application, according to First American.

August 30 -

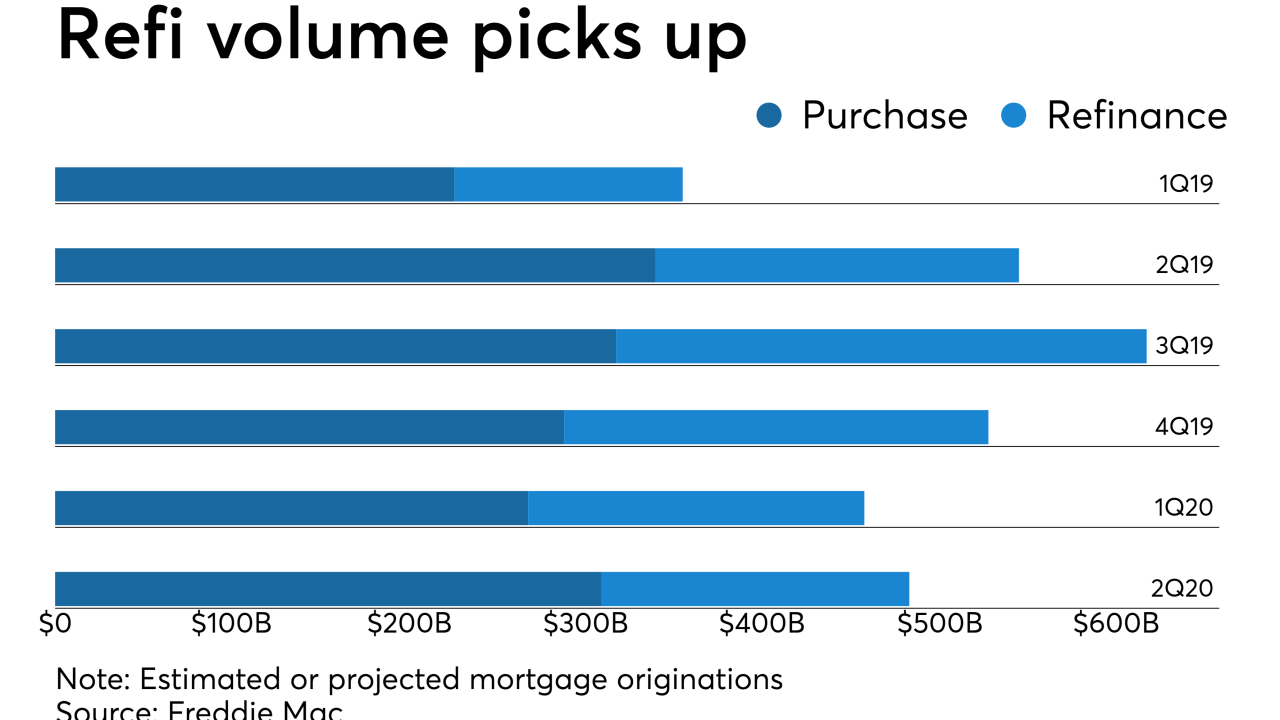

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Lower interest rates that have the power to reduce house payments are triggering a surge in mortgage refinancing activity and giving real estate agents hope that more affordable rates can lift area home sales that are barely lagging behind 2018.

August 26 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22