-

Between 2014 and the third quarter of 2019, the median price of a single-family home in the Boise area increased 75%, to $303,100 from $172,900, according to the National Association of Realtors.

January 28 -

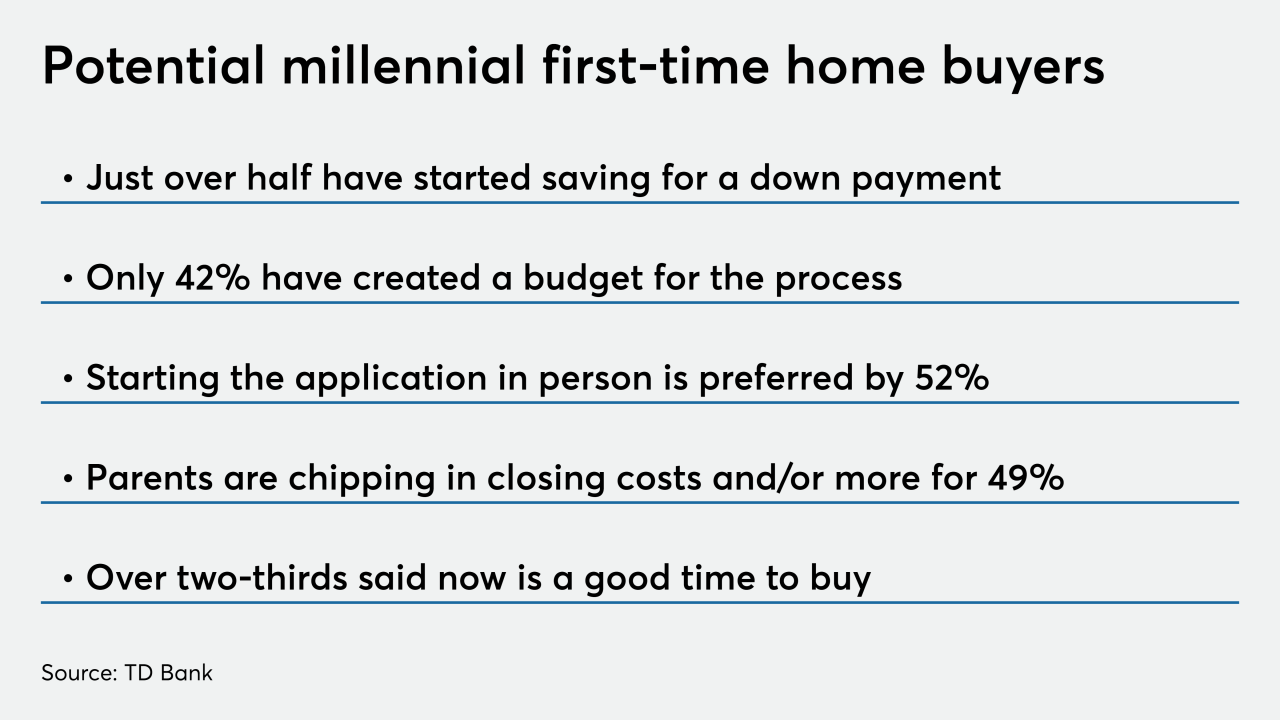

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

Sales of new homes cooled for a third month in December, signaling a potential pullback after purchases climbed to some of the best levels in more than a decade amid lower borrowing costs and a solid labor market.

January 27 -

Bidding wars for Bay Area homes have scraped new lows, as buyer fatigue with high prices and stressful deals saturates most of the region.

January 23 -

The inventory of homes for sale is at a seven-year low and that is likely to continue to shrink in the coming months, a Zillow report said.

January 21 -

The rate of home sales reached a 33-month peak in December, swinging the pendulum of supply and demand, and pushing value appreciation to a 19-month high, according to Redfin.

January 17 -

With home price appreciation decelerating, the top end of the marketplace appears to be taking the biggest hit, according to Zillow.

January 15 -

More than half of Columbus homebuyers are millennials, according to a new study from the mortgage lead generation company LendingTree.

January 14 -

When it comes to purchasing a home vs. renting on the affordability continuum, the reasonably priced properties skew towards less populated areas, according to Attom Data Solutions

January 14 -

While buying a home in most markets results in lower monthly housing payments, in the nation's most populated counties renting is the more affordable option, Attom Data Solutions said.

January 10 -

Connecticut's housing market saw mixed performance in November, with solid gains in year-over-year median sale prices and total sales, but showing some overall weakness in year-to-date data released by the Massachusetts-based Warren Group.

January 9 -

Home sellers in the suburbs north of New York City discounted their way to a strong fourth quarter, whittling pricing to levels that even luxury buyers found appealing

January 9 -

A fight over how to fix California's worst-in-the-nation housing shortage is about to heat up again in Sacramento.

January 7 -

There are an estimated 46,000 vacant homes in the San Francisco Bay Area, a surprising number in a region beset by a crippling housing shortage.

January 6 -

For decades, Seattle has been primarily a city of homeowners, but those days may be coming to an end. It's one of the many ways that the city's current population boom has been transformative.

January 6 -

Officials hope a revamped Scranton, Pa., homebuyer program administered by a nonprofit partner will boost homeownership rates and bolster investments in city neighborhoods.

January 3 -

Whatcom County in northwestern Washington state went from falling prices and plenty of inventory in 2009 to high prices and low inventory in 2019

January 2 -

Sales of new homes increased in November, capping the best three months for demand since 2007 and reflecting sustained momentum in a residential real estate market that’s helping to underpin the economy.

December 23 -

Downtown San Jose, which has been overshadowed by its Bay Area neighbors, is having a real estate development boom because it qualifies as an opportunity zone

December 20 -

Despite home prices continuing to rise faster than household income, affordability gains inched up due to the low mortgage rate landscape, according to Attom Data Solutions.

December 19