-

A renovated office complex in Florida and a recently built Great Wolf Lodge resort in Orange County make up two of the largest loans in Wells Fargo's latest conduit.

April 25 -

Purchase mortgage applications, which until now were unaffected by the recent rise in interest rates, fell by 4% on a seasonally adjusted basis from last week, according to the Mortgage Bankers Association.

April 24 -

Economic growth will slow in 2019, but conditions will help home sales hold steady, with mortgage volume now being projected to rise over 2018, according to Fannie Mae.

April 18 -

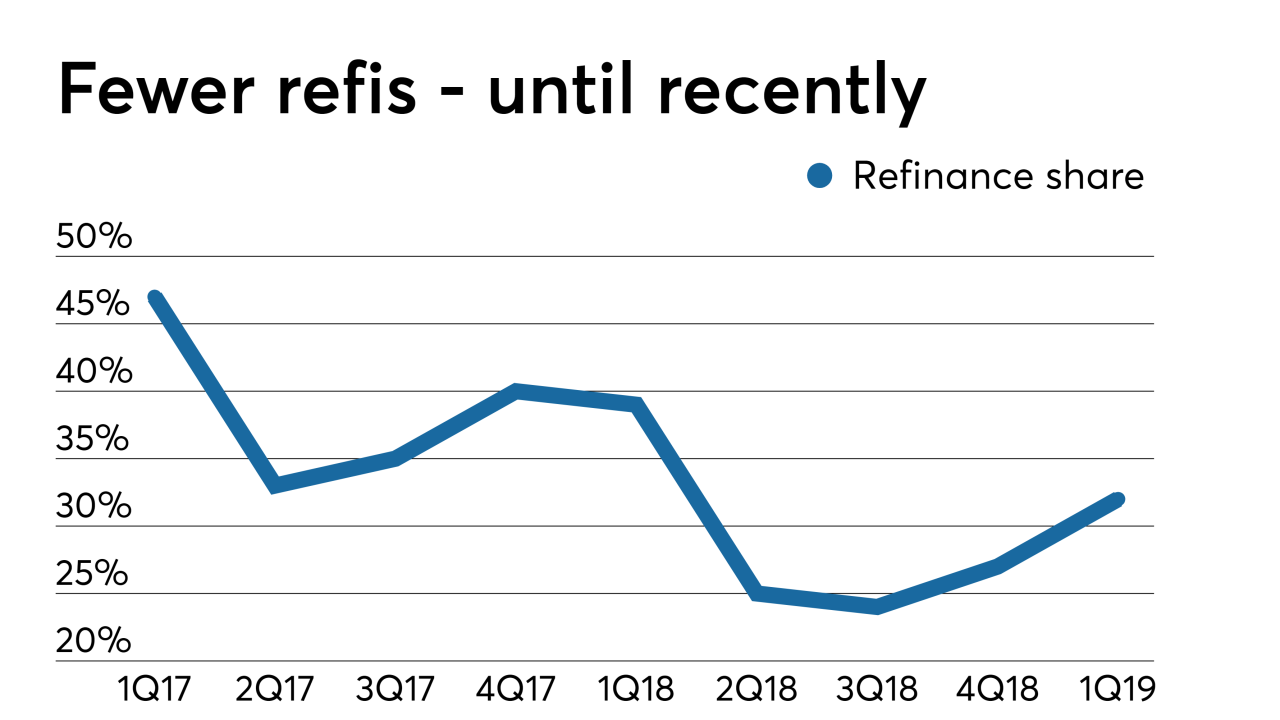

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

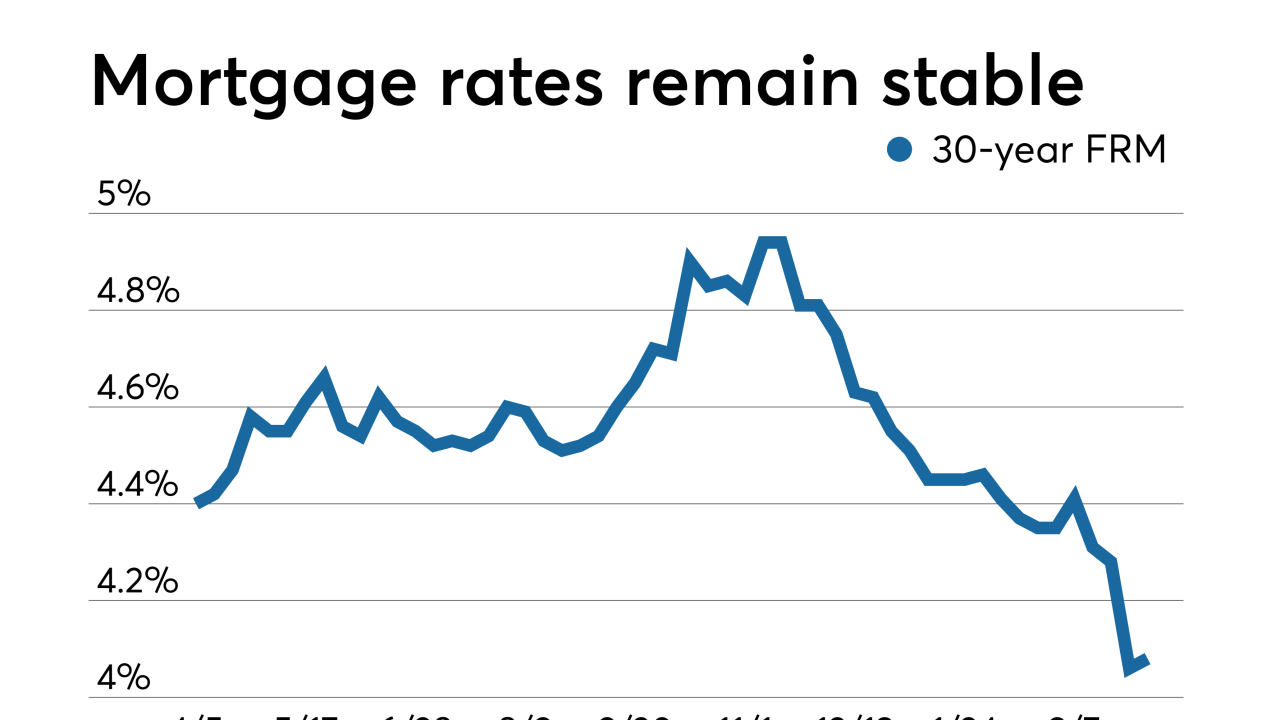

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

April 4 -

From where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course, top producers are adapting when market conditions change.

April 3 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Mortgage refinance applications reached their highest level in three years as interest rates plunged last week in the aftermath of the Federal Open Market Committee's March meeting.

April 3 -

The number of homeowners likely to qualify for a refinance nearly doubled in a single week following the largest mortgage rate decline since the housing bubble burst, according to Black Knight.

April 1 -

Income-related mortgage application fraud risk has the potential to increase as competition rises among buyers during the peak spring season, First American said.

March 29 -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29 -

There was a huge rise in mortgage refinance application activity due to the large drop in interest rates following last week's Federal Open Market Committee meeting.

March 27 -

If mortgage rates fall below 4%, it could more than double the dollar volume of agency mortgages exposed to refinancing incentive, analysts at Keefe, Bruyette & Woods found.

March 25 -

Freddie Mac reduced its 2019 origination projection in its latest monthly forecast, but strong coinciding housing numbers could suggest a future upward revision.

March 22 -

The Federal Reserve decision to shift into Treasuries could pull rates down and increase the prepayment speeds on mortgage-backed securities.

March 22 -

While fading 9.53% annually, February mortgage delinquencies posted a month-over-month increase for the first time in 12 years, according to Black Knight.

March 21 -

The home purchase loan share is up and closing times are down ahead of an expected healthy spring buying season, and declining mortgage rates could be a reason, according to Ellie Mae.

March 21 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20