-

The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. issued a final rule Tuesday that softens leverage demands for the biggest and most systemically risky banks and lowers the community bank leverage ratio to 8%.

November 25 -

The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder.

November 25 -

Nearly 85,000 sellers removed their properties in September, the highest number for that month in eight years, according to Redfin.

November 25 -

Saul Van Beurden, Wells Fargo's consumer banking CEO and former head of technology, will lead the way on harnessing artificial intelligence.

November 25 -

The new cap of $88 billion per company tops this year's $73 billion limit, but keeps pace with multifamily mortgage volume growth in recent months.

November 25 -

The Justice Department subpoenaed a key witness in the case, questioning the conduct of Bill Pulte and Ed Martin.

November 25 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24 -

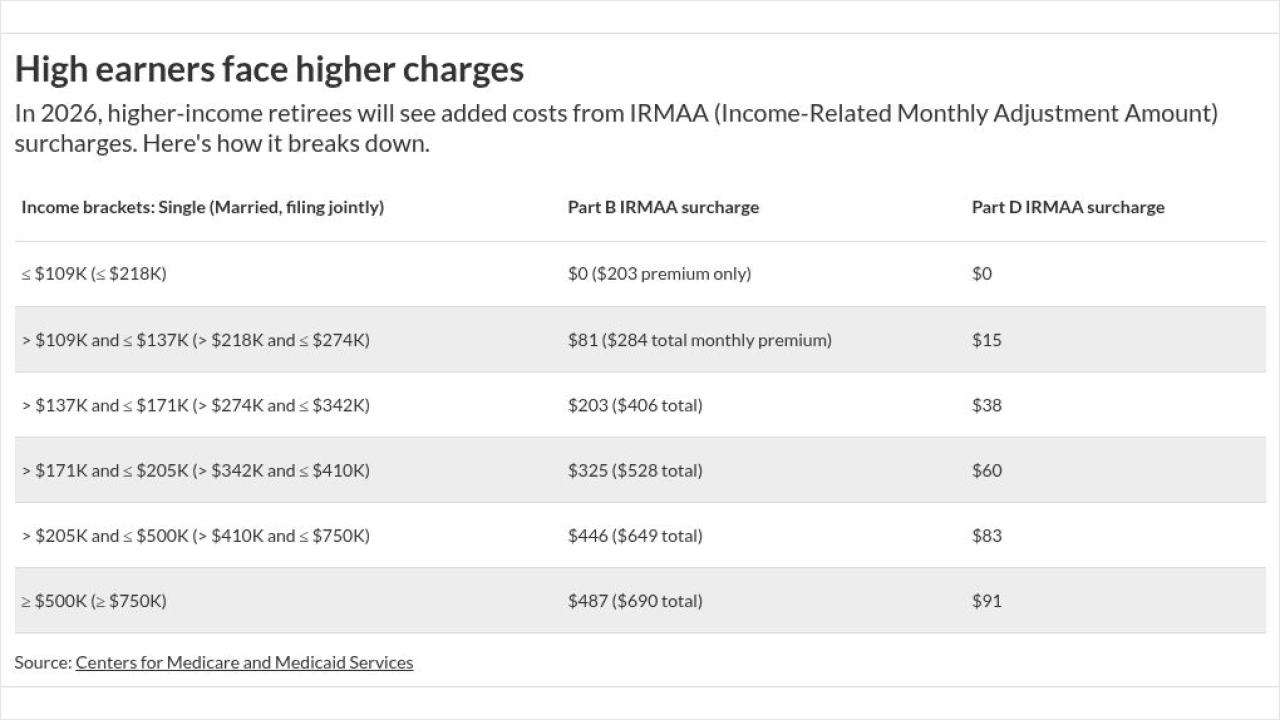

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

A federal judge threw out the criminal charges against former FBI Director James Comey and New York Attorney General Letitia James, ruling that the prosecutor who brought the cases had been illegally appointed.

November 24 -

The government-sponsored enterprise took its first look at what new loan volume might be like in two years and found it could rise closer to pandemic levels.

