-

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

Lenders who employ a technology stack that tracks, collects and analyzes homebuyer behavior will have a distinct advantage as application volume rises.

July 9 NestReady

NestReady -

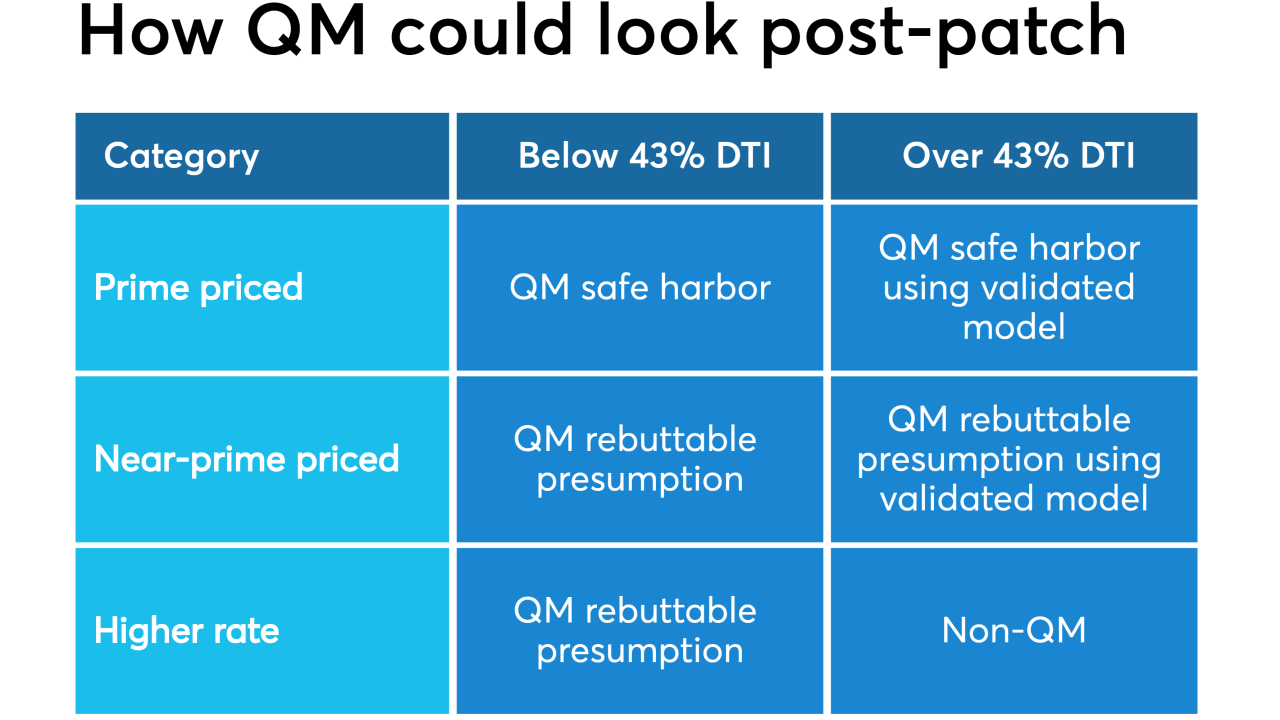

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

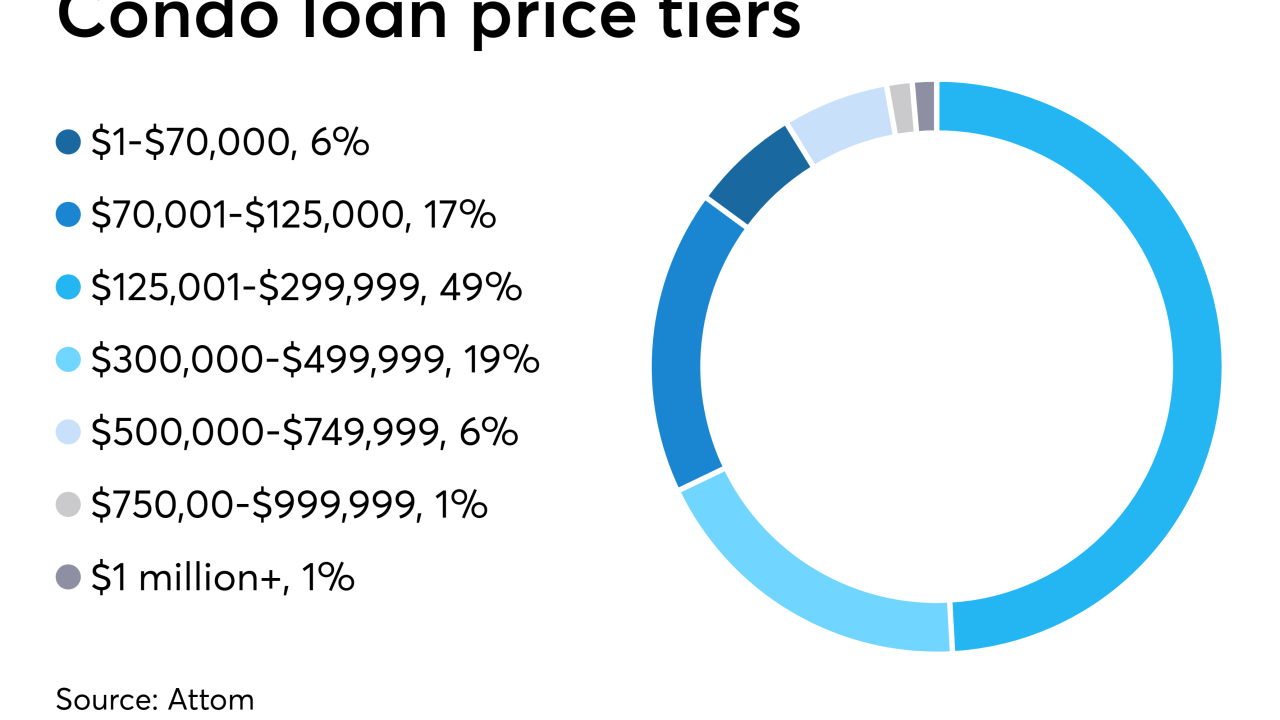

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

Freddie Mac fulfilled its promise to offer a single mortgage that finances the home purchase price and improvements completed after closing.

June 20 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

June 19 -

Housing finance agencies reported increased demand for their loan products, but at the same time the inventory shortage constrains activity and drives them to work with other public entities to find solutions, Moody's said.

June 17 -

Mortgage Industry Advisory Corp. will collect bids Tuesday on behalf of a seller for a more than $1 billion mortgage servicing rights package that includes securitized loans with alternative remittance cycles.

June 17 -

Nearly $300 million of municipal debt sold 12 years ago to expand Central New York's Destiny USA shopping mall were dropped to junk-level Ba2 by Moody's Investors Service.

June 17 -

Ginnie Mae is examining whether the shift in business to nonbank issuers has implications beyond the risks it has historically looked at, and identifying advantages that should be nurtured as well.

June 10 -

Independent mortgage banks became profitable again at the start of the year after realizing losses of $200 for each loan they originated in the fourth quarter of 2018, according to the Mortgage Bankers Association.

June 6 -

The assumption that conservatorship can end without significant changes in how the GSEs operate may be the most dangerous one of all.

June 4 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Despite the benefits of going to a fully or hybrid digital mortgage process, some lenders still hesitate to adopt it as fast as expected.

May 22 -

The Federal Housing Administration and Ginnie Mae will use their lagging digital mortgage positions to their advantage as they put an emphasis on building their technology.

May 21 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC