-

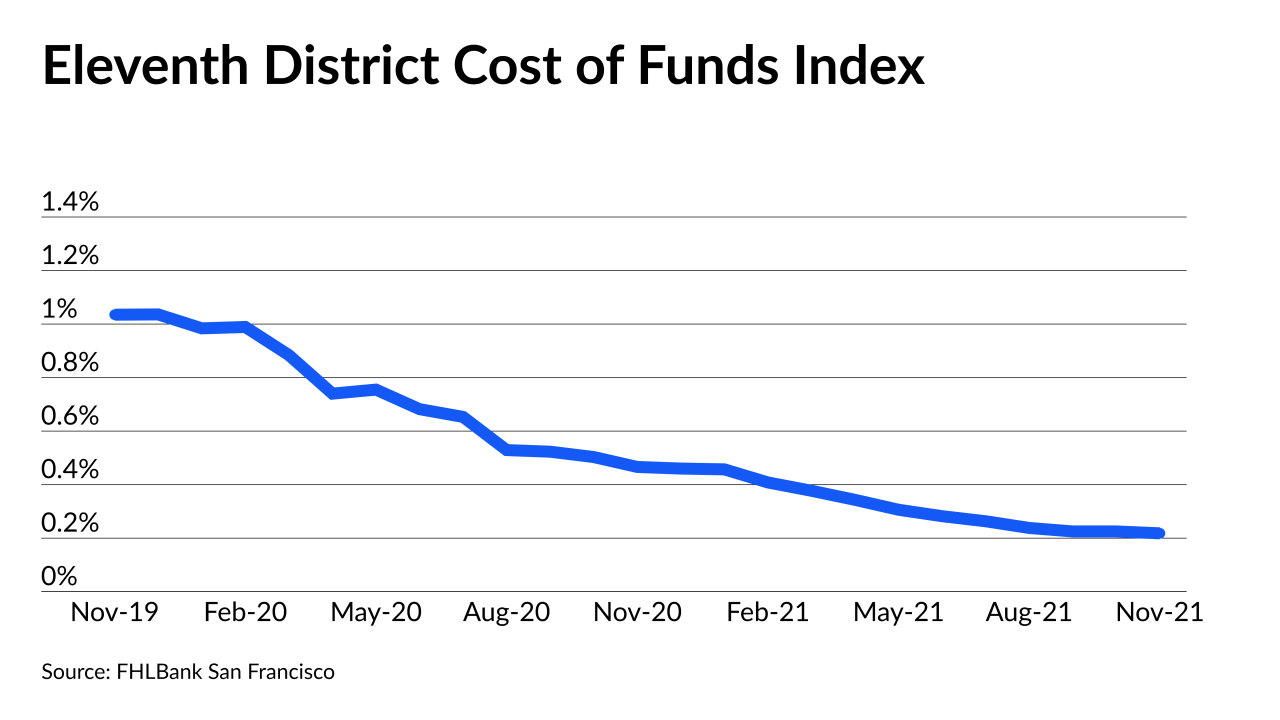

The metric’s imminent end after more than 40 years means servicers need to put replacement plans in motion if they haven’t already.

January 3 -

The new leader, who officially joined the government mortgage-bond insurer on Jan. 3, is the first Senate-confirmed holder of the post in close to five years.

January 3 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

Average per-loan charges last year were little changed despite the addition of a new temporary fee for refinancing. Those for loan-to-value ratios above 80%, home-purchase financing and adjustable-rate mortgages only rose slightly.

December 27 -

The government-sponsored enterprise has 45 days to submit a plan on how it intends to meet the increased target for 2022 through 2024.

December 21 -

Under the Federal Housing Finance Agency rule, the GSEs would need to lay out how levels will change under a variety of stress tests, including required ratios separately proposed for amendment.

December 16 -

Since the pandemic began, there have been fewer active managers buying the less liquid types of securitized debt, creating big opportunities for bargain hunting in securities like mortgage bonds and collateralized loan obligations, hedge fund Ellington Management Group says in a new report.

December 16 -

Bigger loans make mortgage bonds riskier for investors. When homeowners have larger loans, they become more likely to refinance even with relatively small declines in interest rates.

