-

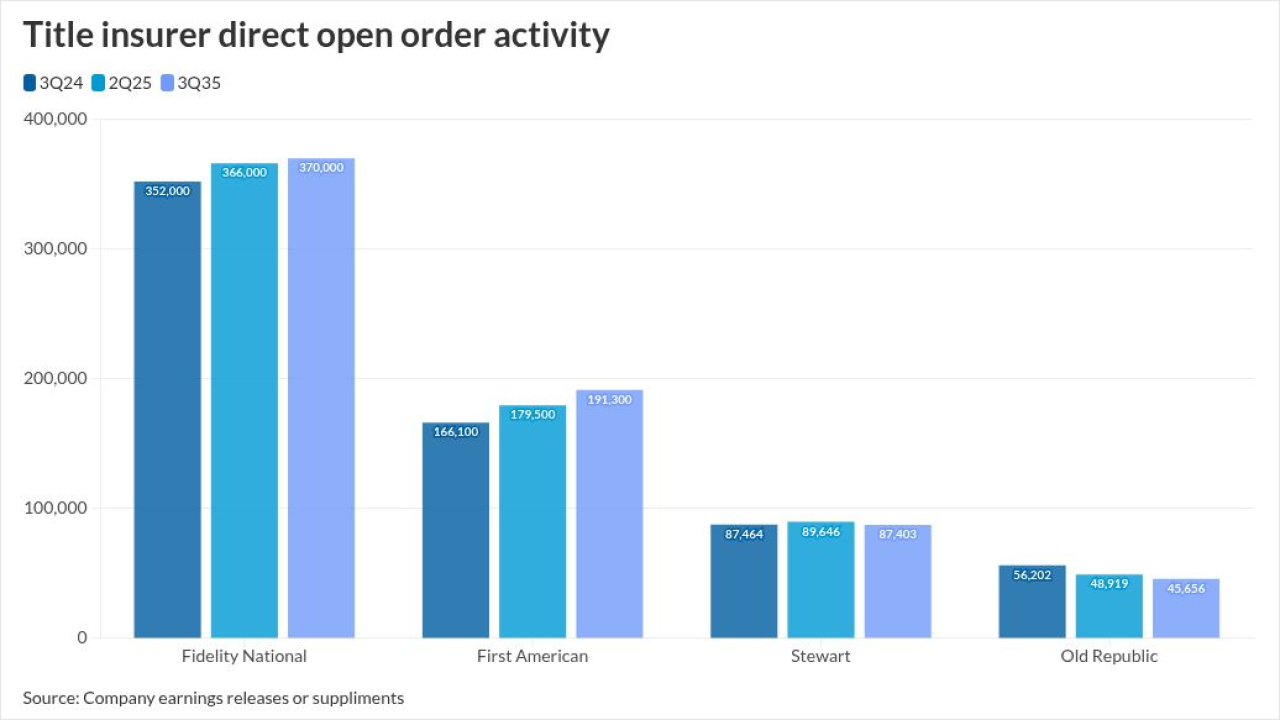

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

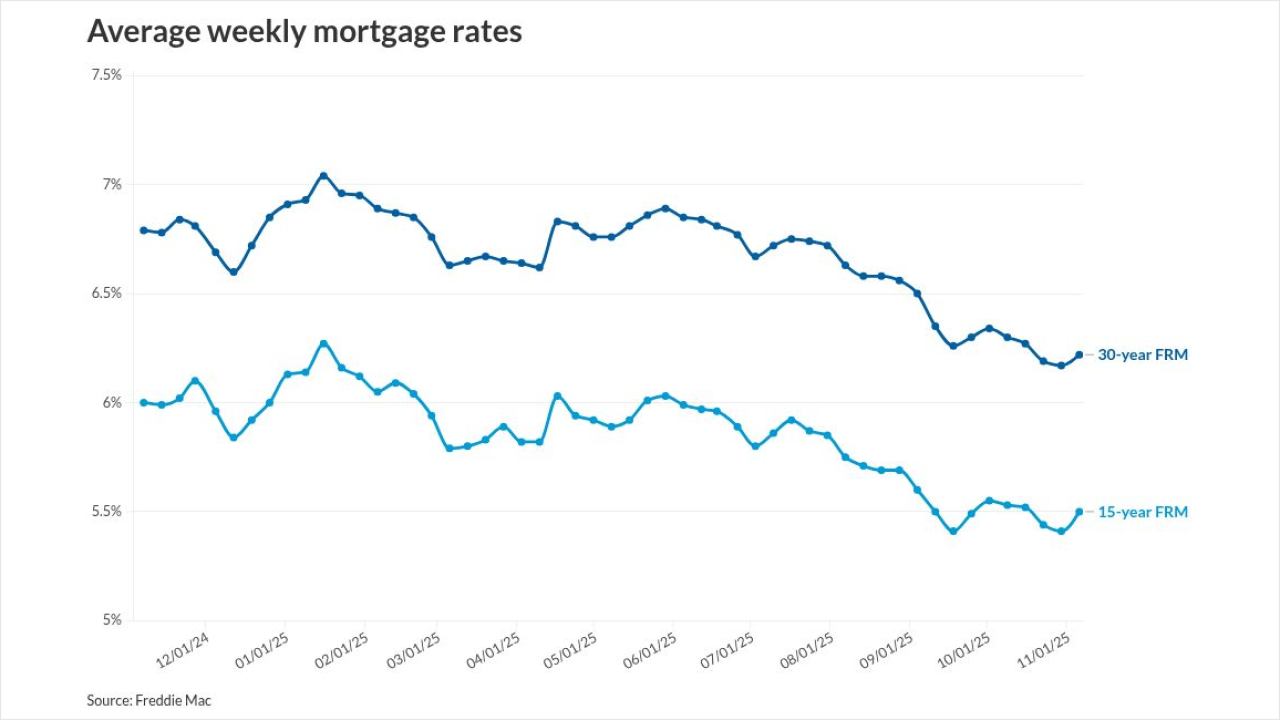

The number of highly qualified refinance candidates rose to 1.7 million, the most in three and a half years, as mortgage rates ease.

November 10 -

The bill would provide pay for furloughed government workers, resume withheld federal payments to states and localities and recall agency employees who were laid off during the shutdown.

November 9 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

The Consumer Financial Protection Bureau ended a consent order earlier than expected against the credit bureau TransUnion, saying the company already paid a $5 million fine and $3 million to consumers.

November 7 -

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

A trade group for participants in the clean energy loan program argues the upcoming regulations will be too burdensome and costly for participants.

November 7 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

The average price of a single-family home increased 1.7% from last year to $426,800 in the third quarter.

November 6 -

Federal Reserve Gov. Christopher Waller said there was a popular "misunderstanding" Thursday regarding who can qualify for a "skinny" master account, noting that only firms with a bank charter would qualify for approval.

November 6 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

A new research report this week found AI could 'unlock' $370 billion in profits for banks, though they're not yet ready to capture it. But big-bank executives say they are already seeing measurable results from their generative and traditional AI investments.

November 6 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6 -

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

The Federal Reserve Board finalized changes to its supervisory rating framework, allowing large bank holding companies to be considered "well managed," even with one deficient rating.

November 6 -

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

In markets across the US, homebuilders sitting on unsold inventory are subsidizing mortgage rates so heavily they sometimes match the record lows last seen during the Covid-19 pandemic.

November 6