-

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8 -

The fate of U.S. office markets is intertwined with that of the biggest technology companies, Starwood Capital Group Chairman Barry Sternlicht said.

April 3 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Rep. Gregory Meeks of New York signaled which legislative provisions Democratic leaders would accept in a bipartisan housing finance package.

April 2 -

The company plans to sell its third-party origination channel to Renasant. It has also lined up a deal to sell its correspondent channel.

April 1 -

The Los Angeles bank will take a $1.4 million hit to earnings after the multifamily properties sold for less than their book value.

April 1 -

Tim Sloan couldn't hang on any longer. Here are insights about why he left now, what role policymakers played in the decision and will continue to have in the company's future, and who in the world would want to lead Wells Fargo.

March 28 -

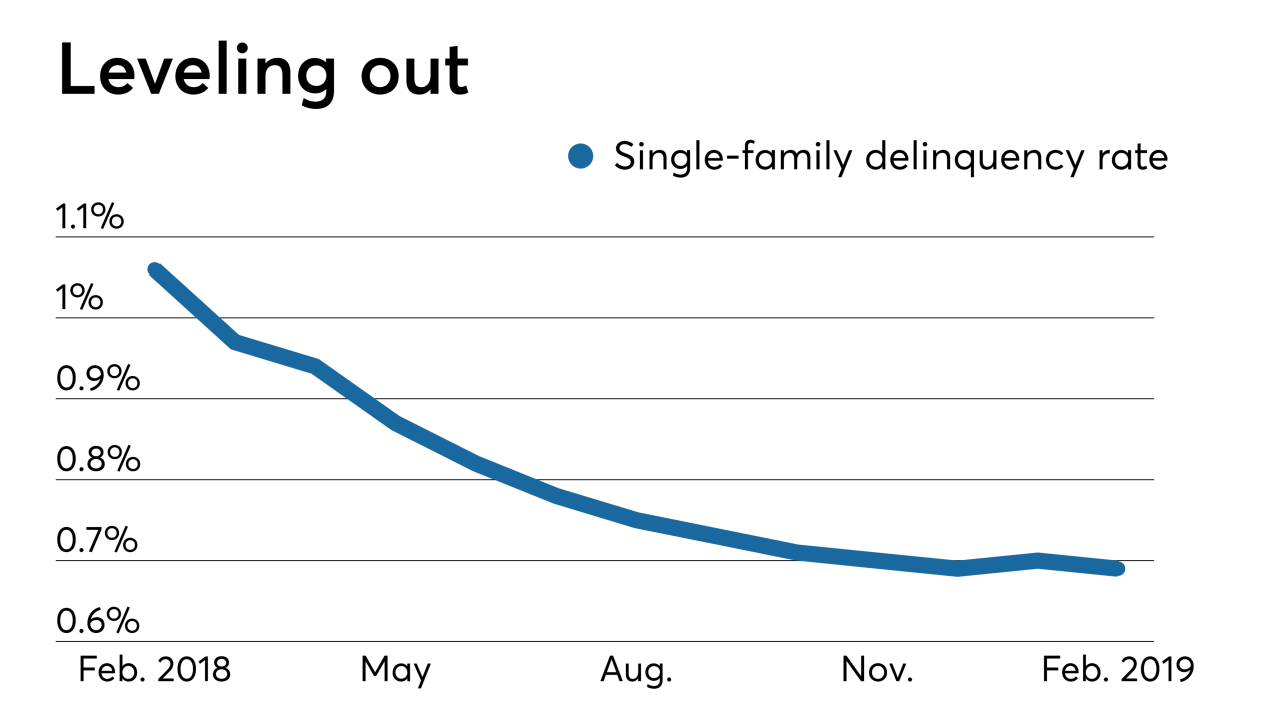

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

A $54-million project to build upscale condominiums at the edge of downtown Detroit has been canceled, unable to get financing, and the Plan B is to put a hotel there.

March 25 -

With a second defendant pleading guilty to conspiracy, it was learned that a Watertown, N.Y., apartment complex is among dozens of rental properties in that state and several others that allegedly received $500 million in fraudulent bank loans.

March 25 -

University Bancorp gained a number of offices from Huron Valley Financial. It also hired lenders and staff with experience in reverse mortgages and wholesale lending.

March 23 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

A report from the Government Accountability Office found that while the Federal Home Loan banks have taken steps to improve diversity among boards of directors, members are still largely male and nonminorities.

March 20 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc. -

As part of a settlement with the National Fair Housing Alliance and the American Civil Liberties Union, the social media platform will no longer allow certain advertisers to target users by age, gender or ZIP code.

March 19 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

Recent remarks from top officials at the FDIC and Fed suggest the agencies' recent impasse over reforming the Community Reinvestment Act may be ending.

March 18