-

While cash-out refinances were a “significant driver” of risky loans leading to the Great Recession, those mortgages pose less of a threat due to tighter underwriting standards, according to Milliman.

May 5 -

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29 -

It would be available to homeowners making 80% or less of their area’s median income who weren't eligible to tap into low rates last year.

April 28 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

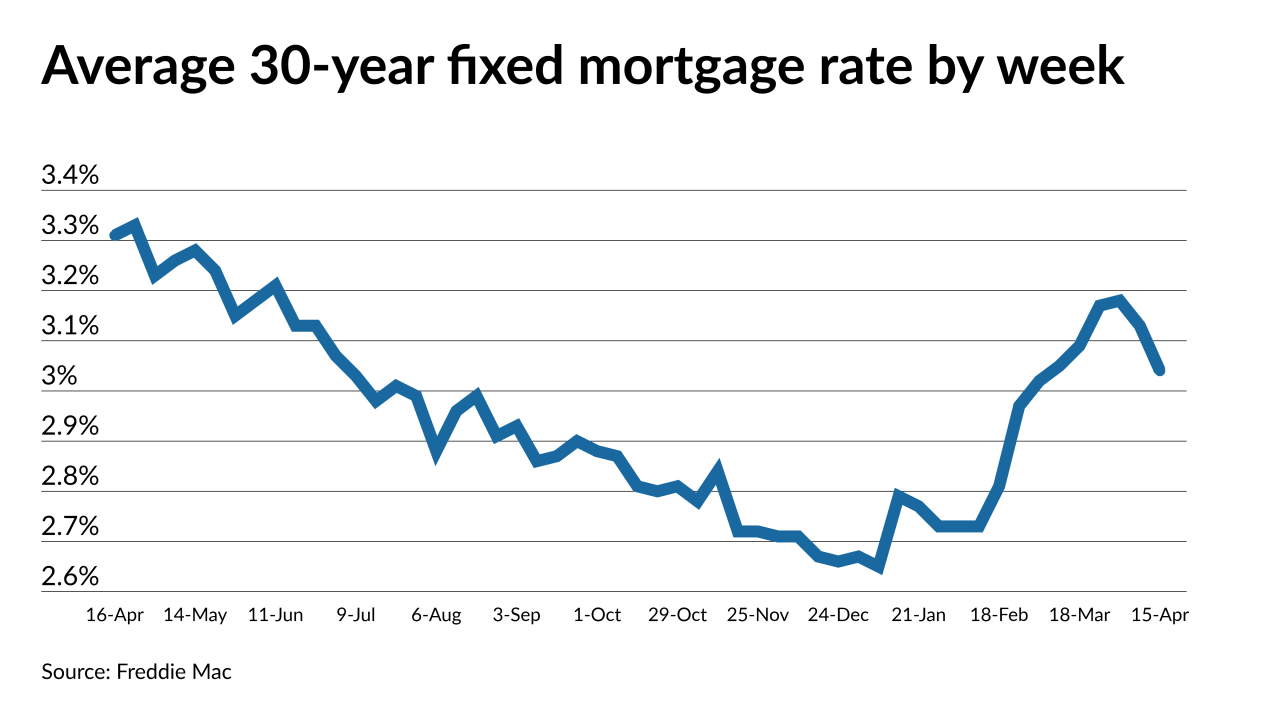

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

The shift ended a long run of higher rates that have depressed loan application activity, and it temporarily creates a new refinancing incentive for some borrowers.

April 8 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

As more borrowers between 21 and 40 leveraged the historically low mortgage rates in January, the average age rose to a report high, according to ICE Mortgage Technology.

March 10