-

The president's latest commentary comes as he is looking to new leadership at the Fed to help reduce borrowing costs, as he increasingly feels political pressure to address voter concerns over affordability.

December 23 -

Three US senators opened an inquiry into insurance ratings firm Demotech and whether its assessments may be exposing Fannie Mae and Freddie Mac to growing risks tied to climate-driven insurer failures.

December 23 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

A group of 22 Democratic state attorneys general filed a lawsuit against acting Consumer Financial Protection Bureau Director Russell Vought, the bureau and the Federal Reserve, arguing that the administration's position that the CFPB cannot be funded is wrong.

December 23 -

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

December 23 -

A California judge dismissed 13 claims against United Wholesale Mortgage that alleged the lender disclosed personal information to third parties.

December 23 -

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23 -

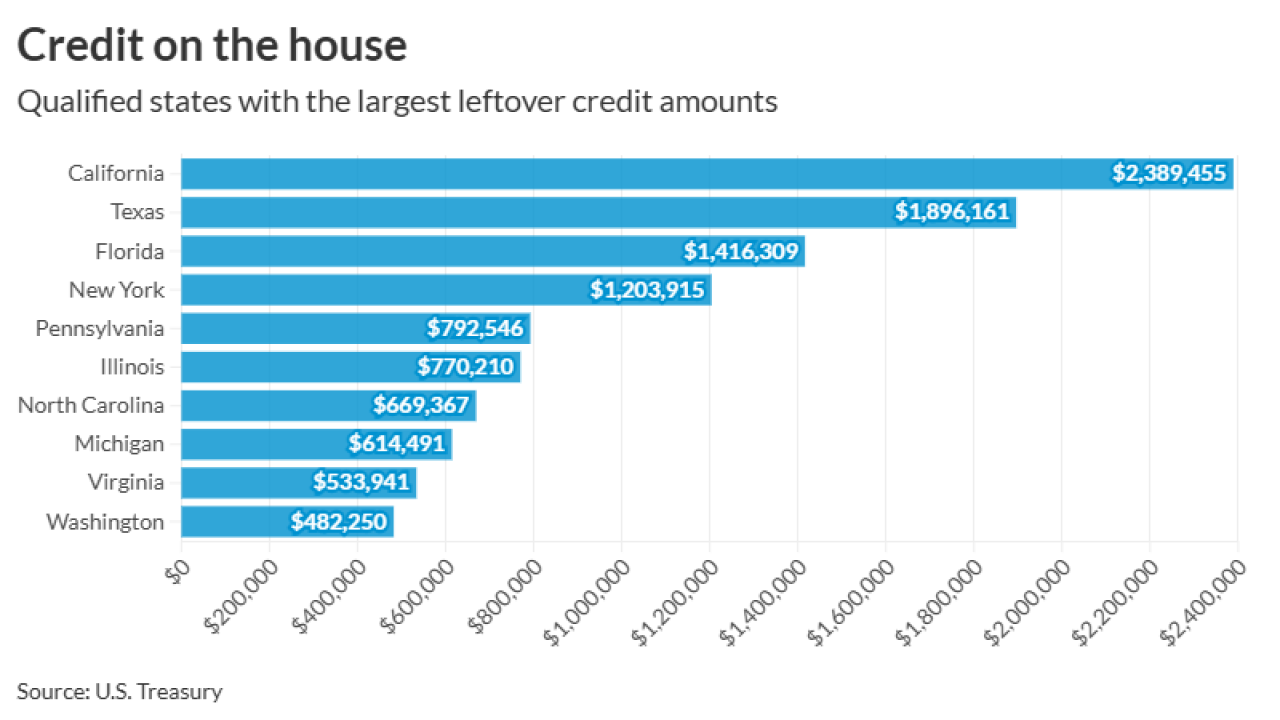

The carryovers range from some $2.4 million in California and some $1.9 million in Texas to $44,851 in Alaska and $39,297 in Vermont.

December 22 -

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

December 22 -

The judge's order allows potentially thousands of consumers to join the lawsuit against the company, similar to other fights between borrowers and servicers.

December 22 -

Overall satisfaction is highest when customers receive status updates from mobile apps, according to the J.D. Power's 2025 U.S. Claims Digital Experience Study.

December 22 -

The inventory slowdown came as properties sold for 1.6% below asking prices, with some sellers opting to remove their listings altogether, according to Redfin.

December 22 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

Existing-home sales in the US barely rose in November, as a recent moderation in price growth and mortgage rates motivated buyers at the margin.

December 19 -

More than 80% of mortgage brokers expect business to grow in 2026, mainly through the strengthening of referral networks and the expansion of non-QM offerings.

December 19 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

The option for holders of older government-sponsored enterprise bonds that predated the move to uniform mortgage-backed securities now has a deadline.

December 18