-

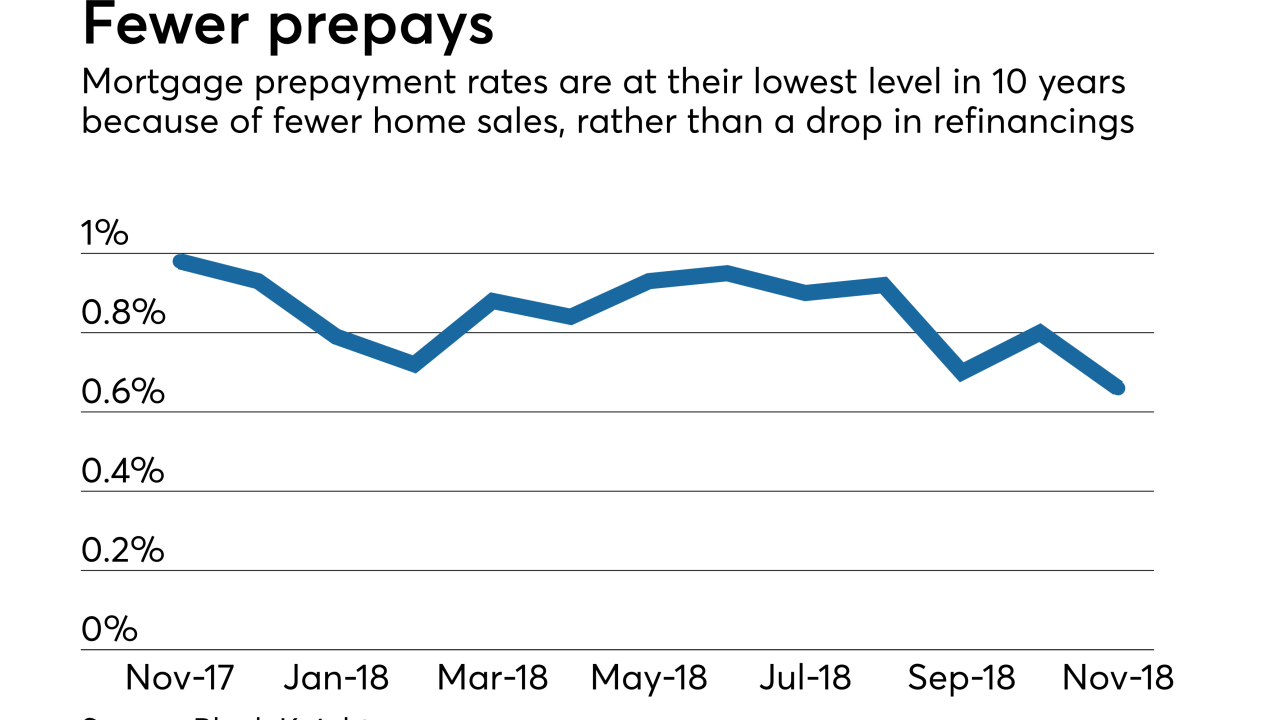

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

Mortgage applications decreased 5.8% from one week earlier, although rates fell during the period to their lowest point in three months, according to the Mortgage Bankers Association.

