-

The Loan Syndications and Trading Association alerts market participants to the challenges of term-SOFR transition before year-end.

September 8 -

The credit union service organization, which changed its name from CU Realty Services in June, has expanded its service area to cater to more homebuyers and help credit unions secure their mortgage pipeline.

September 8 -

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

September 1 -

The Office of the Comptroller of the Currency is seeking nearly $19 million from David Julian, Claudia Russ Anderson and Paul McLinko. The trial before an administrative judge is scheduled to begin in South Dakota on Sept. 13.

September 1 -

Despite “color blind” underwriting algorithms, loan denial rates on mortgages that were not backed by the Federal Housing Administration and the VA skewed heavily toward minority groups, according to a study by The Markup.

August 27 -

In addition to the incentive, Neat Capital in Colorado mandated that its employees get inoculated against COVID-19.

August 25 -

Infrastructure will command most of lawmakers’ attention, but expect banks to keep pushing for bills that would ease the transition away from a key benchmark rate and help them serve legal cannabis businesses.

August 24 -

The COVID-19 pandemic has exacerbated income inequality in America, and that has implications for banks and other lenders. Among those suffering most: renters, front-line workers and minority small-business owners.

August 23 -

The rate at which borrowers went past due on their home loans showed near-term improvement in July, according to Black Knight, but servicers fear those who still have forborne payments won’t recover.

August 20 -

CEO Thomas Cangemi is pushing to modernize a bank that for decades was focused largely on multifamily lending. The company has already agreed to buy the mortgage lender Flagstar Bancorp and its partnership with Figure Technologies, a blockchain-focused fintech, has the potential to make that acquisition more productive.

August 18 -

Forborne mortgages stemming from the coronavirus outbreak reached their lowest level since late March 2020, according to the Mortgage Bankers Association.

August 16 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

Landlord groups have challenged the policy, arguing that the administration bowed to political pressure even though it knew the eviction freeze wouldn’t pass muster with the courts.

August 9 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The numbers in a new Research Institute for Housing America report reinforce other signs that recovery isn’t moving quite as quickly as originally anticipated.

August 4 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

The industry had tightened up last year in the face of COVID-19. But as the economic outlook improves, banks are now easing criteria amid heightened competition, according to the Federal Reserve’s survey of loan officers.

August 2 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

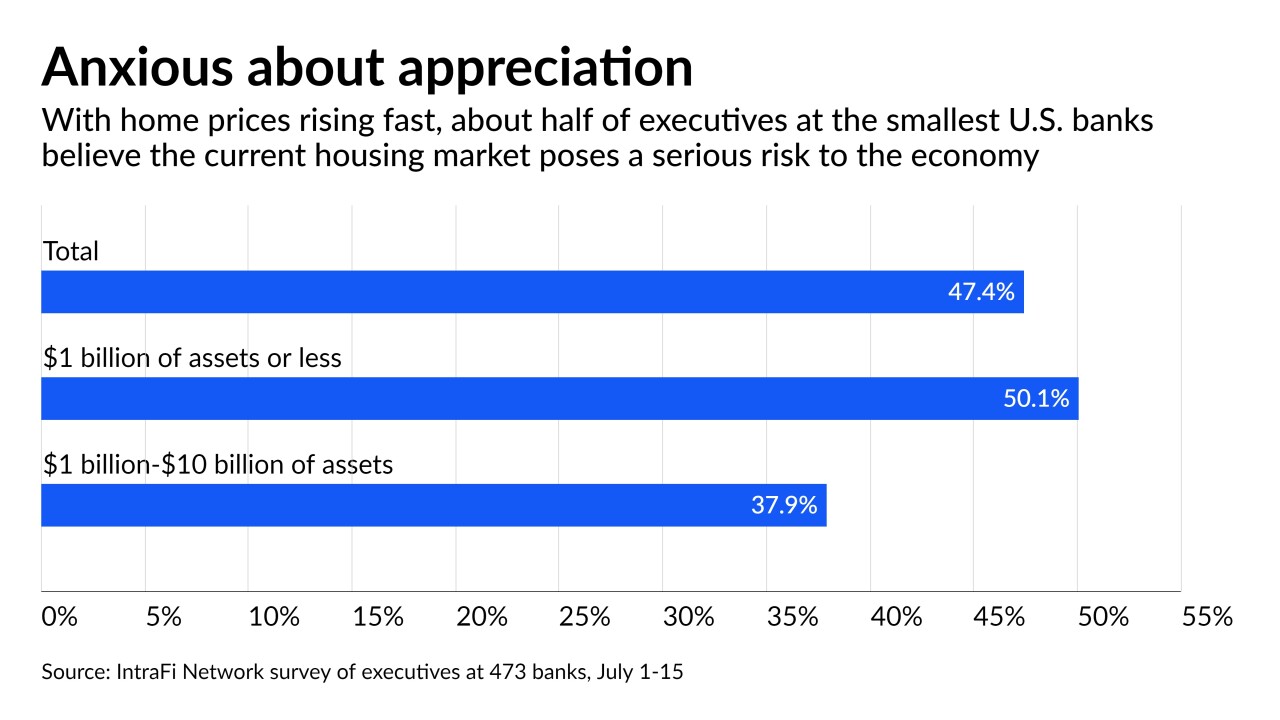

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27