-

Banks should not point blame at the credit bureau but rather should step up and demonstrate their commitment to their customers. If you punt the problem to Equifax, it suggests you don’t really care.

September 12

-

Senate Finance Committee leaders sent a letter to Equifax CEO Richard Smith scrutinizing the scope of the company's data breach and its response.

September 11 -

The hurricane was expected by many to deliver catastrophe. Instead, bankers are largely looking to restore power and confirm the status of employees.

September 11 -

Lawmakers signaled Monday that Congress will likely have a swift and powerful response to revelations that the credit reporting company Equifax was hacked, exposing 143 million people to identity theft.

September 11 -

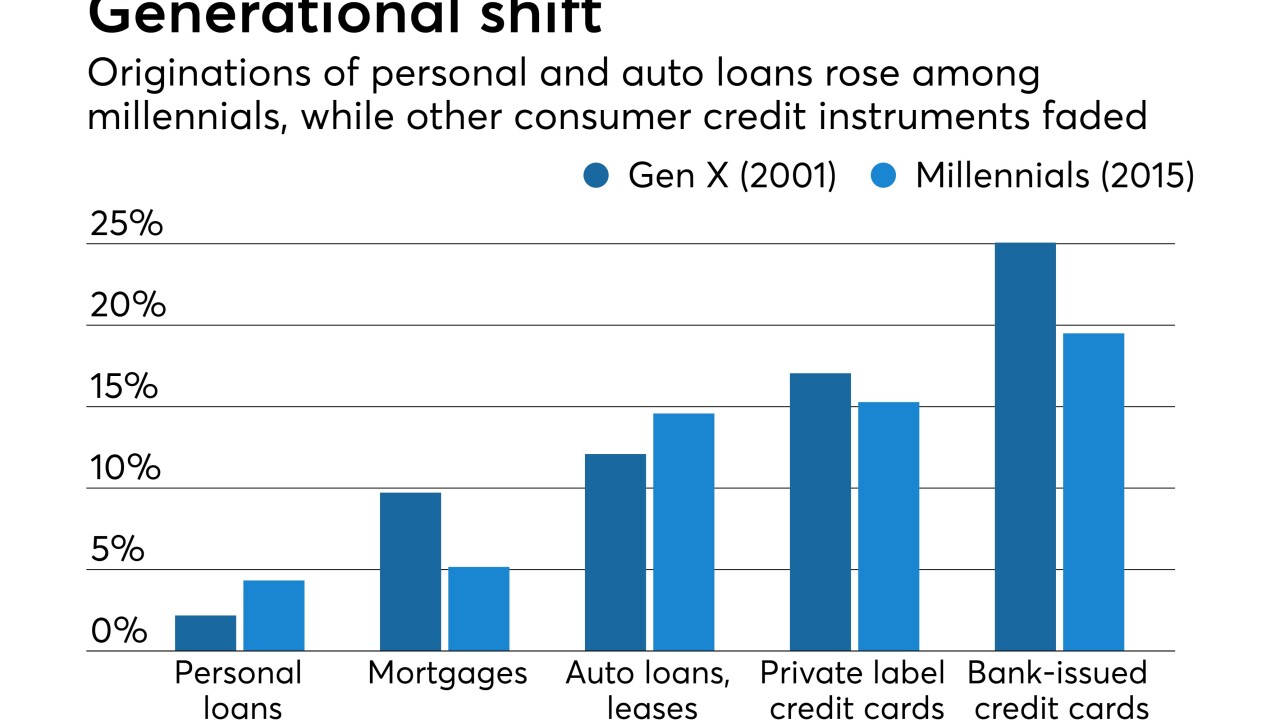

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

Overall mortgage lending increased by 20% in the second quarter but was still down from a year earlier, according to Black Knight Financial Services.

September 11 -

One lawsuit has already been filed against Equifax in the wake of its massive security failure. But that’s the just beginning of the consequences for the credit bureau and the banks that use it.

September 8 -

Over one-quarter of all mortgages in the areas affected by Hurricane Harvey are likely to become delinquent because of the storm, according to an analysis from Black Knight.

September 8 -

The $426.2 million COLT 2017-2 is backed entirely by loans originated by Caliber, an affiliate of private equity firm Lone Star Funds. There are no loans originated by Sterling Bank & Trust, which accounted for 22% of the collateral for the prior deal.

September 8 -

One year after it paid $190 million in fines and restitution for opening millions of unauthorized accounts, Wells Fargo remains mired in scandal. Why hasn't it been able to recover?

September 7 -

Intruders accessed names, Social Security numbers, birth dates, addresses and driver’s license numbers in what could be one of the largest data intrusions.

September 7 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

As head of Fannie Mae's single-family mortgage business, Andrew Bon Salle wants to ease the burden of loan-level price adjustments, streamline condo loan approvals and expand rep and warrant relief. But even he admits there are limits to his power.

September 7 -

In a deregulatory environment, a rule that better enables consumers to bring class actions could lead to an explosion of litigation, which will affect product availability and pricing.

September 6 Davis & Gilbert LLP

Davis & Gilbert LLP -

Ginnie Mae will help issuers with certain servicing obligations if more than 5% of their portfolios are in areas Hurricane Harvey has ravaged.

September 6 -

Quaint Oak in Pennsylvania is making a big push in real estate brokerage, a business that many state-chartered banks might think is illegal for them to pursue.

September 5 -

“You can’t serve the public if your employees are shellshocked,” said one top banker, comments echoed by other institutions dealing with the aftermath of Hurricane Harvey.

September 5 -

Armada Analytics, a commercial real estate underwriting and asset management services provider, acquired Anabranch Flood, a provider of flood risk assessment services.

September 5 -

The Houston company doesn't expect any material impact on its commercial-and-industrial book, though there is potential risk tied to residential mortgages. Management, meanwhile, has started rolling out programs to help customers recover.

September 1