-

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Following the release of the nonbinding statement of policy, regulators still have an important role to play in making sure the industry achieves an effective data-sharing model.

November 1 Quovo

Quovo -

Call-report data on commercial and industrial loans does not fully capture small-business lending by smaller institutions, a recent FDIC survey suggests.

November 1 -

The delinquency rate for U.S. commercial real estate loans in CMBS is now 5.21%, a decrease of 19 basis points from the September level, according to Trepp. That is the second-largest rate drop measured in the last 19 months.

October 31 -

TCF is looking to diversify its streams of revenue as it dials back auto lending amid concerns about weakening credit quality.

October 30 -

The new tool tracks both serious and general delinquencies down to a county level and features interactive charts and graphs.

October 30 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

October 26 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 25 -

BOK Financial benefited from rising interest rates in the third quarter even as it reported declines in fee income and commercial real estate loan balances.

October 25 -

The Michigan company's third-quarter results were down slightly from a year earlier despite increased commercial lending and a wider net interest margin.

October 24 -

Net income at the Livingston, N.J., company climbed 67% due to a variety of one-time items tied to its ongoing restructuring.

October 24 -

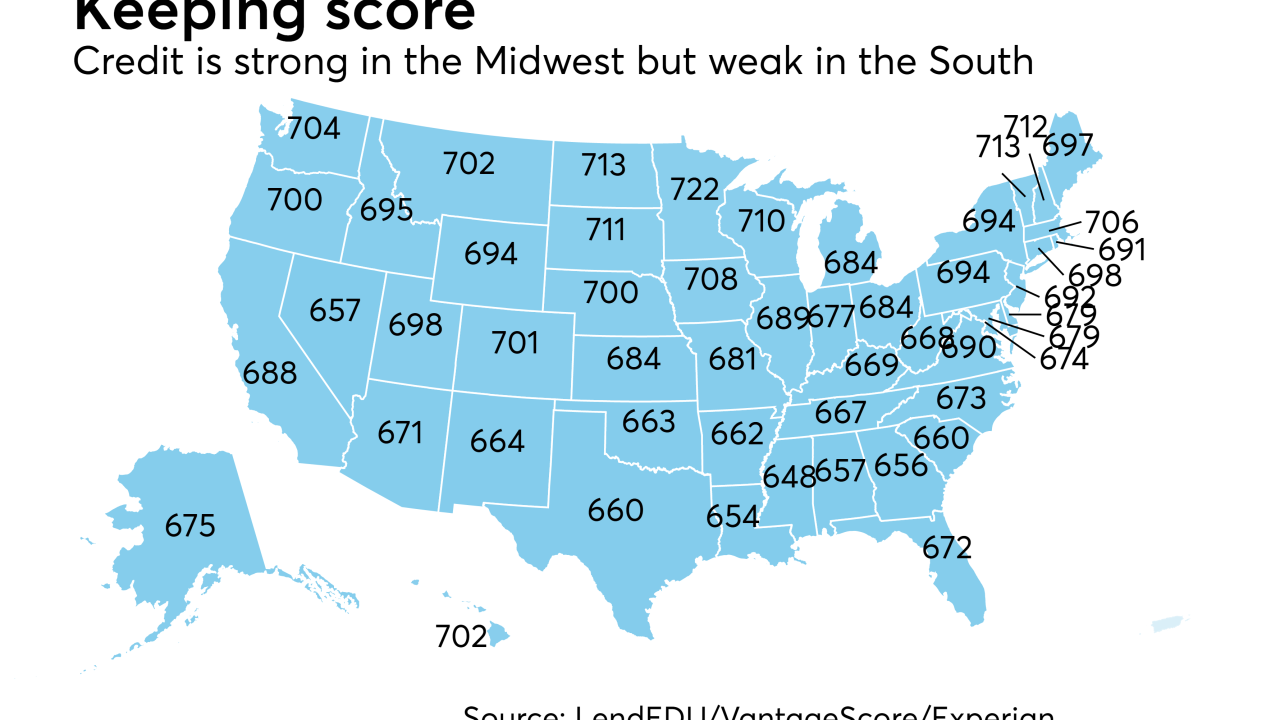

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

SunTrust’s yields have improved as it has increased its credit-card and student lending and made more online personal loans through its LightStream subsidiary.

October 20 -

With online retailers beginning to challenge the dominance of brick-and-mortar grocery stores, CRE loans to strip mails anchored by them look riskier.

October 19 -

The $36.3 billion-asset bank reported double-digit growth in C&I loans, commercial real estate loans and specialty loans to the private-equity, entertainment and energy industries in the third quarter.

October 19 -

Net income for the Oregon regional bank was $61.3 million, a slight decline from the same quarter last year. It earned 28 cents per share and fell short of analysts’ expectations,

October 19 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

The nonbinding guidance, which followed a nearly yearlong inquiry about industry practices, said consumers should have greater ability to obtain information about their financial data, among other principles.

October 18