November 24 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

The Natural Treasury Employees Union has asked a district court to clarify whether Russell Vought, the acting director of the Consumer Financial Protection Bureau, has complied with a preliminary injunction.

November 24 -

While the tone is still generally upbeat, the market is mired below October's price highs and yields are range-bound.

November 24 -

Uncooperative neighbors, vicious pets and threats of violence are some of the dangers mortgage field employees run into when on assignments.

November 24 -

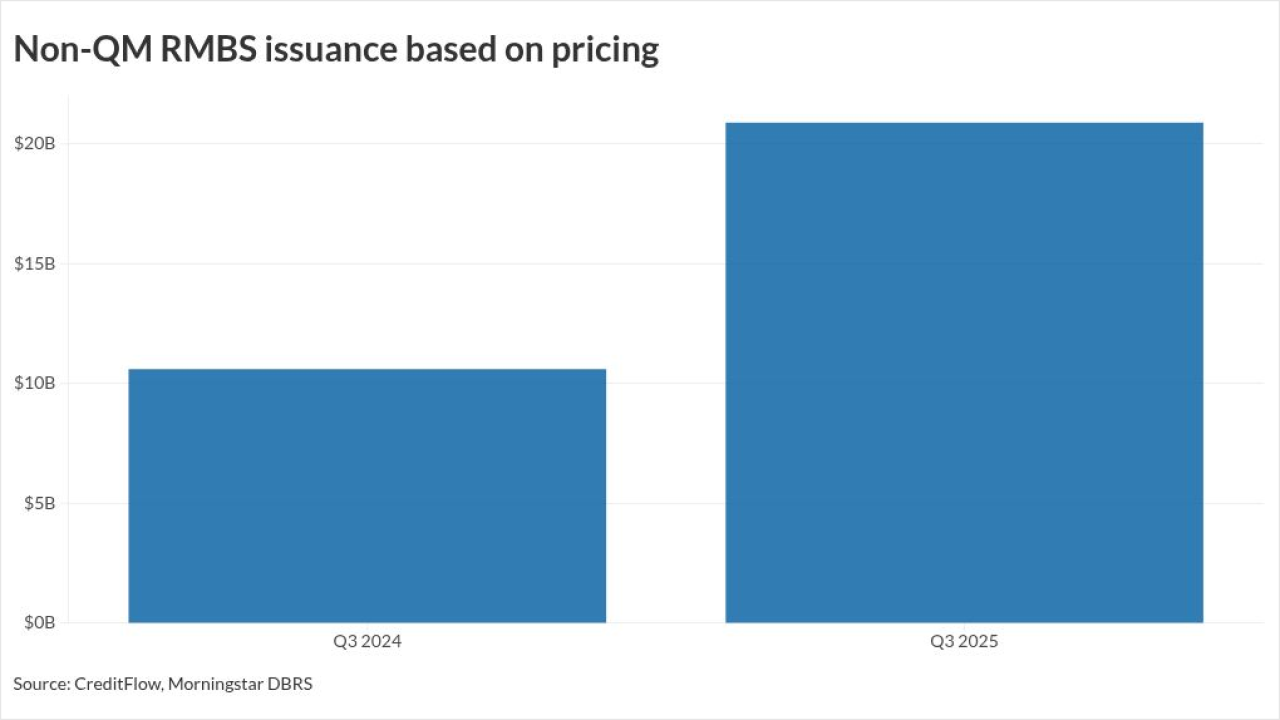

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

Luxury home prices rose 5.5% year over year in October to a median $1.28 million, far outgaining the 1.8% increase of nonluxury homes.

November 24 -

The vendor, SitusAMC Group Holdings, LP, said in a statement Saturday that someone compromised its systems and took client data including "accounting records and legal agreements."

November 23 -

Thursday's wild selloffs, and further losses Friday, were a reminder that the fervor of retail traders — whipped up in part by Federal Housing Finance Agency head Pulte — can quickly turn sour.

November 23