-

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Despite a healthier economy supporting wage and income growth, the narrative that homebuyers are struggling to afford homes for sale hasn't changed much. House values are still on the rise, meaning shoppers are struggling with how much house they can afford.

February 19 -

Women have lower incomes than men, limiting their options when buying a house. But in some of the more pricey housing markets, single female homeowners outpace single male homeowners, which could suggest some tightening in the home value gap, according to Attom Data Solutions.

February 14 -

While property values continued rising in most markets, they grew at a healthier pace for homebuyers, according to the National Association of Realtors.

February 13 -

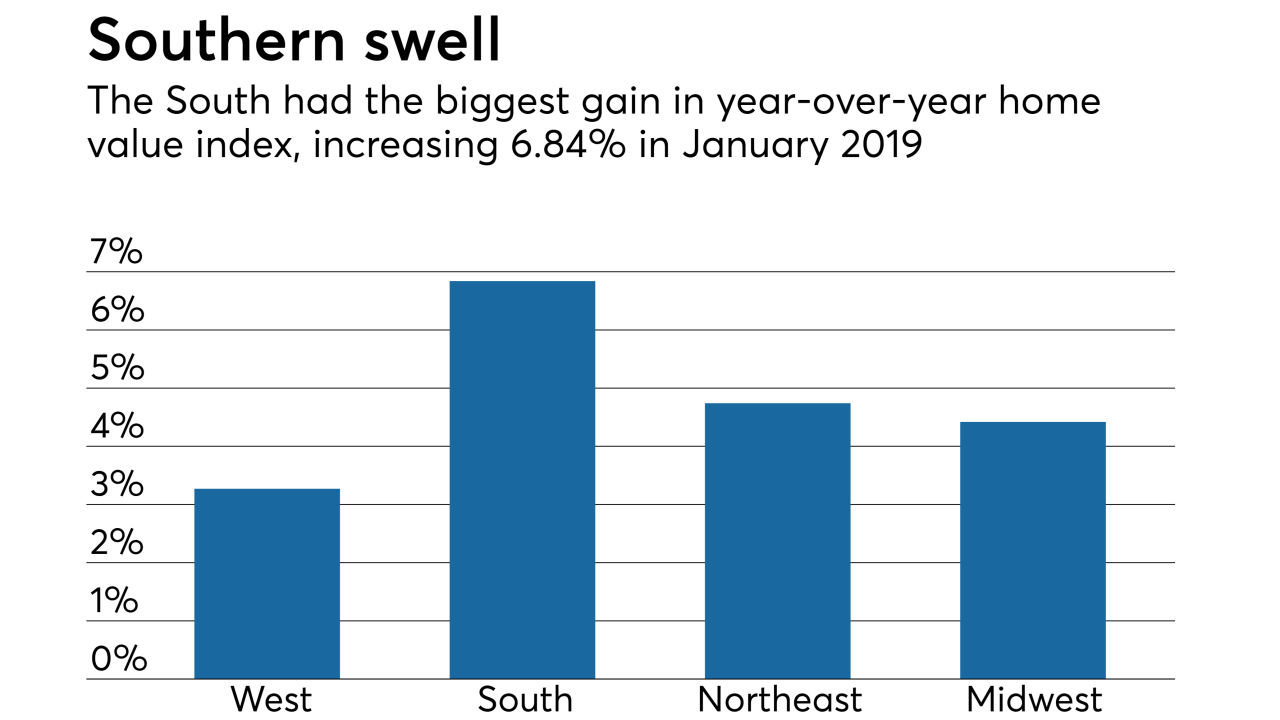

While home price appreciation showed steady growth in January, it's a lower rate than years past and consumer appraisal perception lags reality, according to Quicken Loans.

February 13 -

From the gateway to the West to just below the Mason-Dixon Line, here's a look at the 12 housing markets with the highest percentage of homes affordable to millennial purchasers with median incomes.

