-

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

Taking a home in metro Denver from listing to the closing table now only takes 41 days on average, one of the shortest turnaround times in the country, according to a new study from Trulia.

June 11 -

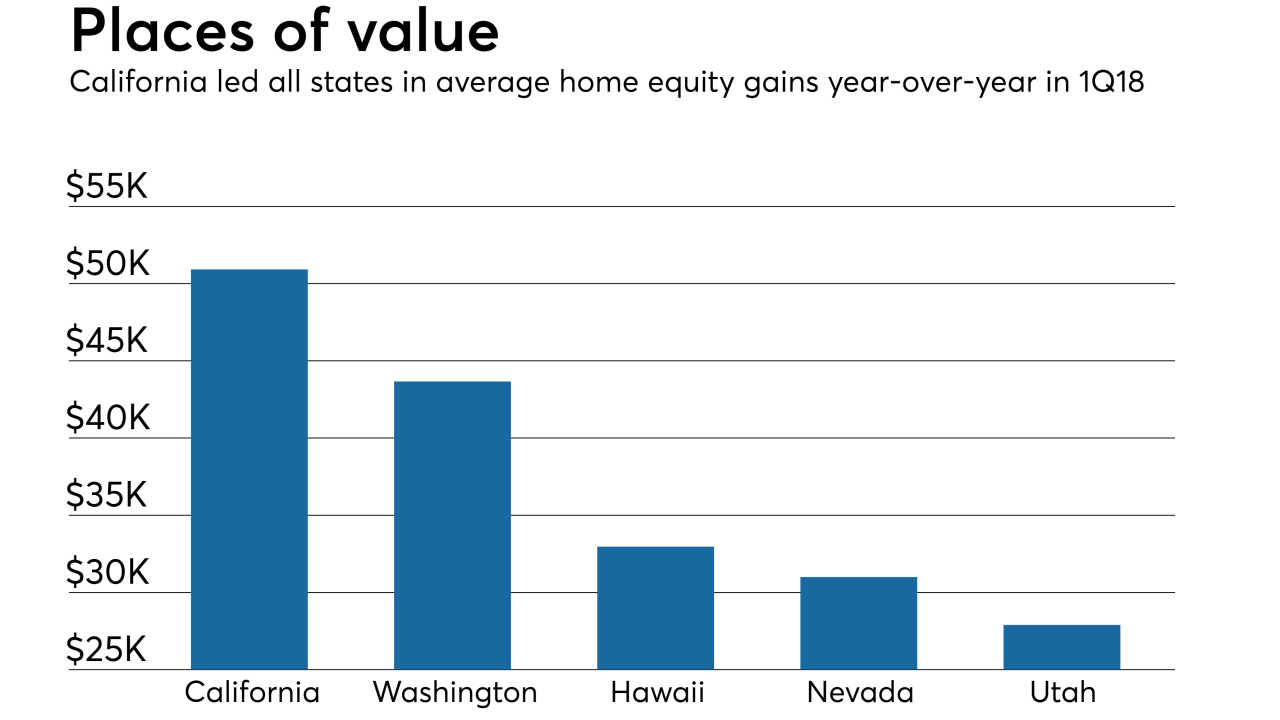

As house values continued growing, homeowners with mortgages saw their equity increase 13.3% year-over-year in the first quarter, a gain of over $1.01 trillion, according to CoreLogic.

June 8 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Dallas-area home prices grew slightly faster than the nationwide rate in the latest comparison by CoreLogic.

May 8 -

In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

May 7 -

The removal of costly appraisal requirements on tens of thousands of smaller commercial properties could help community banks better compete for loans they say they have been losing to nonbank lenders.

May 4 -

Four out of five Franklin County, Ohio, homes that changed hands this year sold above the county auditor's estimated value, in some cases for two or three times as much.

May 4 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12 -

TriStar Bank in Tennessee says a shortage of appraisers is slowing down its commercial real estate lending and raising the cost of appraisals. The claim has outraged appraisers, who argue that the bank is simply trying to avoid paying their fees.

April 11 -

The use of appraisal management companies does not result in higher quality property valuation reports, according to a working paper published by the Federal Housing Finance Agency.

April 11 -

Seattle kicked off 2018 the same way it spent the prior year and a half, as the hottest real estate market in the country, with no slowing down.

March 29 -

Lenda, launched in 2014, currently makes mortgages start to finish in two weeks. But it's aiming to make it a process that can be finished on a borrower's lunch break.

March 28 -

Fannie Mae is about to roll out a new underwriting system that will address some concerns about layered risk that cropped up after it raised its maximum debt-to-income ratio.

March 16 -

From HMDA and TRID to restoring the Protecting Tenants at Foreclosure Act, here's a look at 10 mortgage and housing provisions in the Senate's regulatory reform bill.

March 14 -

New York City is home to more of the most dramatically gentrified neighborhoods than any other city in the country, according to a new report.

March 1 -

Home prices achieved a new peak in December while also marking 68 consecutive months in annual home price appreciation, according to Black Knight.

February 26 -

The legislation, a similar version of which passed in the last Congress, would give favorable regulatory treatment to certain loans even if real estate-related fees were paid to an affiliate of the lender.

February 8