December 9 -

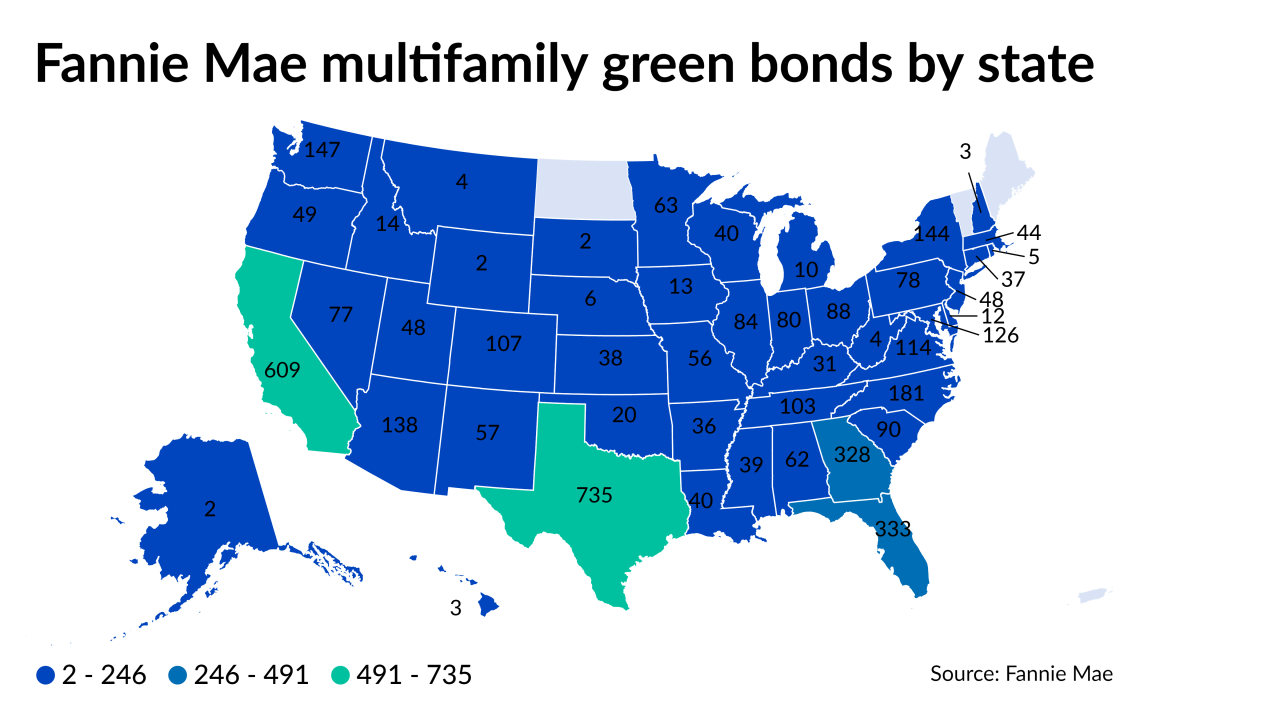

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8 -

The findings in a new TransUnion study could lend momentum to recent efforts by Fannie Mae and Freddie Mac to encourage the reporting and use of rental-payment information in lending.

December 7 -

Bain Capital and American Family Ventures were among the investors in this funding round for the company, which has more than doubled its staff in the past 12 months.

December 6 -

A group of 20 insurers and reinsurers provided coverage for the government-sponsored enterprise’s credit insurance risk transfer deal, which was the biggest in its category to date.

December 3 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

Due in part to pandemic-related forbearance, GSE portfolio loans with year-plus delinquencies hit the highest point seen since the Federal Housing Finance Agency started tracking them in 2015.

November 23 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

The bulk package from an unnamed seller is associated with retail loans generally originated a little over a year ago and purchased by government-sponsored enterprises Fannie Mae and Freddie Mac.

November 18 -

Electronic signatures and remote online notarization can now be used for mortgages that previously were signed in person, subject to certain restrictions.

November 16 -

Amid its first post-IPO securitization of loans made outside a regulatory definition for standard products, the company has seen purchases accelerate, but it underperformed by some analysts’ estimates.

November 10 -

Nearly half of the company’s revenue comes from sources outside of the traditional home lending market, CEO Patricia Cook told analysts during the company’s earnings call.

November 10 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9