-

The actions involved are based on findings by an interagency task force first convened last year by Marcia Fudge, secretary of the Department of Housing and Urban Development.

March 23 -

The researchers found that the disparities that emerged from the analysis of 1.8 million appraisals from 2019 and 2020 were statistically significant.

January 21 -

The Federal Housing Finance Agency found several comments that could lead to fair lending concerns in the “neighborhood description” section of reports.

December 14 -

In areas prone to natural disasters, first-year premiums could rise between 10% to 15% annually, but many appraisers are inaccurately calculating renewal hikes.

November 30 -

Some states are increasing their requirements for home valuation professionals as housing officials warn that they consider mortgage lenders responsible for equitable practices too.

November 19 -

Solidifi will team up with the initiative originally launched by the National Urban League and Fannie Mae.

November 18 -

After permitting remote appraisals on an interim basis during the pandemic, Fannie Mae and Freddie Mac will accept them outright starting in early 2022, the acting head of the Federal Housing Finance Agency said.

October 18 -

Home buyers on the coasts paid the highest amount in fees, led by D.C. residents.

October 12 -

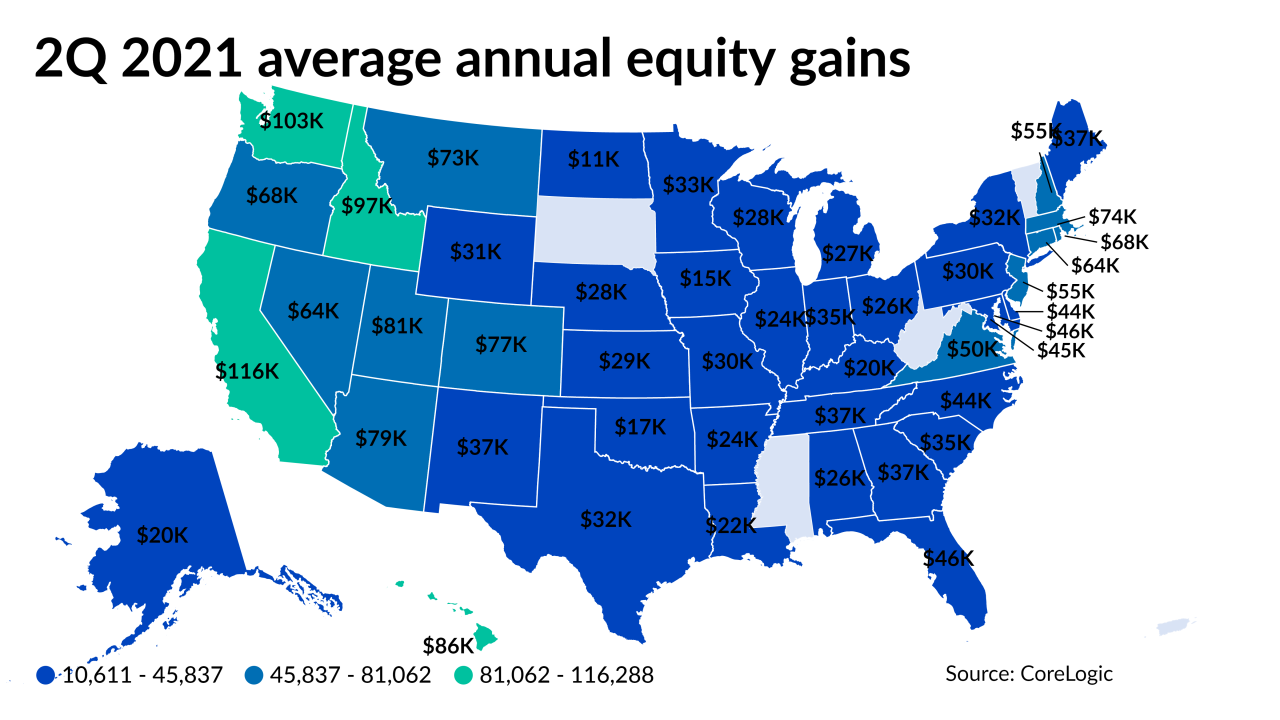

Price appreciation over the past year also dropped the share of underwater mortgage borrowers to an all-time low, according to CoreLogic.

September 23 -

The software from Incenter allows appraisers to use a homeowner’s mobile phone to take time-stamped and geotagged photos, in addition to dimensions recorded with a 3-D scanning digital measuring tape.

September 1 -

Co-chair Susan Rice, a former United Nations Ambassador, has made racial equity a central issue to her agenda as domestic policy council chair.

August 6 -

In the midst of ongoing discussions on how to better leverage analytics and digitize the home inspection process, there are some clear actions that we can take to reduce bias in the mortgage industry, writes the executive vice president of corporate strategy at Clear Capital.

July 28Clear Capital -

There’s now a unique, additional source of demand that’s opening up in an already fiercely-competitive housing market that VA lenders have to solve for.

June 14 -

The continued home price spike also drove the negative equity share to an all-time low, according to CoreLogic.

June 10 -

At the metro level, Buffalo, N.Y., had the worst undervaluation for Black-owned homes at 86% followed by 72% in both Memphis, Tenn., and Indianapolis, Redfin found.

April 20 -

These trends, in addition to the increase in appraisal contingency waivers, could add risk to mortgage lender businesses.

March 22 -

After its three acquisitions since last August, the Philadelphia area-based credit data firm predicts more industry consolidation is on the way.

March 17 -

The agreement calls for the bank to pay $50,000 to an unnamed consumer and requires its staff to undergo fair lending training as it relates to appraisals.

March 9 -

With extreme winter weather about to give way to ballooning insurance and mortgage forbearance claims in Texas, servicers will need to get through their pipelines with urgency while weeding out fraud.

February 25 -

The organization postponed the issuance of its next set of revisions, which would have gone into effect at the start of 2022.

February 22