February 12 -

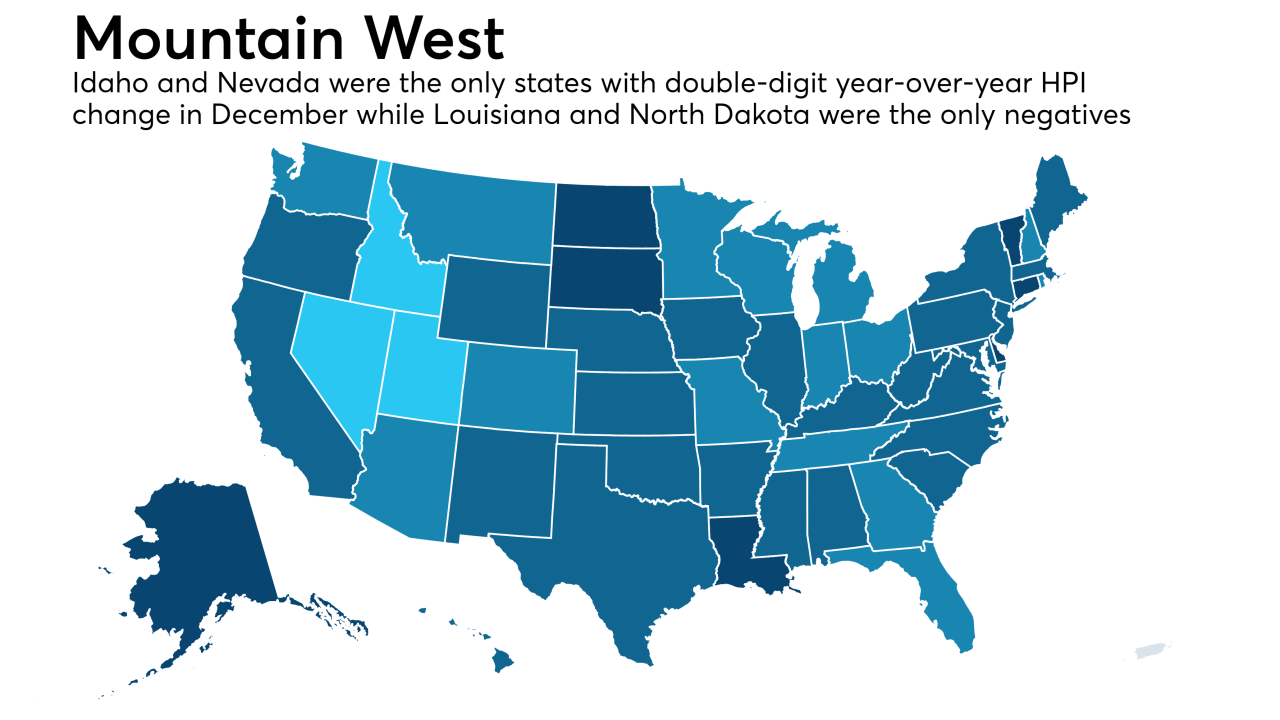

Inventory deficiency and affordability issues kept sales down and hampered home price growth, according to CoreLogic.

February 5 -

Nearly a quarter of Denver-area residents looking for a home on Redfin.com are conducting their searches outside the metro area, and Seattle continues to provoke the most yearning.

February 5 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31 -

Bay Area adjacency without the exorbitant home prices make Sacramento, Calif., an attractive option for consumers, according to Redfin's migration report.

January 30 -

PulteGroup's housing-finance unit recorded a year-to-year decline in its capture rate for the fourth quarter, as competition in the market intensified.

January 29 -

Home prices in 20 U.S. cities rose in November at the slowest pace since early 2015, decelerating for an eighth straight month as buyers balk at the ever-receding affordability of properties.

January 29 -

Property values have continued rising across the country, but six cities bucking the national trend are leading a shift in the housing market, which could lessen affordability hurdles for homebuyers, according to First American Financial Corp.

January 28 -

Several new members of the House Financial Services Committee with backgrounds in housing could use their experience to address Chairman Maxine Waters' top agenda items.

January 23 -

The real estate industry is expecting homebuilders, with the aid of local governments, to add more financially attainable starter homes to the market and ease burdens for buyers, according to Redfin.

January 23 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Fewer houses getting sold helped gains in inventory and brought down the rate of sales price growth to wrap up 2018, according to Redfin.

January 18 -

With the promise of jobs and fledgling tech scenes, five of the top 10 hottest housing markets for 2019 all reside in the South, according to Zillow.

January 15 -

High home prices and expected interest rate hikes should lead to continued growth in multifamily mortgage origination volume in 2019, according to Freddie Mac.

January 14 -

Anticipated increases in 2019 mortgage rates also come with an expected 1 million households eliminated from affording the median-priced new home with every hike of 25 basis points, according to the National Association of Home Builders.

January 11