-

Tom Lopp abruptly suspended a program that accounted for 83% of Sterling Bancorp's mortgage production this year. An ongoing audit of the program and pressure to diversify beyond mortgages are reasons to watch Lopp and Sterling in 2020.

December 27 -

The Consumer Financial Protection Bureau faces a busy policy agenda heading into the new year, as well as strong external forces that are beyond its control.

December 24 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 24 -

The owner of the MacArthur Center Mall in Norfolk, Va., has defaulted on a $750 million loan which includes the property as collateral.

December 20 -

First mortgage volumes continue to rise at credit unions, but home equity lines of credit have fallen dramatically in recent years.

December 20 -

Downtown San Jose, which has been overshadowed by its Bay Area neighbors, is having a real estate development boom because it qualifies as an opportunity zone

December 20 -

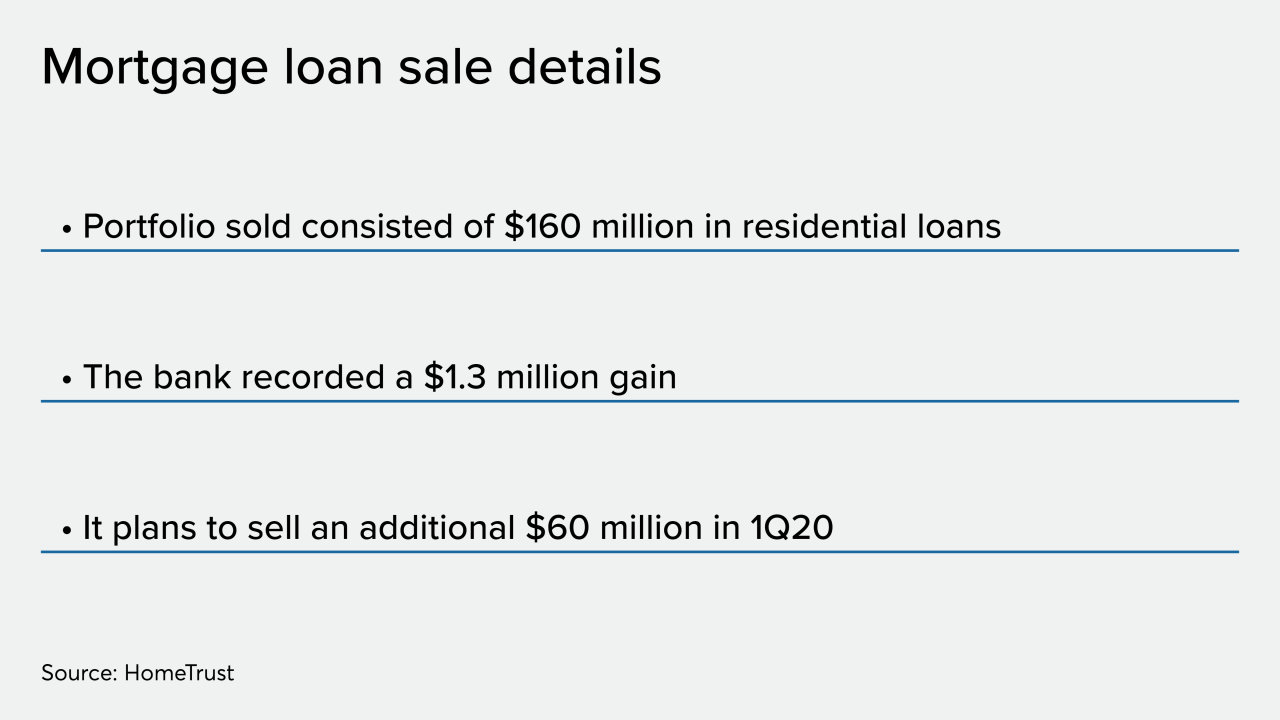

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

The proposed changes laid out by banking regulators would clear up confusion about what qualifies for CRA credit within so-called Opportunity Zones. But not all community development advocates are convinced that the changes are for the better.

