-

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

November 26 -

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

Non-banks tracked by Morningstar DBRS reported combined net income of $367 million for the third quarter, down from $807 million three months prior.

November 26 -

Recent high-profile ethics violations by senior Federal Reserve officials, including new revelations concerning stock trades by former Fed Gov. Adriana Kugler, have sparked debate over the effectiveness of the central bank's oversight, even as some observers stress such cases remain rare.

November 26 -

Years ago, the Federal Housing Administration helped finance thousands of loans for manufactured housing. An effort to restart that program would help millions of Americans afford their own homes.

November 26

-

House Democrats argue that HUD's cut to the Continuum of Care Program could push 170,000 people to homelessness.

November 26 -

The Mortgage Bankers Association's index of home-purchase applications jumped 7.6% to 181.6 in the week ended Nov. 21, data from the group showed Wednesday.

November 26 -

The New York Stock Exchange disclosed the news on Monday of the sudden passing of its head of International Capital Markets.

November 25 -

Swalwell alleges Pulte obtained and used the lawmaker's personal mortgage records in violation of US privacy laws and constitutional protections for political expression.

November 25 -

An expanded data set based on the third quarter annual price changes is what the Federal Housing Finance Agency uses to calculate next year's conforming loan limits.

November 25 -

The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. issued a final rule Tuesday that softens leverage demands for the biggest and most systemically risky banks and lowers the community bank leverage ratio to 8%.

November 25 -

The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder.

November 25 -

Nearly 85,000 sellers removed their properties in September, the highest number for that month in eight years, according to Redfin.

November 25 -

Saul Van Beurden, Wells Fargo's consumer banking CEO and former head of technology, will lead the way on harnessing artificial intelligence.

November 25 -

The new cap of $88 billion per company tops this year's $73 billion limit, but keeps pace with multifamily mortgage volume growth in recent months.

November 25 -

The Justice Department subpoenaed a key witness in the case, questioning the conduct of Bill Pulte and Ed Martin.

November 25 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

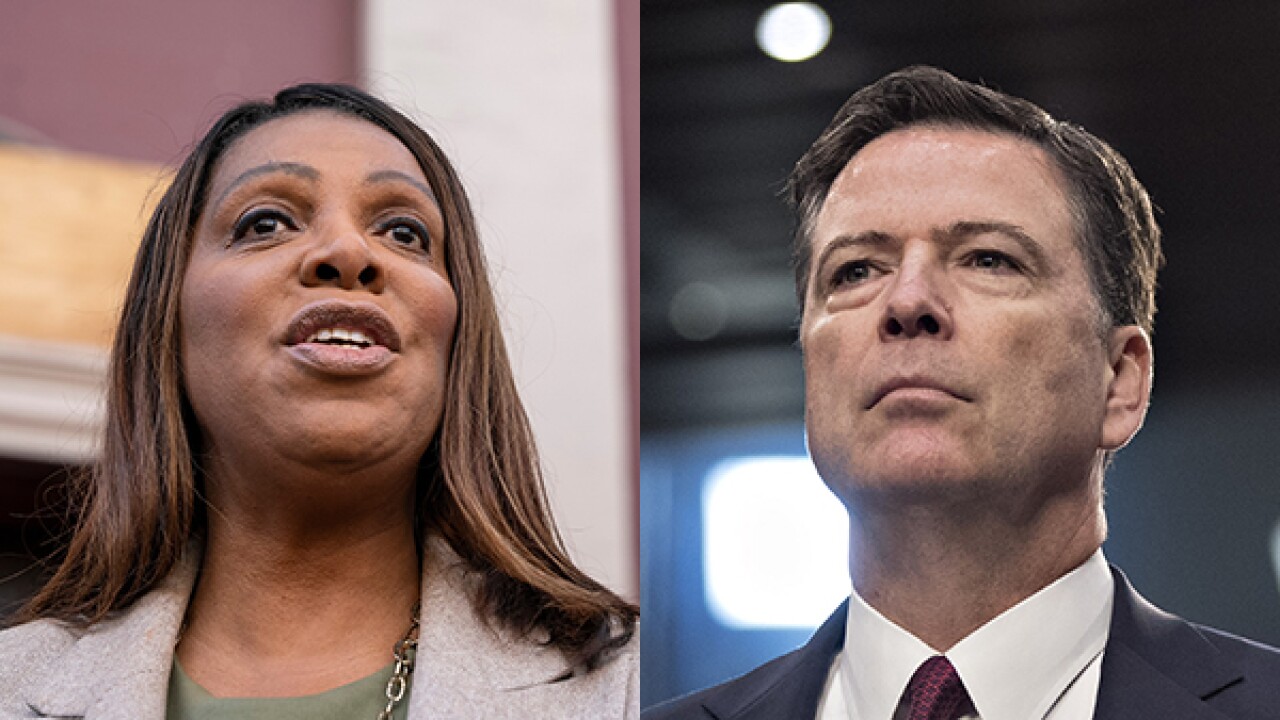

A federal judge threw out the criminal charges against former FBI Director James Comey and New York Attorney General Letitia James, ruling that the prosecutor who brought the cases had been illegally appointed.

November 24