-

The third-largest Canadian bank's proposed minority stake in KeyCorp is an unconventional way to generate more U.S. revenue. Analysts say it's a less risky approach than buying an American bank outright.

August 23 -

While the Department of Veterans Affairs does not have a credit score usage mandate, it has shown to be open to the use of advanced models.

August 15 -

Pandemic era changes to credit reporting have dangerously distorted credit scores for mortgage borrowers. The market is in worse shape than we realize, writes a former Federal Housing Finance Agency director.

August 13

-

The change in medical debt reporting initiated by the three credit bureaus did not go far enough as 15 million Americans are still impacted, the groups led by the National Consumer Law Center said.

August 12 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

Moderating interest rates in the first quarter led to changing fortunes from 2022 and 2023, a Transunion report said.

August 8 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

Shares in U.S. banks weren't immune to a global market sell-off, as worries mounted over whether the U.S. economy's recent resilience is faltering. The turmoil hit some tech stocks hard and led to the worst day for Japanese stocks since the 1980s.

August 5 -

Financial institutions have trouble pinning down a common definition of AI and figuring out which of their processes incorporate the technology. That can lead to trouble with regulators.

August 1 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

The buyer said the all-stock deal to buy The First Bancshares would create a combined bank with $25 billion of assets.

July 29 -

In a new survey of bank executives from IntraFi, 90% of respondents said instances of check fraud have increased in recent years and half want law enforcement to make check fraud a bigger priority to stop criminals from stealing checks in the mail.

July 29 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

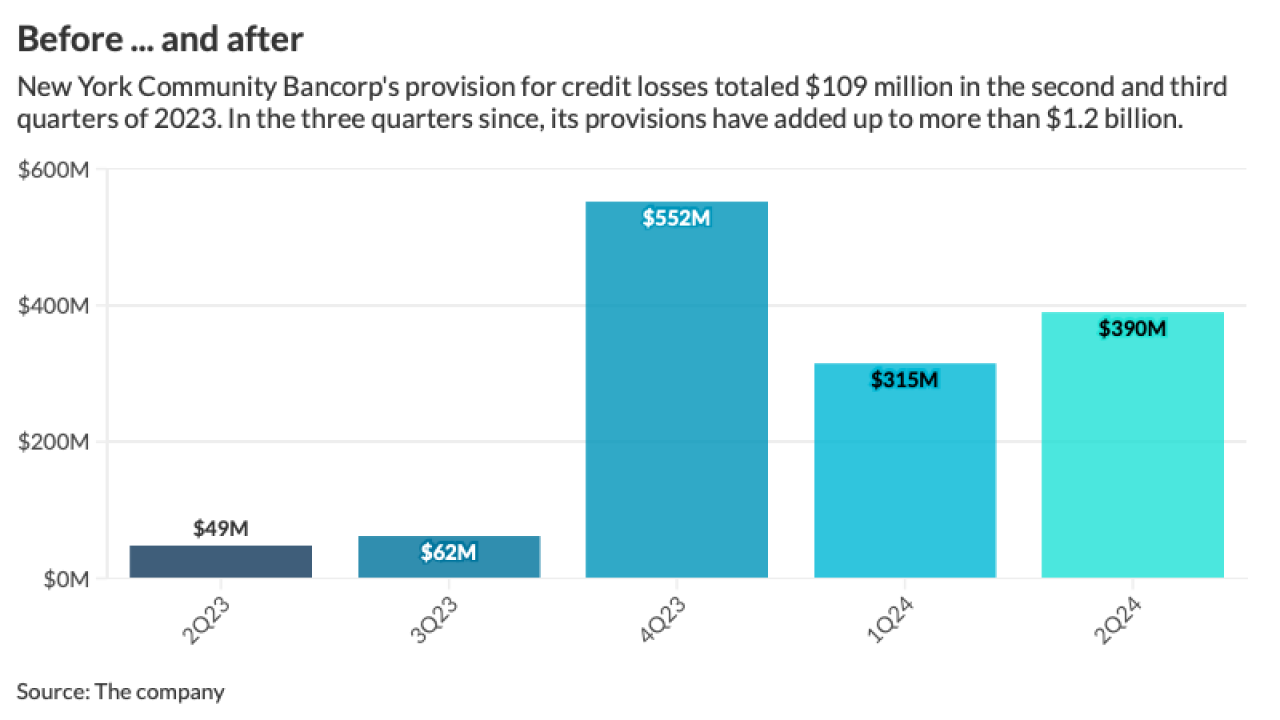

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

Institutional investors have an opportunity to "do well while doing good" while advancing a flagship public/private partnership model writes the Chief Growth Officer of Rocktop.

July 23 Rocktop

Rocktop -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

July 18