-

The House Financial Services chair is sponsoring a bill with one of the Democratic presidential contenders aimed at alleviating the public housing capital backlog.

November 21 -

Median home prices rose annually by more than the national average of 8.3% in nearly half of low-income areas with certain tax advantages, according to Attom Data Solutions.

November 21 -

Elizabeth Warren called out Blackstone Group Inc. for its real estate practices as she laid out her tenants' rights plan, accusing the company of "shamelessly" profiting from the 2008 housing crisis.

November 19 -

Orange County's Housing For All task force has unveiled a 10-year plan to add tens of thousands of new homes and establish for the first time a local funding source that could pump $160 million into fighting Orlando's affordable housing crisis.

November 19 -

The housing bond measure, the largest of its kind in San Francisco's history, comes as the ballooning wage inequality has sent the city's homeless population skyrocketing 17% over the last two years.

November 5 -

Apple will contribute $2.5 billion toward easing the housing crisis in California, joining other technology companies in helping alleviate a problem they are often blamed for exacerbating.

November 4 -

Facebook Inc. is following other tech titans like Microsoft Corp. and Google, pledging to use its deep pockets to ease the affordable housing shortage in West Coast cities.

October 23 -

BART will remove 600 parking spots from Millbrae Station to make way for 400 apartments, including 100 for low-income tenants — 80 of them prioritized for veterans.

October 18 -

Single-family homes sold briskly last month in the Colorado Springs area, while prices rose again — good news for sellers, but an increasingly tough time for entry-level buyers trying to find an affordable house.

October 16 -

RESIMAC Bastille Trust RESIMAC Series 2019-1NC is an Australian-dollar (AUD) $1 billion transaction (approximately US$674.5 million) that will feature a US$250 million Class A-1 tranche of notes, according to Fitch.

October 15 -

Ask someone looking to rent a reasonably priced apartment in Santa Fe, N.M., to describe their experience and they will likely sum it up this way: Frustrating.

October 8 -

The Federal Housing Administration chief has already been serving as the acting deputy secretary of the Department of Housing and Urban Development.

October 8 -

Miami-Dade's housing affordability crisis is so dire, it now poses as much of a threat to the region as sea level rise, according to Florida International University's Jorge M. Perez Metropolitan Center.

October 7 -

The creation of new houses in Rochester, Minn., is on the decline.

October 2 -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

As the affordable housing crisis comes to a head, the Mortgage Bankers Association put up opposition to the "not in my backyard" mindset by getting behind the Yes, In My Backyard bill introduced in the House of Representatives.

September 30 -

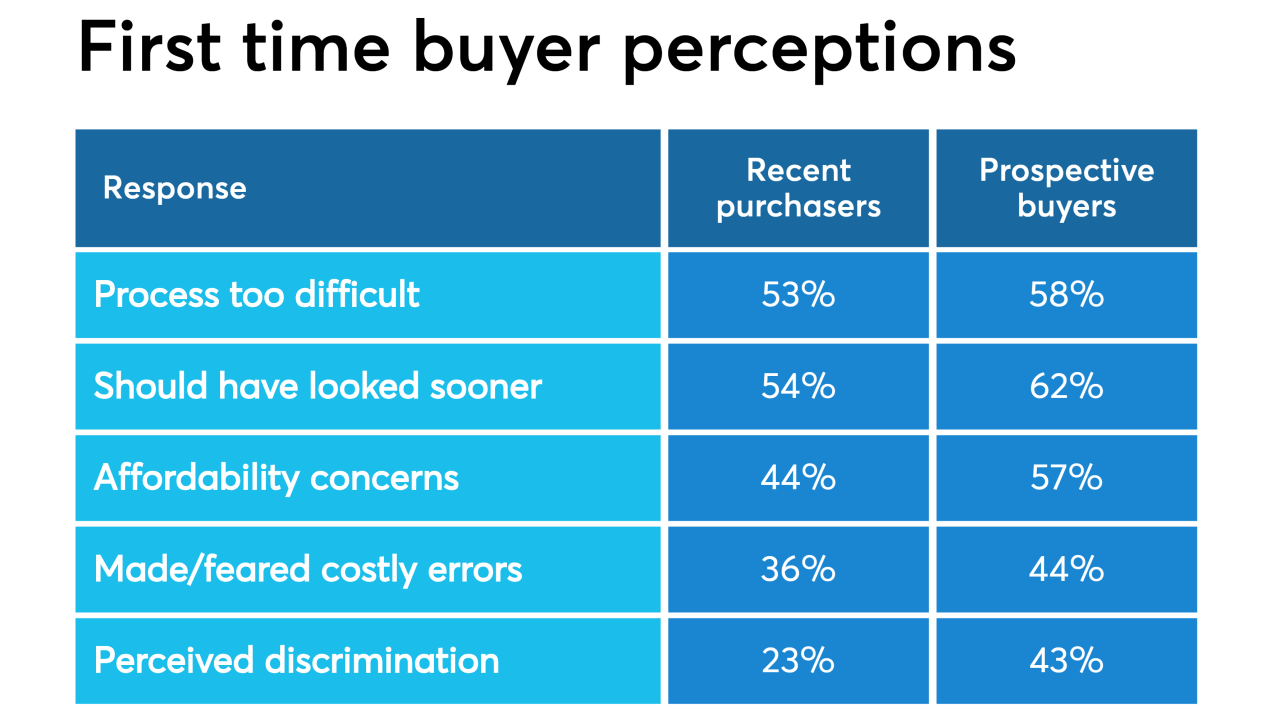

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

The proposed reforms of Fannie Mae and Freddie Mac have gotten all the attention, but the administration also wants to scale back the Federal Housing Administration, expand its capital cushion and adopt risk-based pricing. Some of the ideas have former agency officials concerned.

September 19 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16 -

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13