-

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

The California banking company has two loans tied to DC Solar that are on nonaccrual status.

March 15 -

Gateway Mortgage Group says its launch of a digital-only bank is scheduled for this summer.

March 14 -

The 2020 presidential hopeful removed the contentious provision from a previous version of the bill that had won praise from bankers but sparked fierce opposition from credit unions.

March 13 -

Millennials make up the largest cohort of homebuyers, but a quarter of them don't even know their credit score, which could be a call for mortgage lenders to help them prepare to enter the housing market.

March 13 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

In the face of tough questioning from House members, CFPB Director Kathy Kraninger appeared mostly unfazed and tried to strike a balance between heeding concerns about the agency’s power and supporting its mission to help consumers.

March 7 -

The legislation comes a day before CFPB Director Kathy Kraninger is set to testify to Congress.

March 6 -

Millennial homebuyers took advantage of a winter lull in interest rates, using the opportunity to refinance their loans, according to Ellie Mae.

March 6 -

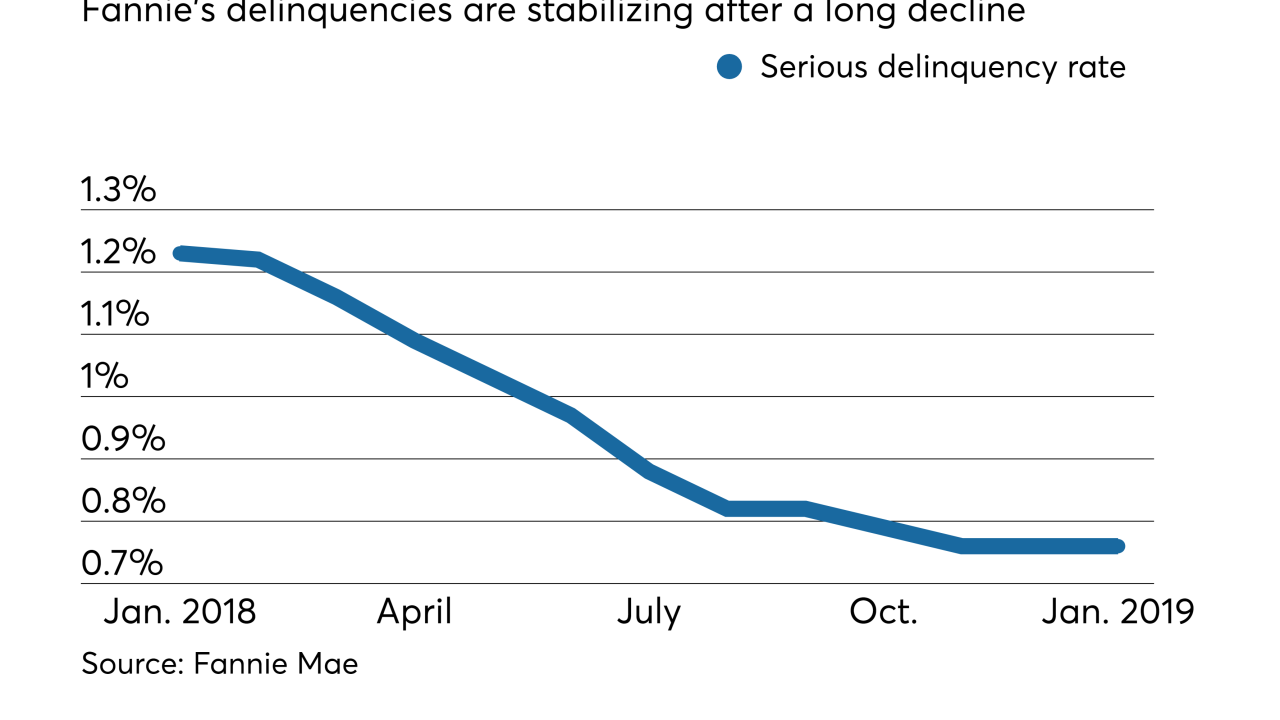

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

Community banks and credit unions fear a Senate plan and other legislative ideas will nullify steps taken by Fannie Mae and Freddie Mac that have made it easier for smaller institutions to compete.

February 28 -

Bank of Marin CEO Russ Colombo is tightening up pricing and terms, citing soaring real estate prices in markets like San Francisco.

February 28 -

The Seattle company has a letter of intent to sell its home loan centers to Homebridge Financial Services.

February 27 -

The root of the credit reporting sector’s problems may be its dominance by a handful of big firms, lawmakers from both parties said at a hearing.

February 26 -

Ahead of testimony by the CEOs of the major bureaus, House Financial Services Committee leaders proposed sweeping changes for the credit reporting industry and credit-score protections for furloughed government workers.

February 25 -

Some companies on SourceMedia’s Best Fintechs to Work For list offer their employees extra time off to live boldly.

February 24 -

Three years ago, the New York-based fintech started organizing a monthly gathering for its female employees. The meetings have helped participants find role models.

February 24 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

The agency has required restitution in just one of six settlements under its new director, raising questions about whether the pattern will continue.

February 20