-

Intruders accessed names, Social Security numbers, birth dates, addresses and driver’s license numbers in what could be one of the largest data intrusions.

September 7 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

Given the scale of damage to the region’s homes and cars, bankers are guarding against an expected spike in missed payments by extending loan terms, deferring payments and making other concessions.

September 7 -

As head of Fannie Mae's single-family mortgage business, Andrew Bon Salle wants to ease the burden of loan-level price adjustments, streamline condo loan approvals and expand rep and warrant relief. But even he admits there are limits to his power.

September 7 -

In a deregulatory environment, a rule that better enables consumers to bring class actions could lead to an explosion of litigation, which will affect product availability and pricing.

September 6 Davis & Gilbert LLP

Davis & Gilbert LLP -

Ginnie Mae will help issuers with certain servicing obligations if more than 5% of their portfolios are in areas Hurricane Harvey has ravaged.

September 6 -

Quaint Oak in Pennsylvania is making a big push in real estate brokerage, a business that many state-chartered banks might think is illegal for them to pursue.

September 5 -

“You can’t serve the public if your employees are shellshocked,” said one top banker, comments echoed by other institutions dealing with the aftermath of Hurricane Harvey.

September 5 -

Armada Analytics, a commercial real estate underwriting and asset management services provider, acquired Anabranch Flood, a provider of flood risk assessment services.

September 5 -

The Houston company doesn't expect any material impact on its commercial-and-industrial book, though there is potential risk tied to residential mortgages. Management, meanwhile, has started rolling out programs to help customers recover.

September 1 -

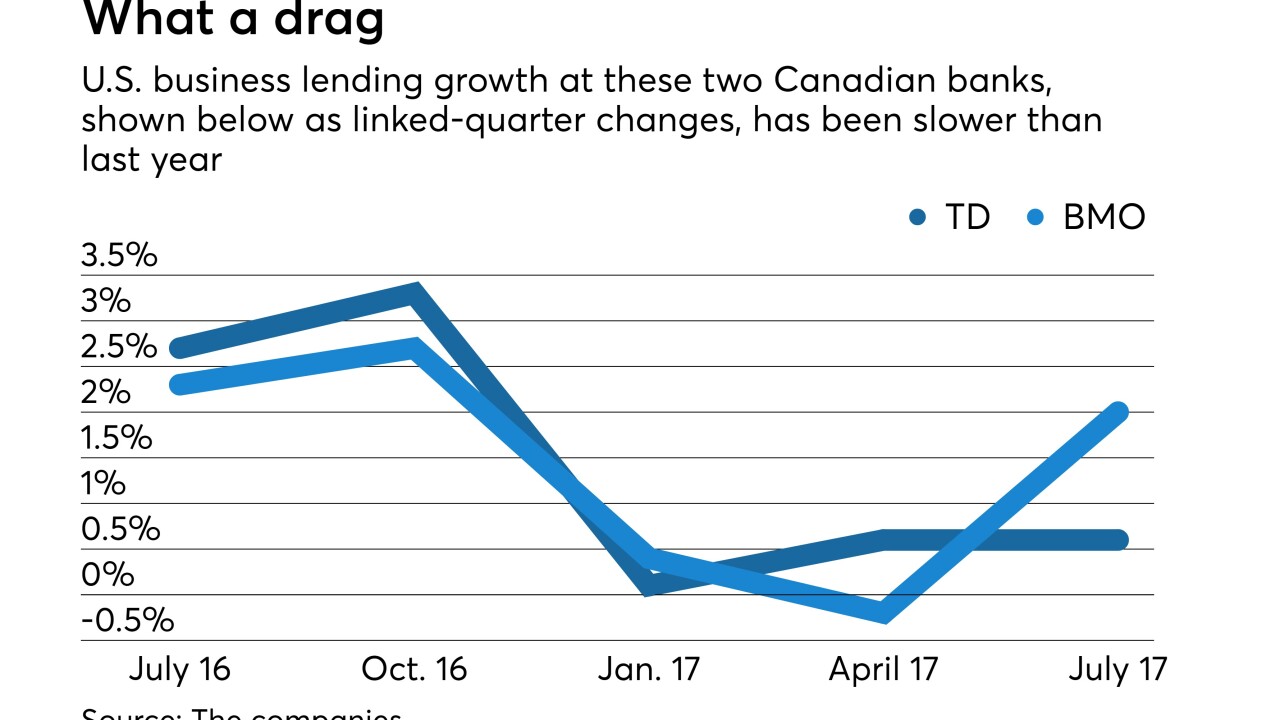

Pain stemming from slow U.S. commercial loan growth has spread north of the border, contradicting the yearslong narrative that Canadian banks are

relying on their U.S. operations to offset economic problems at home. However, TD and BMO executives said this week there is still upside in U.S. consumer banking.August 31 -

The Fed's order noted that Sterling had clarified errors in its Community Reinvestment Act data before receiving a "satisfactory" rating from the OCC.

-

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP -

A credit service provider agreed to exit the industry on Wednesday after a yearlong lawsuit with the Consumer Financial Protection Bureau.

August 31 -

Consumer Financial Protection Bureau Director Richard Cordray said his possible political ambitions did not affect the small-dollar rule, while declining to spell out if he was running for office.

August 30 -

As Republicans policymakers pursue efforts to revamp the Consumer Financial Protection Bureau and replace its leadership, state agencies are already preparing to fill any vacuum that might ensue if the CFPB steps back.

August 30 -

Millennial credit scores are lower than when Generation X consumers were coming of age, reflecting changes in credit consumption and other consumer behaviors.

August 30 -

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, wrote a letter to CFPB Director Richard Cordray calling on him to clarify whether he is running for political office.

August 29 -

Their immediate effort is to ensure colleagues and clients are safe and that banking services are available to hurricane victims. The next big issue is preparing for the financial hit banks and customers will take from wind and water damage.

August 28 -

Republicans are already accusing CFPB Director Richard Cordray of misusing his job as a fundraising platform while many agency allies want him to stay.

August 25