-

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

Intense competition among homebuyers remains as shown by the continual growth of median down payments, according to Attom Data Solutions.

December 13 -

Mortgage lenders are more pessimistic than ever about the industry's profit margin outlook, with many blaming tight competition for the negative attitudes, according to Fannie Mae.

December 12 -

Mortgage applications rose 1.6% from one week earlier as falling interest rates contributed to a boost in refinance activity, according to the Mortgage Bankers Association.

December 12 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

The U.S. Department of Veterans Affairs' report for its 2018 fiscal year reveals that the number of service members utilizing their home loan benefits, as well as the total loan funding offered, have increased significantly throughout Arizona in the last five years.

December 5 -

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

The nation's largest mortgage lending company for U.S. military veterans did less business in Hawaii during its recent fiscal year compared with the prior year.

November 30 -

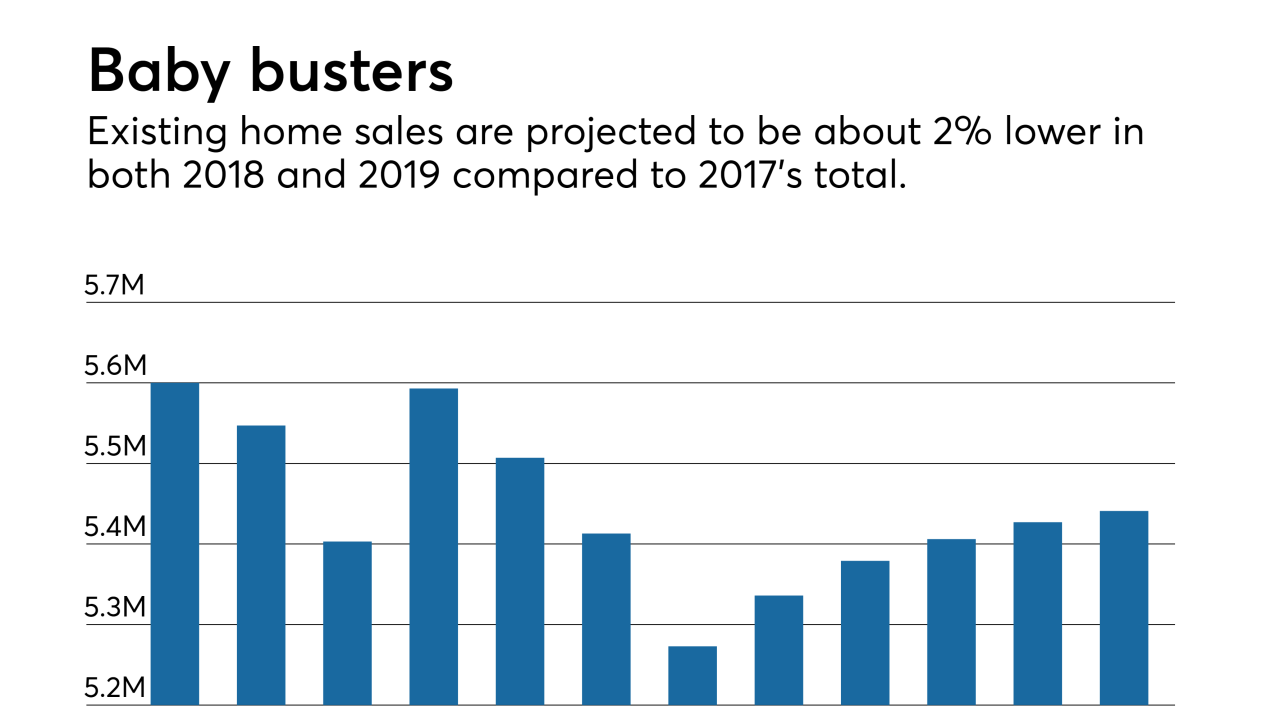

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29