-

A $54-million project to build upscale condominiums at the edge of downtown Detroit has been canceled, unable to get financing, and the Plan B is to put a hotel there.

March 25 -

With a second defendant pleading guilty to conspiracy, it was learned that a Watertown, N.Y., apartment complex is among dozens of rental properties in that state and several others that allegedly received $500 million in fraudulent bank loans.

March 25 -

University Bancorp gained a number of offices from Huron Valley Financial. It also hired lenders and staff with experience in reverse mortgages and wholesale lending.

March 23 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

A report from the Government Accountability Office found that while the Federal Home Loan banks have taken steps to improve diversity among boards of directors, members are still largely male and nonminorities.

March 20 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc. -

As part of a settlement with the National Fair Housing Alliance and the American Civil Liberties Union, the social media platform will no longer allow certain advertisers to target users by age, gender or ZIP code.

March 19 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

Recent remarks from top officials at the FDIC and Fed suggest the agencies' recent impasse over reforming the Community Reinvestment Act may be ending.

March 18 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

The California banking company has two loans tied to DC Solar that are on nonaccrual status.

March 15 -

Gateway Mortgage Group says its launch of a digital-only bank is scheduled for this summer.

March 14 -

The 2020 presidential hopeful removed the contentious provision from a previous version of the bill that had won praise from bankers but sparked fierce opposition from credit unions.

March 13 -

Millennials make up the largest cohort of homebuyers, but a quarter of them don't even know their credit score, which could be a call for mortgage lenders to help them prepare to enter the housing market.

March 13 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

In the face of tough questioning from House members, CFPB Director Kathy Kraninger appeared mostly unfazed and tried to strike a balance between heeding concerns about the agency’s power and supporting its mission to help consumers.

March 7 -

The legislation comes a day before CFPB Director Kathy Kraninger is set to testify to Congress.

March 6 -

Millennial homebuyers took advantage of a winter lull in interest rates, using the opportunity to refinance their loans, according to Ellie Mae.

March 6 -

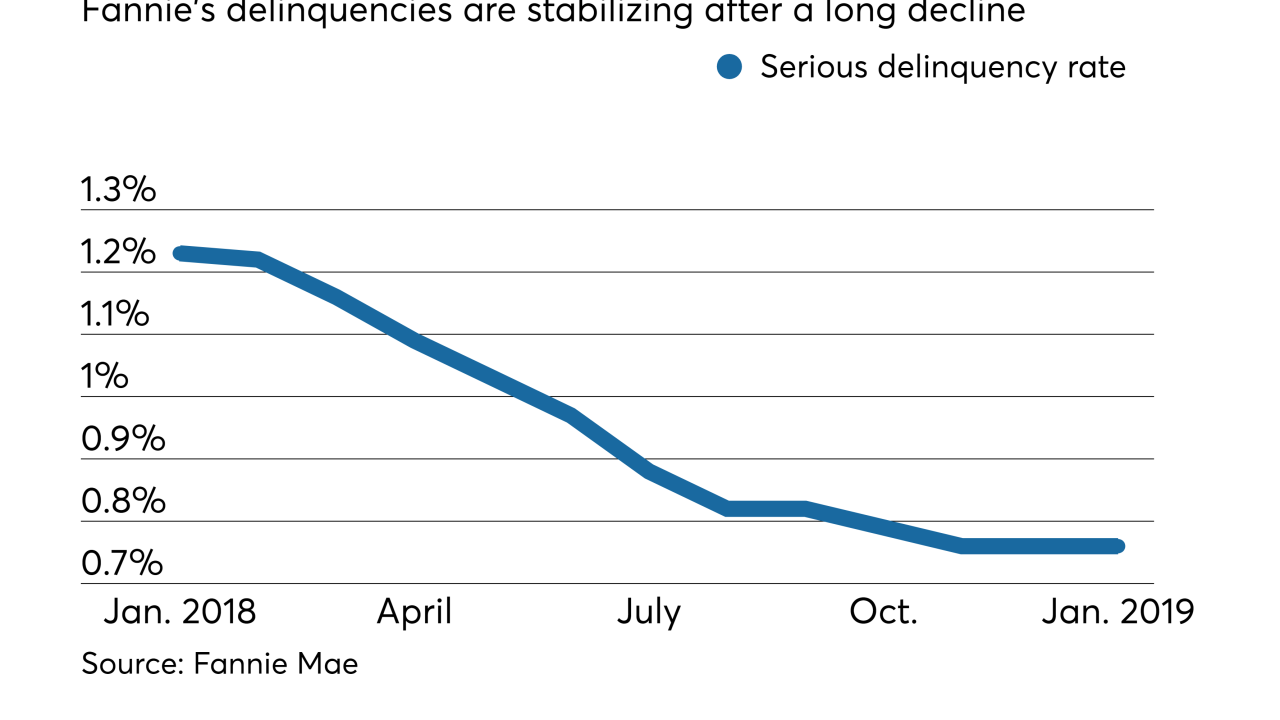

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1