-

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Most housing finance companies are preparing to fight for a dwindling number of loans and operate on thinner margins.

December 26 -

The share of new refinance mortgage applications reached its highest point since December 2016, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 20 -

Underwriting purchase loans is inherently more precarious for mortgage lenders and that contributed to the year-over-year increase in risk in new originations during the third quarter, CoreLogic said.

December 19 -

The Home Affordable Refinance Program recorded a 45% drop in volume in October from the previous year as it continunes to wind down, according to the Federal Housing Finance Agency.

December 15 -

The median down payment for single-family homes purchased with financing has reached a new high in the third quarter, according to Attom Data Solutions.

December 14 -

The share of new refinance mortgage applications reached its highest point since January, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 13 -

Supply constraints tempered real estate and title professionals' outlook for the home purchase market over the next year, according to First American Financial Corp.'s fourth quarter Real Estate Sentiment Index.

December 13 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Mortgage application volume increased from one week earlier, driven by a boost in refinance activity, according to the Mortgage Bankers Association.

December 6 -

Men listed as the primary borrower on a mortgage on average get approved for larger-balance loans than women, Ellie Mae finds in its latest Millennial Tracker survey.

December 6 -

The vast majority of consumers with a home equity line of credit said they are considering using it to pay for planned home renovations this winter.

December 6 -

Mortgage application volume decreased 3.1% from one week earlier as the start of the holiday shopping season likely slowed activity, according to the Mortgage Bankers Association.

November 29 -

Mortgage applications rose slightly this week, increasing 0.1% from a week earlier, according to the Mortgage Bankers Association.

November 22 -

The private equity firm obtained a $540 million loan on the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes, which are situated on 500 acres at the headwaters of the Everglades, from Barclays and Wells Fargo.

November 15 -

Many have speculated that low refinance rates have been preventing homeowners from selling, but this factor is less consequential than expected, according to ValueInsured.

November 15 -

The 60-day-plus mortgage borrower delinquency rate dropped to the lowest point since the recession suggesting that there is still room to broaden credit.

November 15 -

Mortgage application activity rose 3.1% from one week earlier as refinance demand increased, according to the Mortgage Bankers Association.

