-

The Massachusetts progressive said in a New Year's Eve email and video message to supporters that she’s launching an exploratory committee for a 2020 bid, which could give her an early edge in fundraising among several potential rivals for the Democratic Party nomination.

December 31 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

Rep. Maxine Waters, D-Calif., will take the gavel on the Financial Services Committee next term.

December 24 -

Cash-strapped lenders need to find a way to consistently fund marketing that resonates with more cultures if they really want to be able to replace lost volume by reaching underserved borrowers.

December 21 Cultural Outreach

Cultural Outreach -

Many servicers expect their Federal Housing Administration mortgage portfolios to grow in the next year or two, and that increase could coincide with an uptick in delinquencies, warns Altisource Portfolio Solutions.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

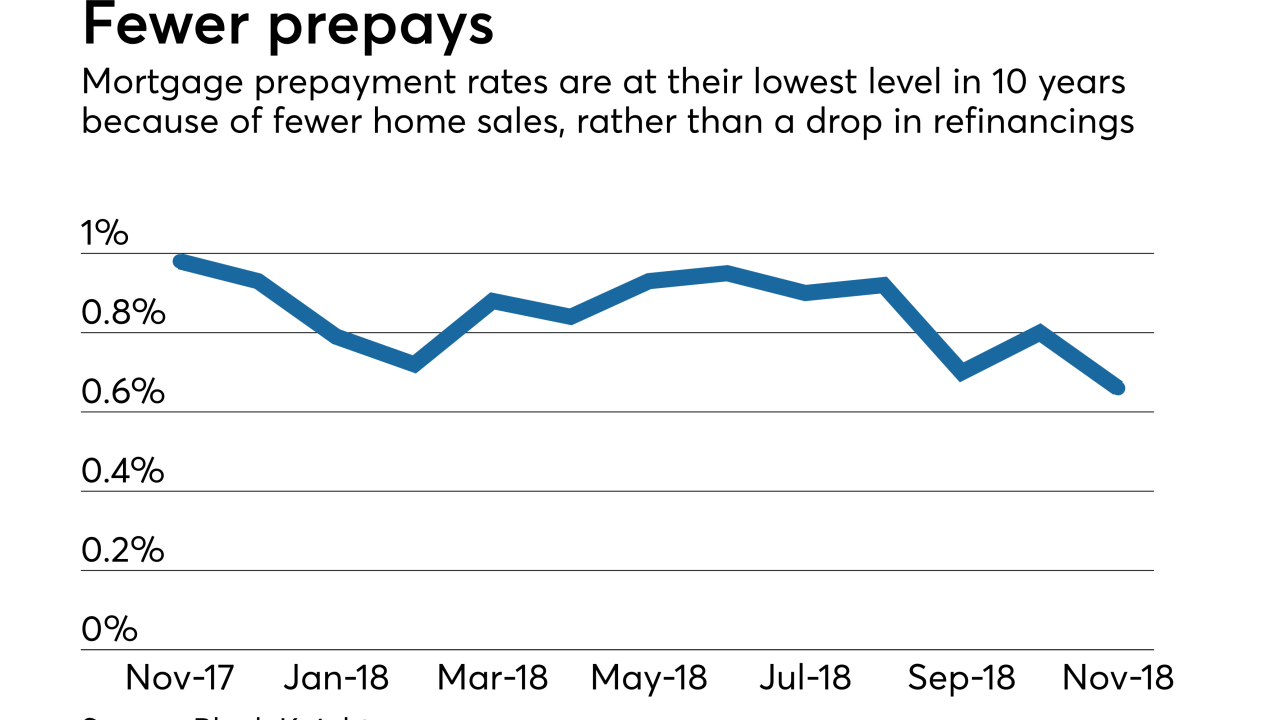

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19 -

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

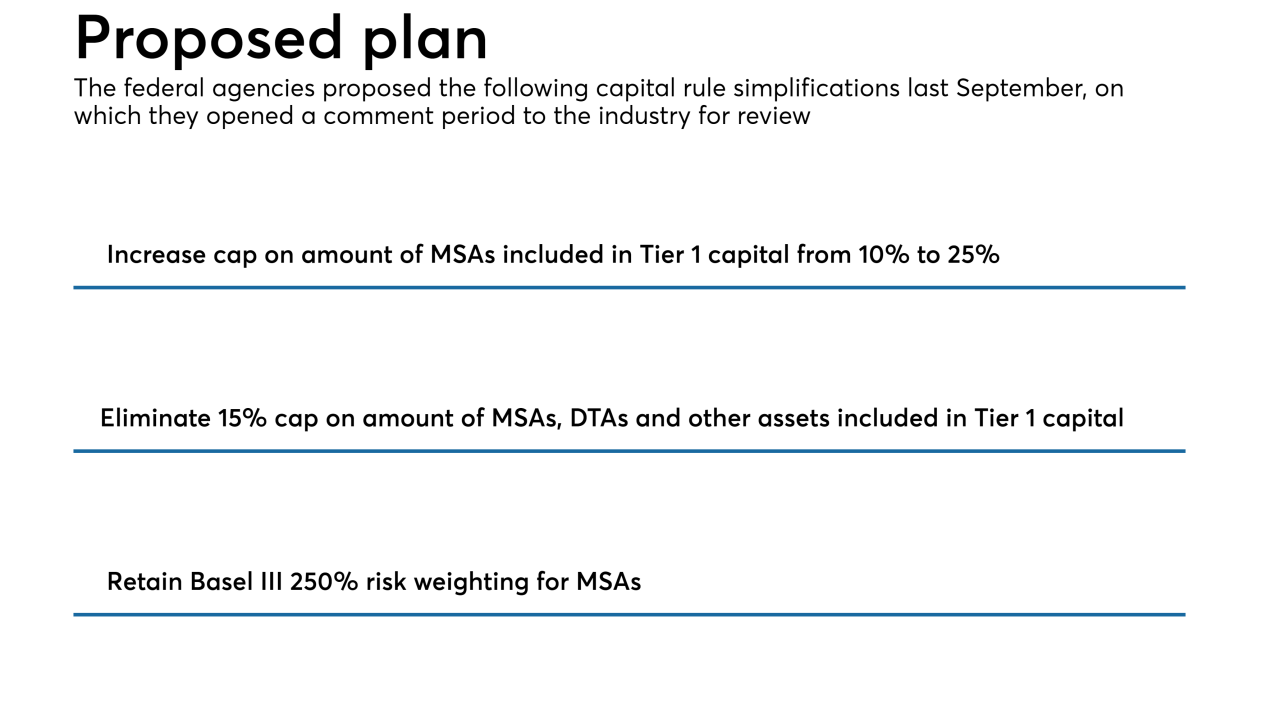

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

Richard Harra was also fined $300,000 for painting a false picture of the bank’s financial health at the height of the financial crisis.

December 18 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 11 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

Merchants has agreed to buy NattyMac, a company it has been in business with since 2014.

December 6 -

Democrats on the House Financial Services Committee are expected to shine a spotlight on Trump-appointed regulators, but that light might shine brightest on one agency in particular.

December 5