December 19 -

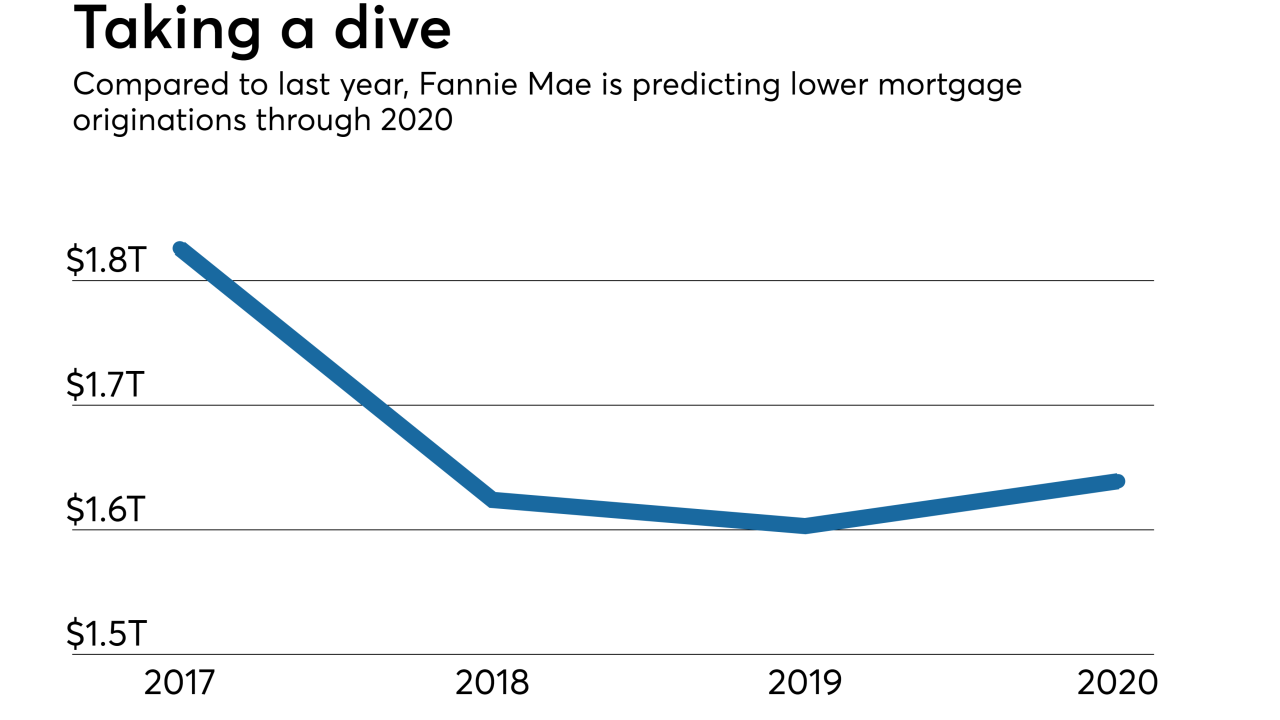

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

Intense competition among homebuyers remains as shown by the continual growth of median down payments, according to Attom Data Solutions.

December 13 -

Mortgage lenders are more pessimistic than ever about the industry's profit margin outlook, with many blaming tight competition for the negative attitudes, according to Fannie Mae.

December 12 -

Mortgage applications rose 1.6% from one week earlier as falling interest rates contributed to a boost in refinance activity, according to the Mortgage Bankers Association.

December 12 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

The U.S. Department of Veterans Affairs' report for its 2018 fiscal year reveals that the number of service members utilizing their home loan benefits, as well as the total loan funding offered, have increased significantly throughout Arizona in the last five years.

December 5 -

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

The nation's largest mortgage lending company for U.S. military veterans did less business in Hawaii during its recent fiscal year compared with the prior year.

November 30 -

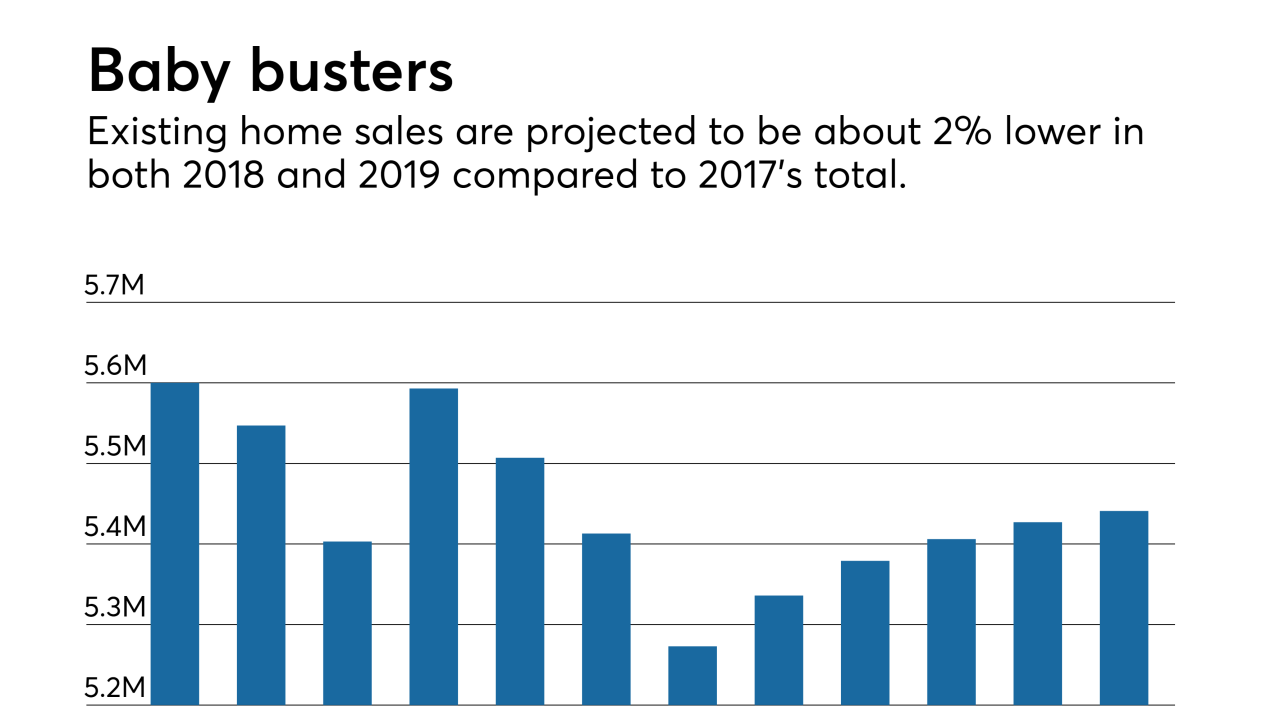

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

The rush in holiday shopping also boosted the housing market as mortgage applications increased 5.5% from one week earlier, according to the Mortgage Bankers Association.

November 28 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

Mortgage application activity decreased 0.1% from one week earlier as refinance volume tanked, although interest rates fell, according to the Mortgage Bankers Association.

November 21 -

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

Mortgage fintech LoanSnap launched VA Smart Loans, which will provide personalized options to current and former service members applying for a Veterans Affairs-guaranteed mortgage.

November 15 -

Borrowers will get more leeway to finance energy- and water-efficient improvements under a new program coming from Freddie Mac.

November 14 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14