November 15 -

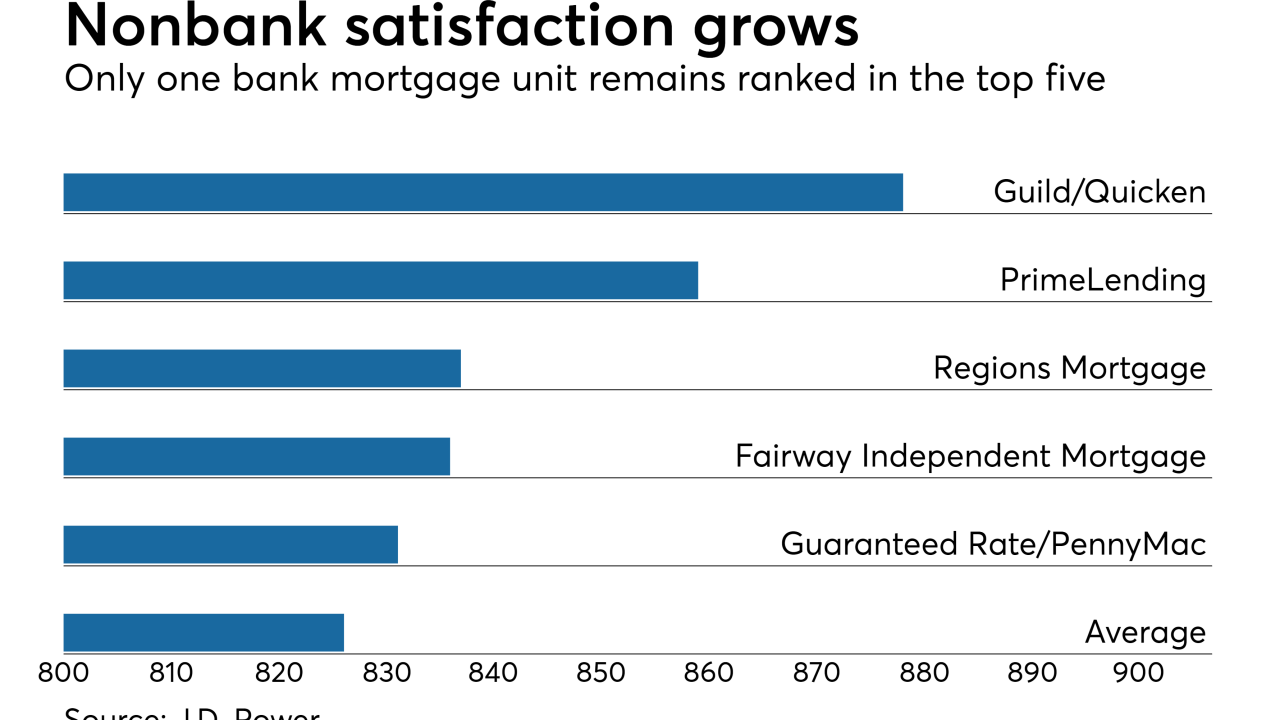

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

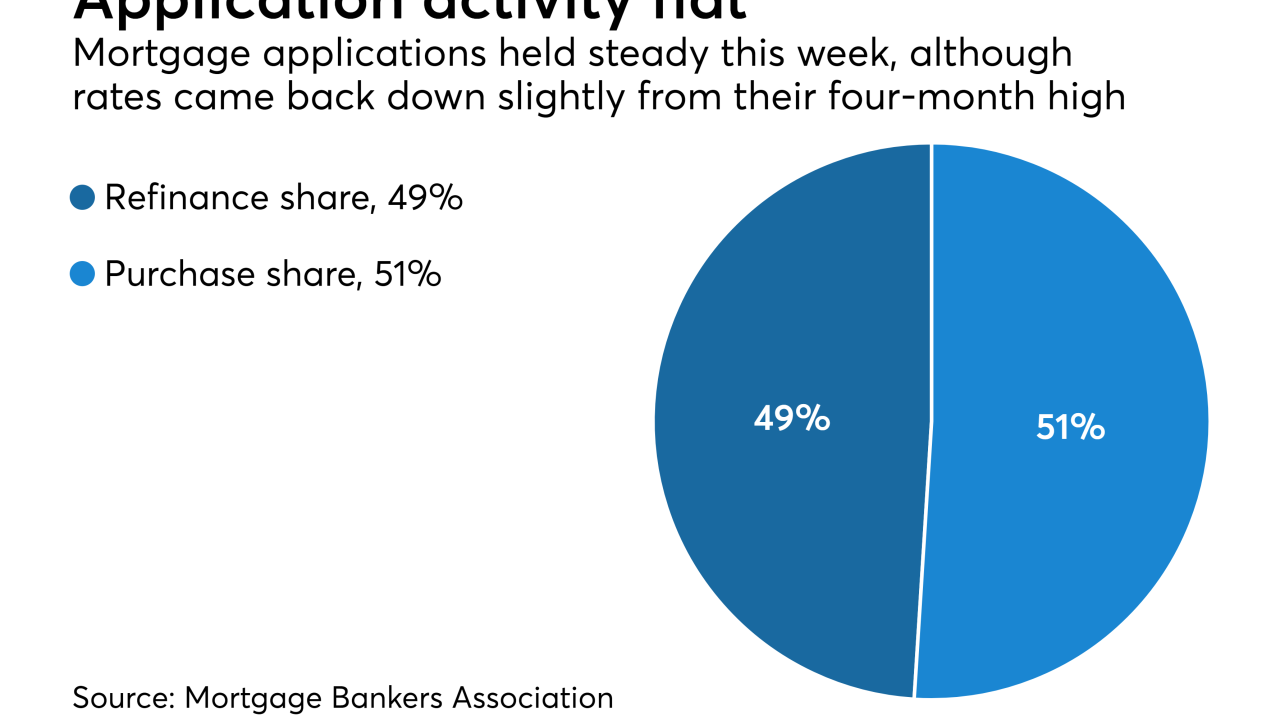

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8