December 17 -

The city of Philadelphia and Wells Fargo have agreed to resolve a 2017 lawsuit in which the city accused the bank of violating the Fair Housing Act by steering minority borrowers into risky, high-cost loans.

December 16 -

Without admitting wrongdoing, the bank has agreed to contribute $10 million to city programs promoting homeownership for low- and moderate-income residents.

December 16 -

The percentage of home loans with late payments is unlikely to fall much further in 2020 when mortgages made to lower credit-score borrowers could rise slightly, according to TransUnion.

December 12 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

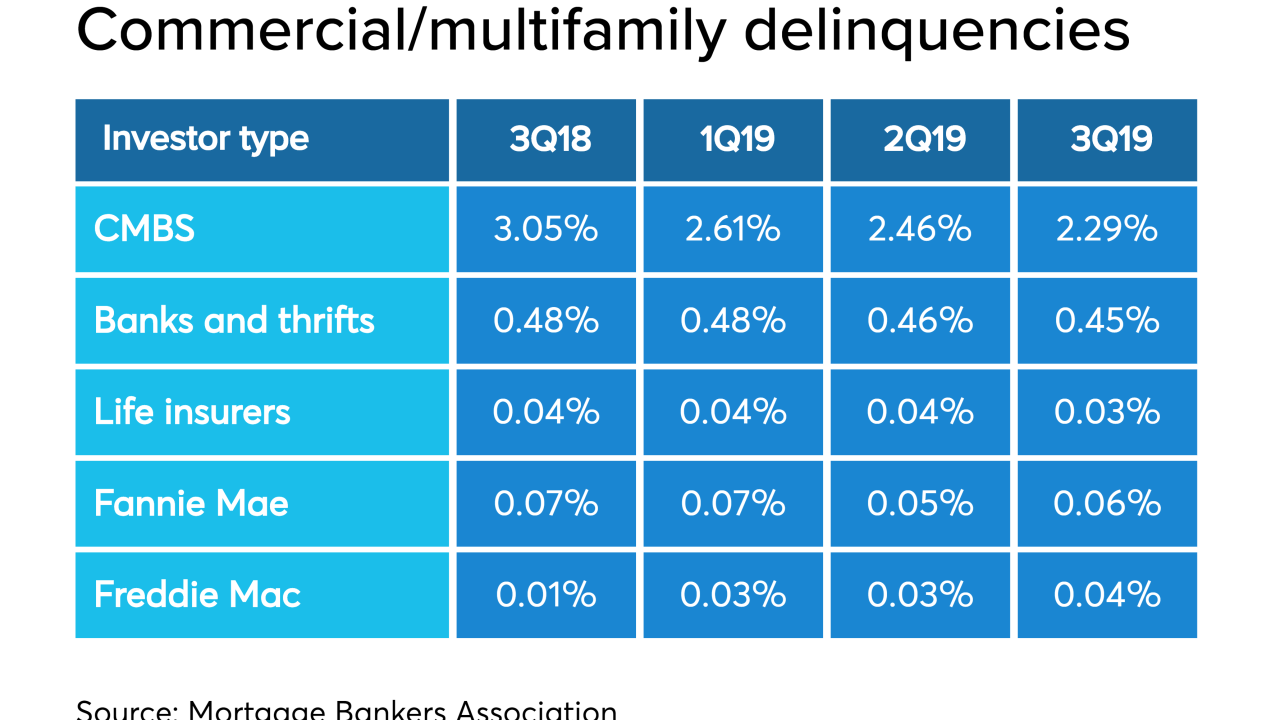

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

Yale researchers have recommended several consumer banking products and services that could help those with mental health challenges manage their money.

November 26 -

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

Lenders contend the proposal goes beyond policing third-party debt collectors and could expose banks to enforcement actions and lawsuits.

November 25 -

The nonbank share of large mortgage servicing is growing, but smaller players tend to be depositories, the Consumer Financial Protection Bureau found in a new report aimed at examining regulatory impacts.

November 22 -

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

In recent months federal regulators have been speaking out on the risks that extreme weather events pose to the financial system, something their European counterparts have been doing for some time.

November 18